Kia 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 45

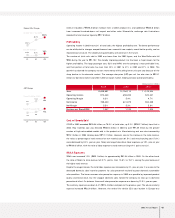

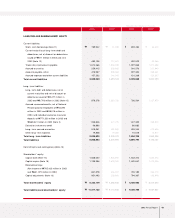

Fixed Assets

The acquisition of affiliated company stocks and capital increases at overseas subsidiaries to ensure

smooth parts supply and boost exports caused long-term investment securities and equity method gains

to grow ₩214.4 billion year on year. Increases in the share prices for marketable securities such as

Hyundai Mobis also helped to boost investments of ₩819.4 billion to almost ₩1.12 trillion at the end of

2003.

Investments related to new model development were increased. At the same time, engine and

transmission production facilities were either expanded or newly built, and the production line at the

Gwangju plant was expanded. As a result, overall annual investments were ₩494.5 billion higher in

2003 than it had been the year before.

Intangible assets also increased ₩154.1 billion because R&D expenses related to such new models as the

Sorento, Morning and KM mini-SUV were capitalized.

Liabilities

Current Liabilities

Increased overseas sales drove up raw material costs and parts procurement, resulting in a modest ₩96.3

billion growth in trade accounts payable year on year. The company issued ₩500 billion in commercial

paper to ensure constant usable liquidity in a domestic capital market beset by widespread credit card

delinquency problems in 2003. The higher banker’s usance from a change in import methods and the rise

in exports elevated short-term borrowings ₩147.7 billion to ₩748.6 billion in 2003. In addition, the

current portions of debentures and of long-term debt was increased to ₩369.6 billion as corporate

bonds came within one year of maturity.

Long-term Liabilities

Long-term borrowings and debentures totaling ₩480.4 billion were redeemed as matured borrowings

and reclassified on the books as current borrowings. The surge in overseas sales volume was expected to

boost overall warranty provision (including both short and long term) significantly. However, steadily

improved quality and the shifting of responsibility for European ELV provision from the Head Office to

local subsidiaries kept the year-on-year increase in warranty provision to ₩27.8 billion. Kia Motors

engaged in various derivative transactions in 2003, and a rising exchange rate at the end of the

accounting year caused a temporary loss on evaluation. Derivative instruments credit has increased by

₩96.9 billion from the 2002 figure.

Shareholders’ Equity

The stock option rights granted in year 2000 were exercised to generate a ₩1 billion gain on the

disposition of treasury stock, causing capital surplus to rise in 2003. A net income of ₩705.4 billion was

generated in 2003, but a 2002 dividend payout of ₩92.0 billion was followed by a ₩88.7 billion share

buyback and cancellation in 2003. As a result, retained earnings increased only ₩524.6 billion year on

year. Meanwhile, profit on paper (valuation income) increased to ₩762.7 billion as a result of higher

prices for listed stocks held by the company. On the other hand, ₩41.6 billion of valuation losses of

short-term(within 12 months) derivative investments occured. Total Capital adjustment was increased by

₩722.8 billion.

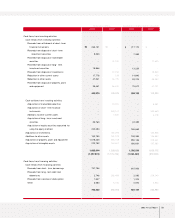

Change in Number of Shares

(Shares in Millions)

449

369 359

00 02 03

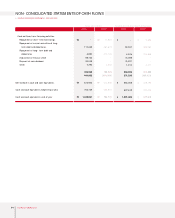

Equity-to-Asset Ratio

40.2%

44.9% 47.7%

01 02 03