Kia 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

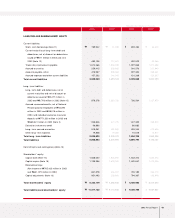

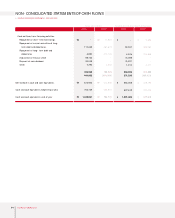

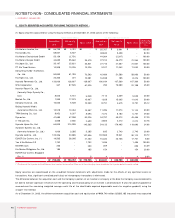

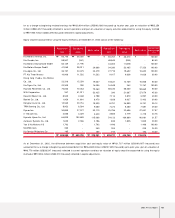

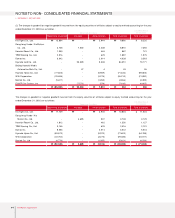

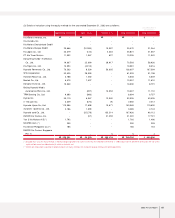

NOTES TO NON-CONSOLIDATED FINANCIAL STATEMENTS

▶DECEMBER 31, 2003 AND 2002

58 Kia Motors Corporation

the carrying amount of the asset is reduced to its recoverable amount and the difference is recognized as an impairment loss. If the recoverable

amount of the impaired asset exceeds its carrying amount in subsequent reporting period, the amount equal to the excess is treated as the

reversal of the impairment loss; however, it cannot exceed the carrying amount that would have been determined had no impairment loss were

recognized.

Intangibles

Intangible assets are stated at cost, net of amortization computed using the straight-line method over the estimated economic useful lives of

related assets. Development costs are amortized over the estimated economic useful life (not exceeding 3 years) from the usable date of the

related productions. Ordinary development and research expenses are charged to current operations. Cost in excess of net identifiable assets

acquired (goodwill) is amortized over 5 years and industrial property rights and other intangibles are amortized over the period between five and

ten years. If the recoverable amount of an intangible asset becomes less than its carrying amount as a result of obsolescence, sharp decline in

market value or other causes of impairment, the carrying amount of the intangible asset is reduced to its recoverable amount and the reduced

amount is recognized as impairment loss. If the recoverable amount of a previously impaired intangible asset exceeds its carrying amount in

subsequent periods, an amount equal to the excess shall be recorded as reversal of impairment loss ; however, it shall not exceed the carrying

amount that would have been determined had no impairment loss were recognized in prior years.

Valuation of Receivables and Payables at Present Value

Receivables and payables arising from long-term installment transactions, long-term cash loans (borrowings) and other similar loan (borrowing)

transactions are stated at present value, if the difference between nominal value and present value is material. The present value discount is

amortized using the effective interest rate method, and the amortization is included in interest expense or interest income. As of December 31,

2003 and 2002, an interest rate of 10.0 percent is used in valuing the receivables and payables at present value.

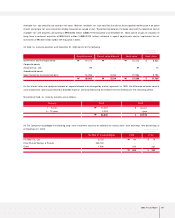

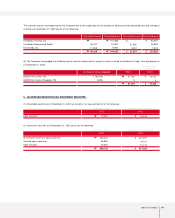

Accrued Severance Benefits

Employees and directors with more than one year of service are entitled to receive a lump-sum payment upon termination of their service with

the Company, based on their length of service and rate of pay at the time of termination. The accrued severance benefits that would be payable

assuming all eligible employees were to resign amount to ₩1,340,068 million (US$1,118,774 thousand) and ₩1,194,229 million (US$997,019

thousand) as of December 31, 2003 and 2002, respectively.

Accrued severance benefits are approximately 58 percent and 56 percent funded at December 31, 2003 and 2002, respectively, through an

individual severance insurance plan. Individual severance insurance deposits, in which the beneficiary is a respective employee, are presented as

deduction from accrued severance benefits.

Before April 1999, the Company and its employees paid 3 percent and 6 percent, respectively, of monthly pay (as defined) to the National

Pension Fund in accordance with the National Pension Law of Korea. The Company paid half of the employees’6 percent portion and is paid

back at the termination of service by offsetting the receivable against the severance payment. Such receivables, totalling ₩44,892 million

(US$37,479 thousand) and ₩48,018 million (US$40,088 thousand) as of December 31, 2003 and 2002, respectively, are presented as a

deduction from accrued severance benefits. Since April 1999, according to a revision in the National Pension Law, the Company and its

employees each pay 4.5 percent of monthly pay to the Fund.

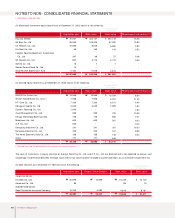

Stock Options

The Company computes total compensation expense to stock options, which are granted to employees and directors, by fair value method using

the option-pricing model. The compensation expense has been accounted for as a charge to current operations and a credit to capital

adjustments from the grant date using the straight-line method.