Kia 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 43

revenue included a ₩495.8 billion increase from a better product mix, and additional ₩203.8 billion

from increased knocked-down unit export and other sales. Meanwhile, exchange rate fluctuations

reduced the total revenue figure by ₩17.8 billion.

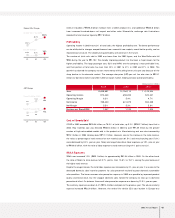

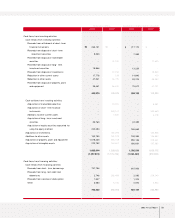

Profitability

Operating income in 2003 was 6.3% of total sales, the highest profitability ever. The better performance

can be attributed to stronger competitiveness from successful new models, overall better quality, and an

improved cost structure. The steadily rising profitability will continue in the future.

The number of total units sold in 2003 was lower than the 2002 figure, and the Won/Dollar rate fell

₩52 during the year to ₩1,192. The steadily improving product mix has been a major reason for the

higher profitability. The large passenger cars, SUVs and MPVs are the company’s most profitable lines,

and their portion of total sales has risen from 33% in 2001 to 41% in 2002 and 47% in 2003. This

growth has allowed the company to earn more money while selling fewer units per year because of the

sharp decline in the domestic market. The average sales price (ASP) per unit has also risen to ₩15.1

million for domestic market and US$11,200 for export market, helping to boost overall profitability.

Cost of Goods Sold

COGS in 2003 exceeded ₩10.84 trillion, or 78.5% of total sales, up 5.2% (₩502.7 billion) from that in

2002. Raw materials cost was elevated ₩380.3 billion in 2003 to over ₩7.89 trillion by the greater

number of high-value-added models sold in the product mix. Manufacturing cost was also increased by

₩13.1 billion in 2003 totaling about ₩1.12 trillion. However, due to the increase in the total revenue,

the ratios as percentage of total revenue for raw materials cost (61.5% ) and manufacturing cost (7.8% )

were decreased by 0.3% year-on-year. Salary and wage hikes drove labor expenses up 10% year on year

to ₩109.3 billion, with the ratio of labor expense to total revenue rising 0.4% points to 9.2% .

SG&A Expenses

SG&A was increased 1.3% (₩25.1 billion) to approximately ₩1.94 trillion in 2003. On the other hand,

the ratio of SG&A to total revenue fell 0.7% points, from 15.8% to 15.1% during the year because of

the higher total revenue.

Despite the wage increase, the total labor expense was increased only 3% year on year. It was due to the

decreased domestic sales incentive payment for sales personnel resulted by poor domestic automobile

sales condition. The lower overseas sales promotion expense in 2003 was possible by improved product

quality and brand value, but the sluggish domestic sales forced the company to step up its domestic

promotional effort. On balance, the overall sales promotion expense was down by 12.3% year-on-year.

The warranty expense was down 3.4% (₩14.4 billion) compare to the previous year. The actual warranty

expense increased ₩32.9 billion. However, the end-of-life vehicle (ELV) cost burden in Europe was

ASP Change

9.4

12.1

9.9

13.6 15.1

11.2

01 02 03

Domestic (Million KRW)

Export (Thousand US$)

Product Mix Change

0.5% 0.3% 2.6%

01 02 03

32.3%

44.6%

RV (SUV, Mini-Van, MPV)

Full Size Passenger

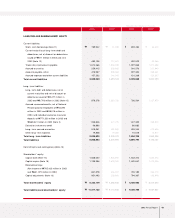

Sales

Operating Income

Operating Margin

Net Income

Net Margin

Earnings per Share(KRW)

2003

12,839,881

812,440

6.3%

705,423

5.5%

1,947

12,158,113

658,493

5.4%

641,379

5.3%

1,743

11,129,204

522,241

4.7%

552,235

5.0%

1,424

2002 2001

40.7%

(Korean won in millions)