Kia 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

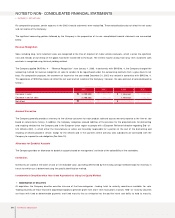

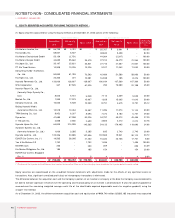

NOTES TO NON-CONSOLIDATED FINANCIAL STATEMENTS

▶DECEMBER 31, 2003 AND 2002

62 Kia Motors Corporation

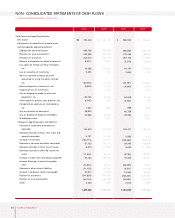

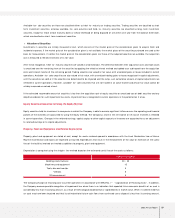

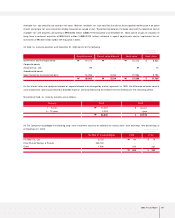

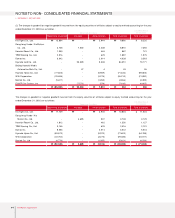

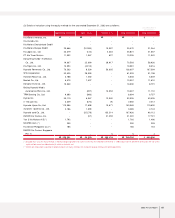

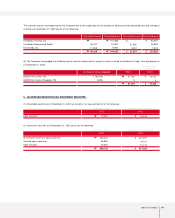

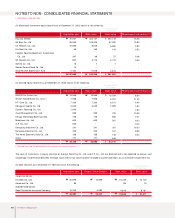

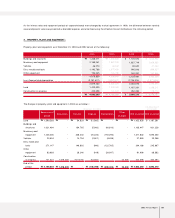

5. EQUITY SECURITIES ACCOUNTED FOR USING THE EQUITY M ETHOD :

(1) Equity securities accounted for using the equity method as of December 31, 2003 consist of the following :

Equity securities are valued based on the unaudited financial statements with adjustments made for the effects of any significant events or

transactions. Also, significant unrealized profit (loss) on intercompany transactions is eliminated.

The difference between the acquisition cost and the Company’s portion of an investee’s net equity at the date the Company was considered to

be able to exercise significant influence over the operating and financial policy of an investee is amortized over 5 years for positive goodwill or

reversed over the remaining weighted average useful life of the identifiable acquired depreciable assets for negative goodwill, using the

straight-line method.

As of December 31, 2003, the difference between acquisition cost and equity value of ₩39,749 million (US$33,185 thousand) was accounted

Acquisition

cost

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

Kia Motors America, Inc.

Kia Canada, Inc.

Kia Motors Deutschland GmbH

Kia Motors Europe GmbH

Kia Japan Co., Ltd.

PT. Kia Timor Motors

Dong feng Yueda-Kia Motors

Co., Ltd.

Kia Tigers Co., Ltd.

Hyundai Powertech Co., Ltd.

WIA Corporation

Haevichi Resort Co., Ltd.

(formerly Cheju Dynasty Co.,

Ltd.)

Bontek Co., Ltd.

Donghui Auto Co., Ltd.

Beijing Hyundai Mobis

Automotive Parts Co., Ltd.

TRW Steering Co., Ltd.

Dymos Inc.

e-HD.com Inc.

Hyundai Hysco Co., Ltd.

Autoever Systems Co., Ltd.

(formerly Autoever Co., Ltd.)

Hyundai card Co., Ltd.

EUKOR Car Carriers, Inc. (* )

Yan Ji Kia Motors A/S

NGVTEK Com

Kia Service Philippines Co., Ltd.

EUKOR Car Carriers Singapore

Pte. (* )

(* ) The shares of the Company and its affiliates on these investees total more than 20 percent of the outstanding shares; accordingly, the Company applied the equity method.

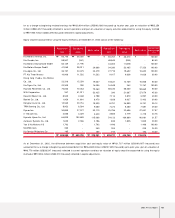

66,798

58,507

53,139

44,695

33,197

10,908

50,893

20,300

120,000

347

8,520

1,950

10,530

13,518

8,952

41,680

4,558

64,829

1,000

123,336

19,565

1,792

250

185

5

759,454

₩

₩

Net equity

value

4,781

6,537

(2,751)

55,662

25,821

13,226

61,783

221

128,607

87,535

5,161

17,973

5,528

13,264

6,207

47,998

2,650

214,999

3,285

23,885

28,395

-

-

-

-

750,767

₩

₩

Book value

-

-

-

25,470

25,821

13,226

70,593

10,081

128,607

61,325

6,048

13,907

10,530

13,307

8,094

52,026

2,650

143,365

3,285

107,936

21,202

1,792

250

185

5

719,705

₩

₩

Acquisition

cost

55,767

48,845

44,364

37,314

27,715

9,107

42,489

16,948

100,184

290

7,113

1,628

8,791

11,286

7,474

34,797

3,805

54,123

835

102,969

16,334

1,496

209

154

4

634,041

$

$

Net equity

value

3,991

5,458

(2,297)

46,470

21,557

11,042

51,580

185

107,369

73,080

4,309

15,005

4,615

11,074

5,182

40,072

2,212

179,495

2,743

19,941

23,706

-

-

-

-

626,789

$

$

Book value

-

-

-

21,264

21,557

11,042

58,936

8,416

107,369

51,198

5,049

11,610

8,791

11,110

6,757

43,436

2,212

119,690

2,743

90,112

17,701

1,496

209

154

4

600,856

$

$

Ownership

percentage

(% )

100.00

82.53

100.00

100.00

100.00

30.00

50.00

100.00

50.00

45.30

40.00

39.00

35.12

30.00

29.00

27.29

22.76

24.06

20.00

20.72

8.00

100.00

24.39

20.00

8.00