IHOP 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

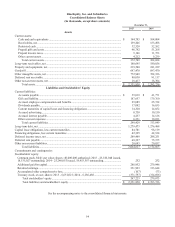

56

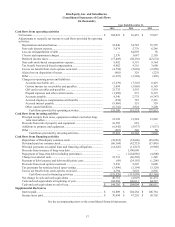

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Equity

(In thousands)

Common Stock Accumulated

Other

Comprehensive

Loss

Treasury Stock

Shares

Outstanding Amount

Additional

Paid-in

Capital Retained

Earnings Shares Cost Total

Balance at December 31, 2012................. 19,198 $ 254 $ 264,342 $ 322,045 $ (152) 6,165 $ (277,684) $ 308,805

Net income ................................................. — — — 72,037 — — — 72,037

Other comprehensive loss .......................... — — — — (12) — — (12)

Purchase of DineEquity common stock ..... (412) — — — — 412 (29,698) (29,698)

Reissuance of treasury stock ...................... 319 — (2,612) — — (319) 11,692 9,080

Net issuance of shares for stock plans........ (18) (1) — — — — — (1)

Repurchase of restricted shares for taxes ... (46) — (3,324) — — — — (3,324)

Stock-based compensation ......................... — — 9,364 — — — — 9,364

Tax benefit from stock-based compensation.. — — 3,690 — — — — 3,690

Dividends on common stock...................... — — 139 (57,504) — — — (57,365)

Conversion of liability award to equity...... — — 2,603 — — — — 2,603

Balance at December 31, 2013................. 19,041 253 274,202 336,578 (164) 6,258 (295,690) 315,179

Net income ................................................. — — — 36,453 — — — 36,453

Other comprehensive gain.......................... — — — — 91 — — 91

Purchase of DineEquity common stock ..... (388) — — — — 388 (32,006) (32,006)

Reissuance of treasury stock ...................... 360 — (4,793) — — (360) 13,000 8,207

Net issuance of shares for stock plans........ (21) (1) 1 — — — — —

Repurchase of restricted shares for taxes ... (38) (3,194) — — — — (3,194)

Stock-based compensation ......................... — — 9,319 — — — — 9,319

Tax benefit from stock-based compensation.. — — 4,316 — — — — 4,316

Dividends on common stock...................... — — 95 (59,387) — — — (59,292)

Balance at December 31, 2014................. 18,954 252 279,946 313,644 (73) 6,286 (314,696) 279,073

Net income ................................................. — — — 104,923 — — — 104,923

Other comprehensive loss .......................... — — — — (34) — — (34)

Purchase of DineEquity common stock ..... (722) — — — — 722 (70,014) (70,014)

Reissuance of treasury stock ...................... 357 — (3,377) — — (357) 12,913 9,536

Net issuance of shares for stock plans........ (21) — — — — — — —

Repurchase of restricted shares for taxes ... (33) — (3,499) — — — — (3,499)

Stock-based compensation ......................... — — 8,892 — — — — 8,892

Tax benefit from stock-based compensation.. — — 4,862 — — — — 4,862

Dividends on common stock...................... — — 128 (66,644) — — — (66,516)

Balance at December 31, 2015................. 18,535 $ 252 $ 286,952 $ 351,923 $ (107) 6,651 $ (371,797) $ 267,223

See the accompanying notes to the consolidated financial statements.