IHOP 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

76

13. Stock-Based Incentive Plans

General Description

Currently, the Company is authorized to grant stock options, stock appreciation rights, restricted stock, cash-settled and

stock-settled restricted stock units and performance units to officers, other employees and non-employee directors under the

DineEquity, Inc. 2011 Stock Incentive Plan (the “2011 Plan”). The 2011 Plan was approved by stockholders on May 17, 2011

and permits the issuance of up to 1,500,000 shares of the Company’s common stock for incentive stock awards. The 2011 Plan

will expire in May 2021.

The IHOP Corp. 2001 Stock Incentive Plan (the “2001 Plan”) was adopted in 2001 and amended and restated in 2005 and

2008 to authorize the issuance of up to 4,200,000 shares of common stock. The 2001 Plan has expired but there are stock

options issued under the 2001 Plan outstanding as of December 31, 2015.

The 2011 Plan and the 2001 Plan are collectively referred to as the “Plans.”

Stock-Based Compensation Expense

From time to time, the Company has granted nonqualified stock options, restricted stock, cash-settled and stock-settled

restricted stock units and performance units to officers, other employees and non-employee directors of the Company under the

Plans. The nonqualified stock options generally vest ratably over a three-year period in one-third increments and have a

maturity of ten years from the grant date. Options vest immediately upon a change in control of the Company, as defined in the

Plans. Option exercise prices equal the closing price of the Company's common stock on the New York Stock Exchange on the

date of grant. Restricted stock and restricted stock units are issued at no cost to the holder and vest over terms determined by

the Compensation Committee of the Company's Board of Directors, generally three years from the date of grant or immediately

upon a change in control of the Company, as defined in the Plans. The Company either utilizes treasury stock or issues new

shares from its authorized but unissued share pool when vested stock options are exercised, when restricted stock awards are

granted and when restricted stock units settle in stock upon vesting.

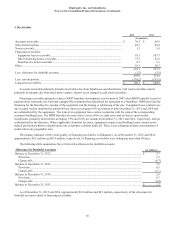

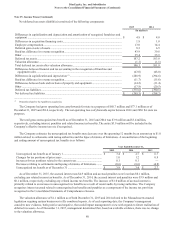

The following table summarizes the Company's stock-based compensation expense included as a component of general and

administrative expenses in the consolidated financial statements:

Year Ended December 31,

2015 2014 2013

(In millions)

Total stock-based compensation expense:

Equity classified awards expense............................................................... $ 9.0 $ 9.4 $ 9.4

Liability classified awards (credit) expense............................................... (0.4) 2.4 0.9

Total pre-tax stock-based compensation expense........................................... 8.6 11.8 10.3

Book income tax benefit ................................................................................. (3.3) (4.5) (3.9)

Total stock-based compensation expense, net of tax ...................................... $ 5.3 $ 7.3 $ 6.4

As of December 31, 2015, total unrecognized compensation cost related to restricted stock and restricted stock units of

$13.9 million and $3.2 million related to stock options is expected to be recognized over a weighted average period of

approximately 1.66 years for restricted stock and restricted stock units and 1.39 years for stock options.