IHOP 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

72

9. Leases

The Company is the lessor or sub-lessor of approximately half of all domestic IHOP franchise restaurants. The restaurants

are subleased to IHOP franchisees or in a few instances operated by the Company or an Applebee's franchisee. These

noncancelable leases and subleases consist primarily of land, buildings and improvements.

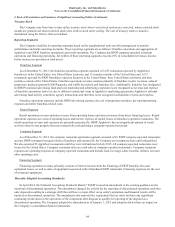

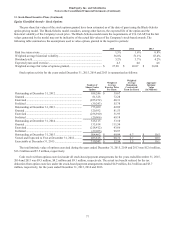

The following is the Company's net investment in direct financing lease receivables:

December 31,

2015 2014

(In millions)

Total minimum rents receivable................................................................................................. $ 108.9 $ 126.7

Less: unearned income ............................................................................................................... (35.2)(45.1)

Net investment in direct financing leases receivable.................................................................. 73.7 81.6

Less: current portion................................................................................................................... (8.7)(8.0)

Long-term direct financing leases receivable............................................................................. $ 65.0 $ 73.6

Contingent rental income, which is the amount above and beyond base rent, for the years ended December 31, 2015, 2014

and 2013 was $16.7 million, $14.1 million and $12.7 million, respectively.

The following is the Company's net investment in equipment leases receivable:

December 31,

2015 2014

(In millions)

Total minimum leases receivable................................................................................................ $ 140.5 $ 165.4

Less: unearned income ............................................................................................................... (45.0) (58.1)

Net investment in equipment leases receivable.......................................................................... 95.5 107.3

Less: current portion................................................................................................................... (7.5) (7.4)

Long-term equipment leases receivable ..................................................................................... $ 88.0 $ 99.9

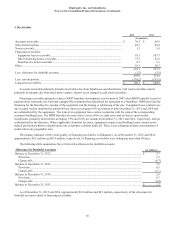

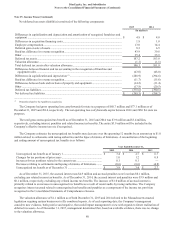

The following are minimum future lease payments on noncancelable leases as lessee at December 31, 2015:

Capital

Leases Operating

Leases

(In millions)

2016 ............................................................................................................................................ $ 24.0 $ 76.5

2017 (1) ........................................................................................................................................ 21.3 69.2

2018 ............................................................................................................................................ 20.6 73.7

2019 ............................................................................................................................................ 17.3 69.5

2020 ............................................................................................................................................ 15.2 67.5

Thereafter.................................................................................................................................... 45.2 255.9

Total minimum lease payments.................................................................................................. 143.6 $ 612.3

Less: interest............................................................................................................................... (44.6)

Capital lease obligations............................................................................................................. 99.0

Less: current portion(2)............................................................................................................................................. (14.2)

Long-term capital lease obligations............................................................................................ $ 84.8

______________________________________________________

(1) Due to the varying closing date of the Company's fiscal year, 11 monthly payments will be made in fiscal 2017.

(2) Included in current maturities of capital lease and financing obligations on the consolidated balance sheet.

The asset cost and carrying amount on company-owned property leased at December 31, 2015 was $89.0 million and

$62.7 million, respectively. The asset cost and carrying amount on company-owned property leased at December 31, 2014, was

$90.1 million and $64.5 million, respectively. The asset cost and carrying amounts represent the land and building asset values

and net book values on sites leased to franchisees.

The minimum future lease payments shown above have not been reduced by the following future minimum rents to be

received on noncancelable subleases and leases of owned property at December 31, 2015: