Kia 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

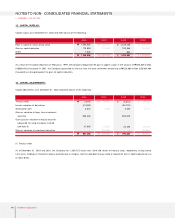

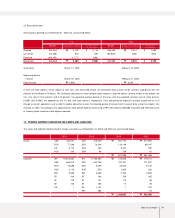

NOTES TO NON-CONSOLIDATED FINANCIAL STATEMENTS

▶DECEMBER 31, 2003 AND 2002

76 Kia Motors Corporation

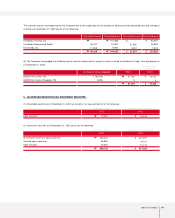

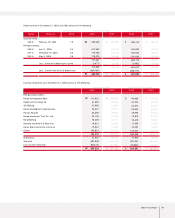

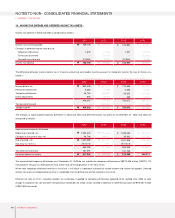

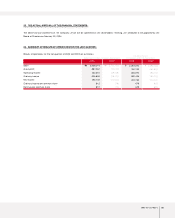

15. CAPITAL SURPLUS :

Capital surplus as of December 31, 2003 and 2002 consist of the following :

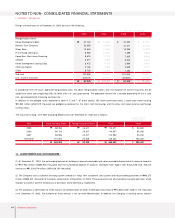

As a result of the capital reduction on February 2, 1999, the Company recognized the gain in capital surplus in the amount of ₩340,848 million

(US$284,562 thousand). In 2001, the Company accounted for the loss from the stock retirement amounting to ₩220,989 million (US$184,496

thousand) as a charged against the gain on capital reduction.

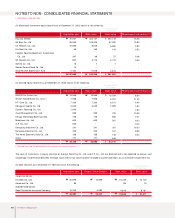

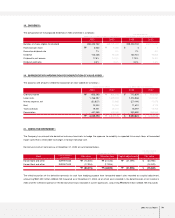

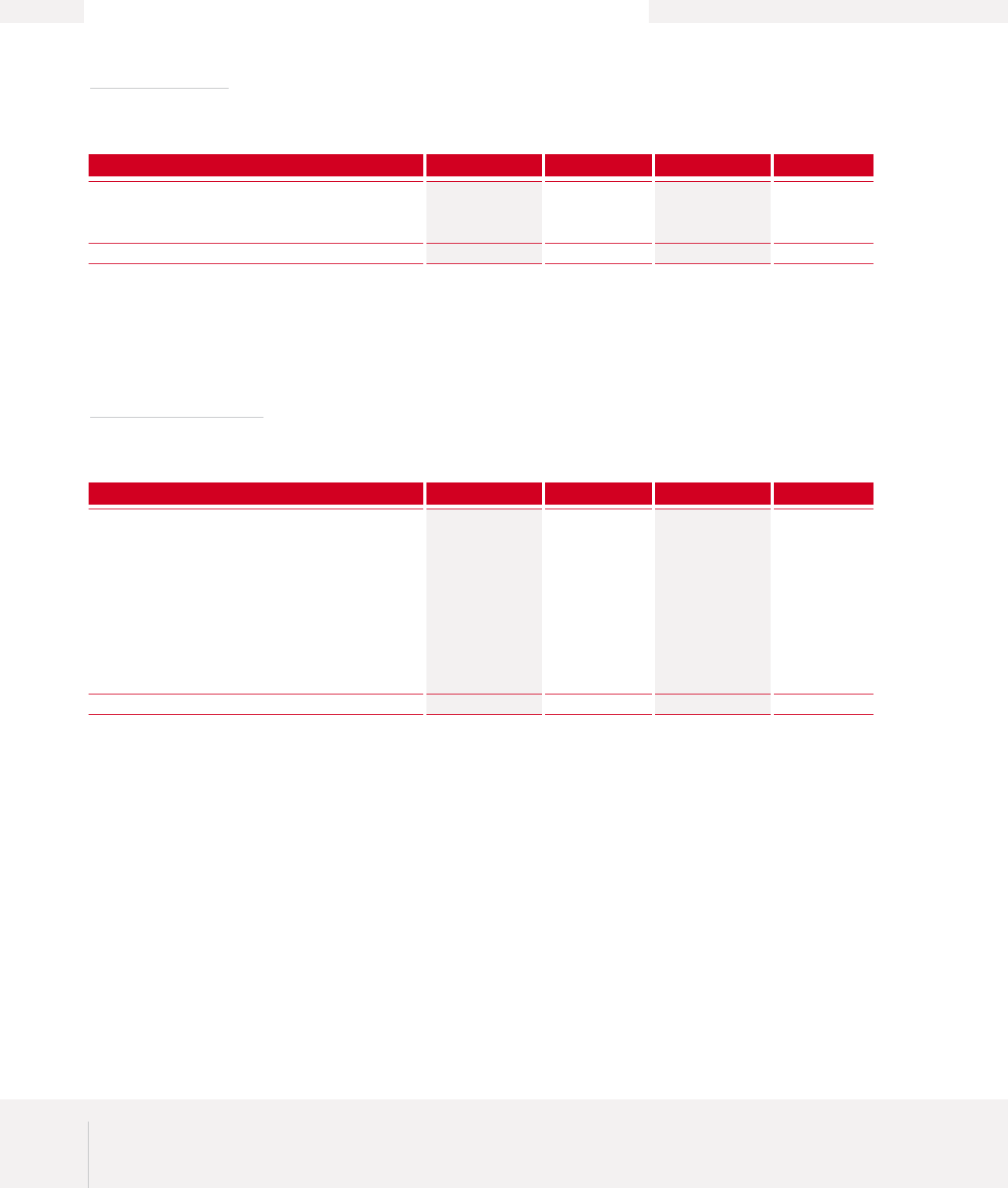

16. CAPITAL ADJUSTM ENTS :

Capital adjustments as of December 31, 2003 and 2002 consist of the following :

(1) Treasury stock

As of December 31, 2003 and 2002, the Company has 1,309,723 shares and 1,609,158 shares of treasury stock, respectively, arising mainly

from cross-holdings of investment equity securities due to mergers, and has recorded treasury stock at acquisition cost in capital adjustments as

of those dates.

2003 2002 2003 2002

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

Paid-in capital in excess of par value

Gain on capital reduction

Other

1,580,065

119,859

1,032

1,700,956

1,580,065

119,859

-

1,699,924

1,319,139

100,066

862

1,420,067

1,319,139

100,066

-

1,419,205

₩

₩

₩

₩

$

$

$

$

2002 2003 2002

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

Treasury stock

Loss on valuation of derivatives

Stock option cost

Gain on valuation of long-term investment

securities

Gain (Loss) on valuation of equity securities

accounted for using the equity method

(see Note 5)

Gain on valuation of investment securities

(7,839)

(41,599)

3,622

969,404

27,905

-

951,493

(9,631)

-

3,735

-

(10,803)

245,380

228,681

(6,544)

(34,729)

3,024

809,320

23,296

-

794,367

(8,040)

-

3,118

-

(9,019)

204,859

190,918

₩

₩

₩

₩

$

$

$

$

2003