Kia 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 59

Derivative Instruments

All derivative instruments are accounted for at fair value with the valuation gain or loss recorded as an asset or liability. If the derivative

instrument is not part of a transaction qualifying as a hedge, the adjustment to fair value is reflected in current operations. The accounting for

derivative transactions that are part of a qualified hedge based both on the purpose of the transaction and on meeting the specified criteria for

hedge accounting differs depending on whether the transaction is a fair value hedge or a cash flow hedge. Fair value hedge accounting is

applied to a derivative instrument designated as hedging the exposure to changes in the fair value of an asset or a liability or a firm commitment

(hedged item) that is attributable to a particular risk. The gain or loss both on the hedging derivative instruments and on the hedged item

attributable to the hedged risk is reflected in current operations. Cash flow hedge accounting is applied to a derivative instrument designated as

hedging the exposure to variability in expected future cash flows of an asset or a liability or a forecasted transaction that is attributable to a

particular risk. The effective portion of gain or loss on a derivative instrument designated as a cash flow hedge is recorded as a capital

adjustment and the ineffective portion is recorded in current operations.

The effective portion of gain or loss recorded as a capital adjustment is reclassified to current earnings in the same period during which the

hedged forecasted transaction affects earnings. If the hedged transaction results in the acquisition of an asset or the incurrence of a liability, the

gain or loss in capital adjustment is added to or deducted from the asset or the liability.

Accounting for Foreign Currency Transactions and Translation

The Company maintains its accounts in Korea won. Transactions in foreign currencies are recorded in Korean won based on the prevailing rates

of exchange on the transaction date. Monetary accounts with balances denominated in foreign currencies are recorded and reported in the

accompanying non-consolidated financial statements at the exchange rates prevailing at the balance sheet dates. The balances have been

translated using the Bank of Korea Basic Rate, which was ₩1,197.80 and ₩1,200.40 to US$1.00 at December 31, 2003 and 2002, respectively,

and the translation loss and gain is reflected in current operations.

Income Tax Expense

The Company recognizes deferred income taxes. Accordingly, income tax expense is determined by adding or deducting the total income tax

and surtaxes to be paid for the current period and the changes in deferred income tax debits (credits). The difference between the income tax

expense and the amount of income tax shown in the current period’s tax return will be offset against the deferred income tax credits (debits),

which will occur in subsequent periods.

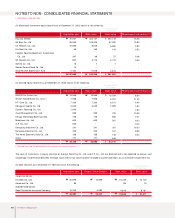

Earnings Per Share

Ordinary income per common share and earnings per common share are computed by dividing ordinary income (after deduction for tax effect)

and net income, respectively, by the weighted average number of common shares outstanding during period. The numbers of shares used in

computing earnings per common share are 362,335,493 and 367,993,115 for the years ended December 31, 2003 and 2002, respectively.

Diluted ordinary income per share and diluted earnings per share are computed by dividing ordinary income and net income, after addition for

the effect of expenses related to diluted securities on net income, by the number of the weighted average number of common shares plus the

number of dilutive potential common shares. Stock options, which have dilutive effect, are regarded as being exercised at the beginning of the

period, and the number of dilutive potential common shares computed using treasury stock method (352,306 shares in 2003) is added to the

diluted number of common shares. Stock options granted to employees and directors as of December 31, 2002 have no dilutive effect on

ordinary income per share and earnings per share.