Kia 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

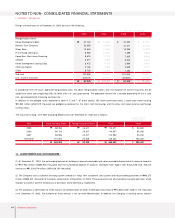

NOTES TO NON-CONSOLIDATED FINANCIAL STATEMENTS

▶DECEMBER 31, 2003 AND 2002

74 Kia Motors Corporation

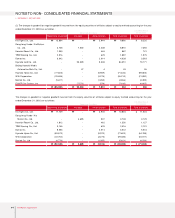

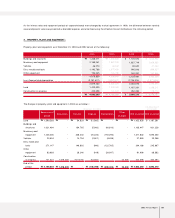

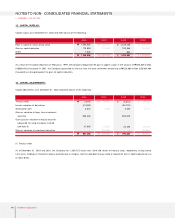

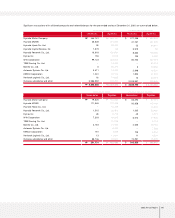

Foreign currency loans as of December 31, 2003 consist of the following :

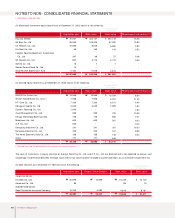

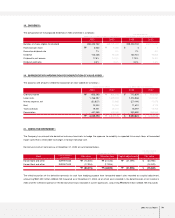

In accordance with the court-approved reorganization plan, the above reorganization claims, with the exception of current maturities, will be

repaid over seven years beginning 2002 to 2008, after a 3-year grace period. The applicable interest rate is variable depending on the 3-year

non-guaranteed bond circulating earnings rate.

In addition to the pledged assets explained in Note 4, 5 and 7, 87 blank checks, 165 blank promissory notes, 2 promissory notes totalling

₩1,820 million (US$1,519 thousand) are pledged as collateral for the short-term borrowings and the long-term local currency and foreign

currency loans.

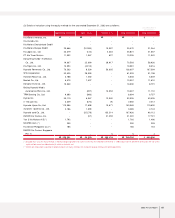

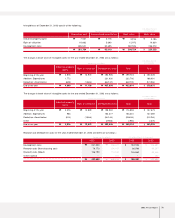

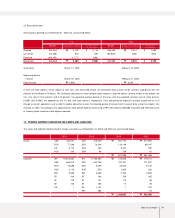

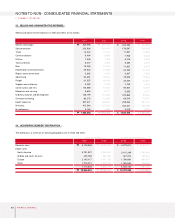

The maturities of long-term debt (excluding debentures) as of December 31, 2003 are as follows :

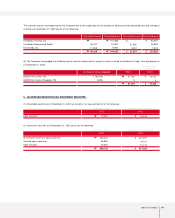

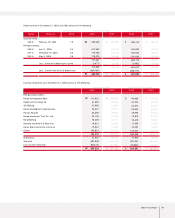

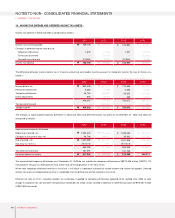

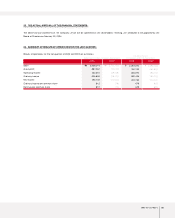

13. COM M ITM ENTS AND CONTINGENCIES :

(1) At December 31, 2003, the outstanding balance of installment accounts receivable and notes receivable discounted with recourse amounts

to ₩77,936 million (US$65,066 thousand) and the outstanding balance of accounts receivable from export sales discounted with recourse

amounts to ₩1,229,074 million (US$1,026,109 thousand).

(2) The Company uses a customer financing system related to a long-term installment sales system and has provided guarantees of ₩48,272

million (US$40,301 thousand) to the banks concerned as of December 31, 2003. These guarantees are all covered by insurance contracts, which

regulate a customer and the Company as a contractor and a beneficiary, respectively.

(3) The Company is a defendant to seven lawsuits for compensation of losses or damages amounting to ₩13,383 million (US$11,173 thousand)

as of December 31, 2003. The outcome of these lawsuits is not currently determinable. In addition, the Company is carrying certain lawsuits

2003 2002 2003 2002

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

Reorganization claims:

Korea Development Bank

Bankers Trust Company

Woori Bank

First Citicorp Leasing Inc.

Korea Non-Bank Lease Financing

Citibank

Korea Development Leasing Corp.

Chohung Capital

Other

Sub total

Less : Current maturities

37,132

32,665

12,445

8,965

8,415

6,617

3,472

3,160

8,725

121,596

(24,317)

97,279

44,655

39,283

14,416

10,781

10,119

7,958

4,175

3,800

13,424

148,611

(24,767)

123,844

31,000

27,271

10,390

7,485

7,025

5,524

2,899

2,638

7,284

101,516

(20,300)

81,216

37,281

32,796

12,035

9,001

8,448

6,644

3,486

3,172

11,208

124,071

(20,678)

103,393

₩

₩

₩

₩

$

$

$

$

Local currency loansYear

Korean won (in millions)

U.S. dollars (Note 2)

(in thousands)

2005

2006

2007

Thereafter

88,994

89,720

88,586

101,924

369,224

₩

₩

24,317

24,317

24,317

24,328

97,279

₩

₩

113,311

114,037

112,903

126,252

466,503

₩

₩

94,600

95,206

94,259

105,402

389,467

$

$

Foreign currency loans Total Total