Kia 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

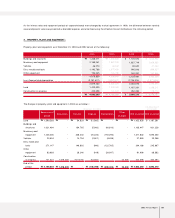

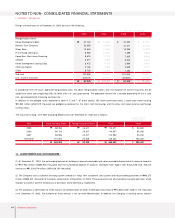

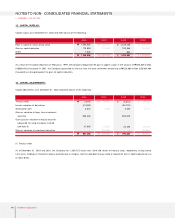

NOTES TO NON-CONSOLIDATED FINANCIAL STATEMENTS

▶DECEMBER 31, 2003 AND 2002

68 Kia Motors Corporation

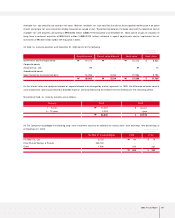

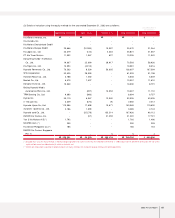

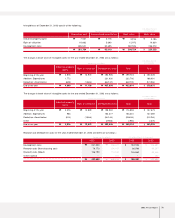

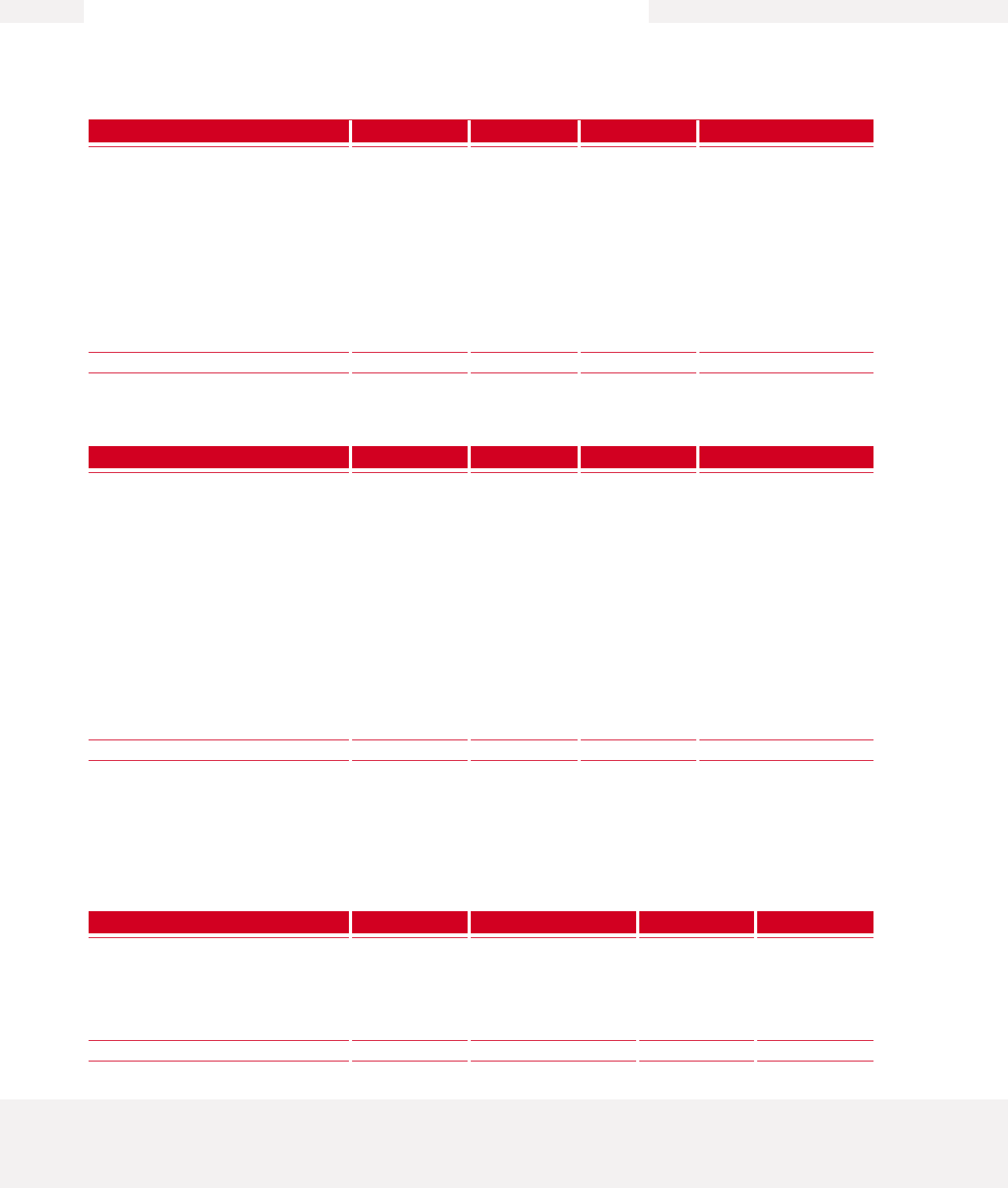

(3) Marketable investment equity securities as of December 31, 2002 consist of the following :

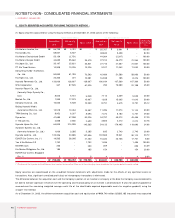

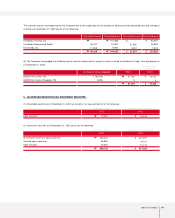

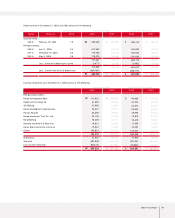

(4) Unlisted equity securities as of December 31, 2002 consist of the following :

The value of investments in equity securities of Daeshin Factoring Co., Ltd. and A.P. Co., Ltd. has declined and is not expected to recover, and

accordingly, the difference between the book value and the fair value has been charged to current operations as an investment impairment loss.

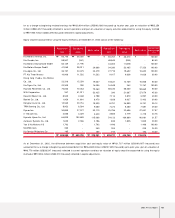

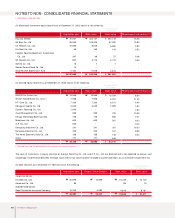

(5) Debt securities as of December 31, 2002 consist of the following :

Acquisition cost Book value Book value Percentage of ownership (% )

Korean won (in millions)

U.S. dollars (Note 2)

(in thousands)

Hyundai MOBIS

INI Steel Co., Ltd.

LG Telecom Co., Ltd.

Kia Steel Co., Ltd.

Kanglim Specific Equipment Automotive

Co., Ltd.

SK Telecom Co., Ltd.

Samho Co., Ltd.

Samlip General Food Co., Ltd.

