IHOP 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Dividends

During the fiscal years ended December 31, 2015, 2014 and 2013, we declared and paid dividends on common stock as

shown Note 10 - Stockholders' Equity, of the Notes to the Consolidated Financial Statements included in this report.

On February 23, 2016, our Board of Directors approved payment of a cash dividend of $0.92 per share of common stock,

payable at the close of business on April 8, 2016 to the stockholders of record as of the close of business on March 18, 2016.

Share Repurchases

On February 26, 2013, our Board of Directors approved a stock repurchase program authorizing us to repurchase up to

$100 million of our common stock (the “2013 Repurchase Program”). In October 2014, the Company's Board of Directors

terminated the 2013 Repurchase Program and approved a stock repurchase program authorizing us to repurchase up to $100

million of DineEquity common stock (the “2014 Repurchase Program”). On October 1, 2015, The Company's Board of

Directors terminated the 2014 Repurchase Program and approved a new stock repurchase program authorizing the Company to

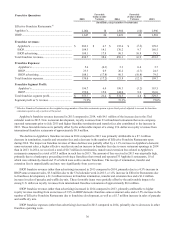

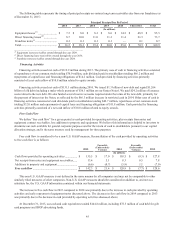

repurchase up to $150 million of DineEquity common stock (the “2015 Repurchase Program”). The following table

summarizes the cumulative purchases under each of these programs:

Shares Cost of shares

Remaining Dollar

Value of Shares that

may be

Repurchased

(In millions)

2013 Repurchase Program............................................ 779,278 $ 59.7 $ —

2014 Repurchase Program............................................ 537,311 $ 54.5 $ —

2015 Repurchase Program............................................ 204,487 $ 17.5 $ 132.5

We do, from time to time, repurchase shares owned and tendered by employees to satisfy tax withholding obligations on

the vesting of restricted stock awards. Such shares are purchased at the closing price of our common stock on the vesting date.

Off-Balance Sheet Arrangements

We have obligations for guarantees on certain franchisee lease agreements, as disclosed below in “Contractual Obligations

and Commitments” and Note 10 - Commitments and Contingencies, of Notes to Consolidated Financial Statements. Other than

such guarantees, we did not have any off-balance sheet arrangements, as defined in Item 303(a)(4) of SEC Regulation S-K as of

December 31, 2015.

Contractual Obligations and Commitments

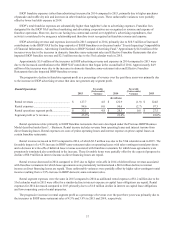

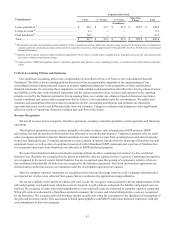

The following are our significant contractual obligations and commitments as of December 31, 2015:

Payments Due By Period

Contractual Obligations 1 Year 2 - 3 Years 4 - 5 Years More than

5 Years Total

(In millions)

Debt(1).......................................................................... $ 55.6 $ 111.2 $ 111.2 $ 1,397.3 $ 1,675.3

Operating leases.......................................................... 76.5 142.9 137.0 255.9 612.3

Capital leases(1)............................................................ 24.0 41.9 32.5 45.2 143.6

Financing obligations(1)............................................... 5.0 9.8 11.4 69.8 96.0

Purchase commitments ............................................... 116.1 9.8 4.2 — 130.1

Unrecognized income tax benefits(2)........................... 1.0 — — 2.9 3.9

Total minimum payments............................................ 278.2 315.6 296.3 1,771.1 2,661.2

Less interest................................................................. (70.2)(135.5)(130.7)(136.9)(473.3)

Total............................................................................. $ 208.0 $ 180.1 $ 165.6 $ 1,634.2 $ 2,187.9

(1) Includes interest calculated on balances as of December 31, 2015 using interest rates in effect as of December 31, 2015.

(2) While up to $1.0 million is expected to be paid within one year, there is no contractual obligation to do so. For the remaining liability, due to the uncertainties

related to these tax matters, we are unable to make a reasonably reliable estimate when a cash settlement with a taxing authority will occur.