IHOP 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

79

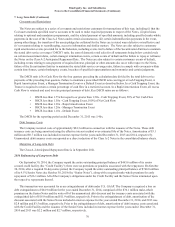

15. Income Taxes

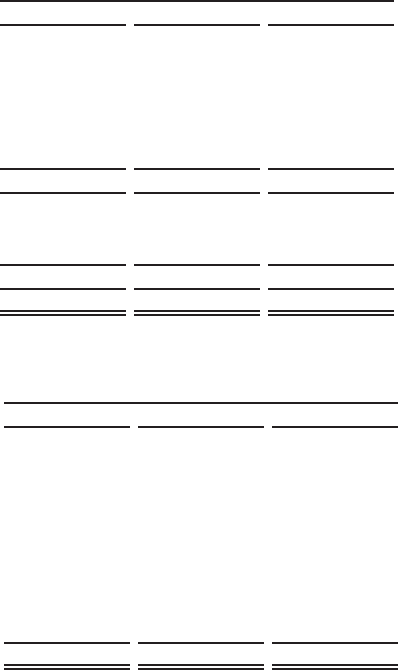

The provision (benefit) for income taxes for the years ended December 31, 2015, 2014 and 2013 was as follows:

Year Ended December 31,

2015 2014 2013

(In millions)

Provision (benefit) for income taxes:

Current

Federal................................................................................................... $ 67.3 $ 33.2 $ 48.5

State....................................................................................................... 8.0 3.6 2.1

Foreign................................................................................................... 2.4 2.7 2.4

77.7 39.5 53.0

Deferred

Federal................................................................................................... (13.6) (22.1) (13.5)

State....................................................................................................... (0.4) (2.3) (0.9)

(14.0) (24.4) (14.4)

Provision for income taxes......................................................................... $ 63.7 $ 15.1 $ 38.6

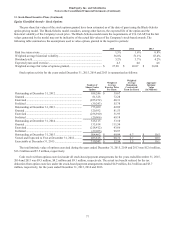

The provision for income taxes differs from the expected federal income tax rates as follows:

Year Ended December 31,

2015 2014 2013

Statutory federal income tax rate ................................................................ 35.0% 35.0% 35.0%

State and other taxes, net of federal tax benefit .......................................... 2.8 2.4 2.9

Change in unrecognized tax benefits .......................................................... 0.8 2.4 1.4

Change in valuation allowance ................................................................... — — (2.7)

Domestic production activity deduction ..................................................... (0.7) (6.0) —

Research and experimentation tax credit .................................................... 0.1 (3.4) —

State adjustments including audits and settlements.................................... (0.2) (1.1) (1.1)

Compensation related tax credits, net of deduction offsets......................... (0.2) (0.8) (0.6)

Other............................................................................................................ 0.2 0.8 —

Effective tax rate......................................................................................... 37.8% 29.3% 34.9%

The Company retroactively adopted the domestic production activity deduction and the federal research and

experimentation credit in 2014. Deductions related to 2014 domestic production activity lowered the 2014 tax rate by 2.3%,

while deductions related to domestic production activity in prior years lowered the 2014 tax rate by 3.7%. Similarly, tax credits

related to 2014 research activity lowered the 2014 tax rate by 0.5%, while tax credits related to research activity in prior years

lowered the 2014 tax rate by 2.9%.

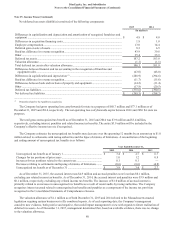

The Company files federal income tax returns and the Company or one of its subsidiaries file income tax returns in various

state and international jurisdictions. With few exceptions, the Company is no longer subject to federal, state or non-United

States tax examinations by tax authorities for years before 2008. In the second quarter of 2013, the Internal Revenue Service

(“IRS”) issued a Revenue Agent’s Report (“RAR”) related to its examination of the Company’s U.S federal income tax return

for the tax years 2008 to 2010. The Company disagrees with a portion of the proposed assessments and has contested them

through the IRS administrative appeals procedures. We anticipate the appeals process to continue into 2016. The Company

continues to believe that adequate reserves have been provided relating to all matters contained in the tax periods open to

examination.

The Company has elected to adopt the recent amendment to U.S. GAAP that requires deferred tax assets and liabilities,

along with related valuation allowances, be classified as non-current on the balance sheet as of the beginning of the fourth fiscal

quarter of 2015 on a retrospective basis. See Note 2, Basis of Presentation and Summary of Significant Policies - Recently

Adopted Accounting Standards.