Stock Market Stabilization Fund

70,047

99,999

10,056

96

347

837

16

14

6,442

187,854

302,107

105,325

8,020

169

68

5,716

1

-

11,828

433,234

252,218

87,932

6,696

141

57

4,772

1

-

9,874

361,691

16.26

15.60

0.59

0.52

0.38

0.03

-

-

-

₩

₩

₩

₩

$

$

Acquisition cost Book value Book value Percentage of ownership (% )

Korean won (in millions)

U.S. dollars (Note 2)

(in thousands)

EUKOR Car Carries, Inc

Wuhan Grand Motor Co., Ltd.(* )

KT I Com Co., Ltd.

Dongwon Capital Co., Ltd.

Daeshin Factoring Co., Ltd.

Asset Management Co., Ltd.

Kihyup Technology Banking Corp.

Mobil.com Co., Ltd.

A.P. Co., Ltd.

Dongyung Industries Co., Ltd.

Namyang Industrial Co., Ltd.

The Korea Economic Daily Co., Ltd.

Other

19,565

7,500

7,200

3,000

2,000

950

700

600

550

241

200

168

771

43,445

19,565

7,500

7,200

3,000

-

950

700

600

-

241

200

168

771

40,895

16,334

6,261

6,011

2,505

-

793

584

501

-

201

167

140

644

34,141

8.00

21.40

0.40

4.62

3.33

19.99

2.41

6.02

9.20

19.23

8.00

0.22

-

₩

₩

₩

₩

$

$

(* ) Excluded from using the equity method as the investment was regarded temporary.

Acquisition cost Present Value Discount Book value

Korean won (in millions)

U.S. dollars (Note 2)

(in thousands)

Corporate bonds:

Kia Steel Co., Ltd.

Acrowave Co., Ltd.

Subordinated bonds:

Seoul Guarantee Insurance Company

32,698

89

16,200

48,987

16,959

-

6,382

23,341

15,739

89

9,818

25,646

₩

₩

₩

₩

₩

₩

Book value

13,140

74

8,197

21,411

$

$