Kia 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kia M otors

January 2003 February March April May June July August September October November December

130

(% )

125

120

115

110

105

100

95

90

85

80

75

KOSPI

2003 Annual Report 33

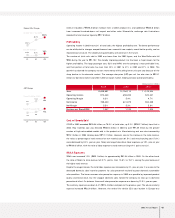

KIA M otors Share Price vs. KOSPI

The price of Kia Motors stock moved along with the composite price index early in 2003, but fell below the average rate of share price changes from July.

Kia shares indicated the first signs of a rebound in October and were back on pace with the overall market by year’s end. The reasons Continued labor

unrest in July and August and a general economic downturn in Korea kept the share prices low through the third quarter. However, domestic sales rose in

the fourth quarter and overseas operations outperformed original expectations, enabling the company to achieve its 2003 performance targets. Kia

management is resolutely determined to achieve even better results in the year ahead to boost value for the investor.

2003

No. of Shares (in thousands)

Stock Price(Based on the Closing price, KRW)

Liability / Equity

Total Debt / Total Asset

Net Debt / Equity

Total Debt / EBITDA

EBITDA / Interest Expense

PER (Price Earnings Ratio)

EPS (Earnings per Share, KRW)

ROE (Return on Equity)

EV / EBITDA

Equity held by Foreigners

Dividend Rate

Dividend Propensity

359,730

10,900

109.9%

19.1%

3.8%

1.67x

11.90x

5.64x

1,947

14.95%

3.22x

33.10%

7%

17.8%

2002

369,730

8,800

122.6%

16.5%

Net Cash

1.35x

7.39x

5.05x

1,743

17.13%

2.88x

17.26%

5%

14.35%

2001

369,597

8,860

148.7%

24.4%

40.5%

2.11x

5.15x

6.22x

1,424

17.11%

4.77x

13.41%

-

-