IHOP 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

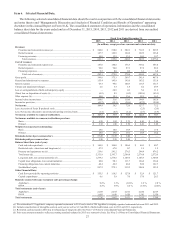

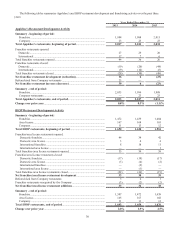

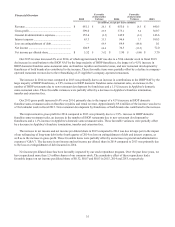

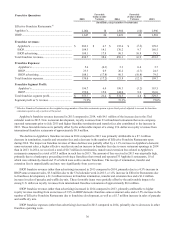

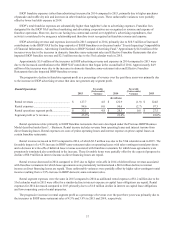

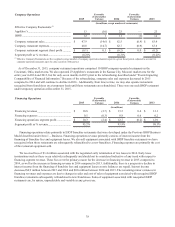

Results of Operations - Fiscal 2015, 2014 and 2013

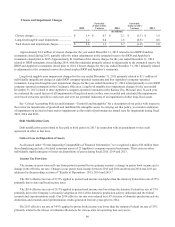

Events Impacting Comparability of Financial Information

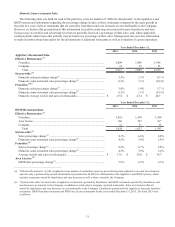

Refinancing of Long-term Debt

In the fourth quarter of 2014, we extinguished $1.225 billion principal amount of long-term debt that bore interest at a

weighted average rate of approximately 7.3% and issued $1.3 billion principal amount of new long-term debt bearing interest at

a fixed rate of 4.277%. As a result, our 2015 interest expense is significantly lower than it was in 2014 and 2013. We

recognized a loss on extinguishment of debt of $64.9 million in 2014, and as a result, our net income and net income per

diluted share were significantly lower in 2014 compared to both 2015 and 2013. See “Liquidity and Capital Resources -

Refinancing of Long-Term Debt,” for additional information.

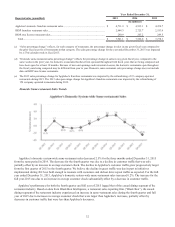

53rd week in Fiscal 2015

Our fiscal year ends on the Sunday nearest to December 31 of each year. Every five or six years, our fiscal year contains 53

calendar weeks. Our 2015 fiscal year contained 53 calendar weeks, whereas fiscal 2014 and 2013 each contained 52 calendar

weeks. The estimated impact of the 53rd week on fiscal 2015 results of operations in comparison with fiscal 2014 was an

increase in revenue of $13.8 million, an increase in gross profit of $9.4 million, an increase in income before income taxes of

$6.8 million and an increase in cash from operating activities of approximately $6 million. The gross margin for this one-week

period is higher than that for the entire 2015 fiscal year because certain fixed costs were not incurred during the 53rd week. Our

fiscal 2016 will contain 52 calendar weeks.

Advertising Contributions to IHOP National Advertising Fund

During 2014, the Company and franchisees whose restaurants contribute a large majority of total annual contributions to

the IHOP national advertising fund (the “IHOP NAF”) entered into an amendment to their franchise agreements that increased

the advertising contribution percentage of those restaurants' gross sales. Pursuant to the amendment, for the period from June

30, 2014 to December 31, 2014, 2.74% of each participating restaurant's gross sales was contributed to the IHOP NAF and

0.76% was contributed to local advertising cooperatives. For the period from January 1, 2015 to December 31, 2017, 3.50% of

each participating restaurant's gross sales will be contributed to the IHOP NAF with no significant contribution to local

advertising cooperatives. The amended advertising contribution percentage is also applicable to IHOP company-operated

restaurants. This change increased total franchise revenue by $10.5 million and $5.9 million in 2015 and 2014, respectively.

Consolidation of Kansas City Restaurant Support Center

In September 2015, we announced a strategic decision to consolidate many core Applebee's restaurant and franchisee

support functions at our Glendale, California headquarters. In conjunction with this action, we plan to exit a significant portion

of the Applebee's restaurant support center in Kansas City, Missouri. We estimate we will incur a total of approximately $8

million in costs related to the exit of the facility and $8 million in employee termination benefits and other personnel-related

costs associated with this consolidation. The majority of the facility exit costs will be incurred as of the date a significant

portion of the facility is vacated, estimated to be in the first half of fiscal 2016.

We recorded a net charge of $5.9 million in 2015, of which $4.9 million related to severance and other personnel-related

costs for employees impacted by the consolidation action and $1.0 million resulted from increased depreciation expense due to

the shortening of the estimated useful life of facility assets.

Refranchising of 23 Applebee's Company-operated Restaurants

In July 2015, we completed the refranchising and sale of related restaurant assets of 23 Applebee’s company-operated

restaurants in the Kansas City, Missouri market area. The impact of this change was a net decrease in 2015 total revenue of

$17.9 million and an increase in 2015 gross profit of approximately $1.0 million. We received proceeds of $9 million and

recognized a gain of approximately $2 million on the transaction. Most of the proceeds were used to repurchase shares of our

stock. As a result of this transaction, we no longer operate any Applebee's restaurants at this time.