IHOP 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

67

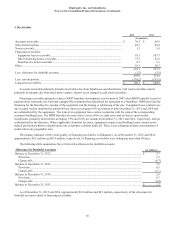

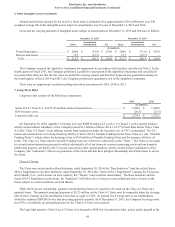

4. Property and Equipment

Property and equipment by category is as follows:

2015 2014

(In millions)

Leaseholds and improvements.................................................................................................... $ 256.4 $ 258.3

Equipment and fixtures............................................................................................................... 82.2 78.4

Properties under capital lease ..................................................................................................... 58.8 59.2

Buildings and improvements...................................................................................................... 57.9 58.7

Land............................................................................................................................................ 57.8 59.2

Construction in progress............................................................................................................. 0.8 5.1

Property and equipment, gross ................................................................................................... 513.9 518.9

Less: accumulated depreciation and amortization...................................................................... (294.3) (277.7)

Property and equipment, net....................................................................................................... $ 219.6 $ 241.2

The Company recorded depreciation expense on property and equipment of $22.8 million, $22.7 million and $23.1 million

for the years ended December 31, 2015, 2014 and 2013, respectively.

Accumulated depreciation and amortization includes accumulated amortization for properties under capital lease in the

amount of $38.8 million and $36.8 million at December 31, 2015 and 2014, respectively.

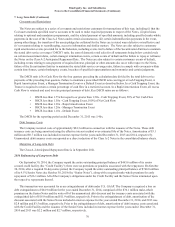

5. Goodwill

The significant majority of the Company's goodwill arose from the November 29, 2007 acquisition of Applebee's. As of

December 31, 2015 and 2014, the balance of goodwill was $697.5 million, of which $686.7 million has been allocated to the

Applebee's franchise reporting unit and $10.8 million to the IHOP franchise reporting unit.

The Company assessed goodwill for impairment in accordance with its policy described in Note 2. In the fourth quarter of

fiscal 2015, the Company performed a qualitative assessment of the goodwill of the Applebee's franchise unit and the IHOP

franchise unit and concluded it was more-likely-than-not that the fair values exceeded the respective carrying amounts and

therefore bypassed any quantitative testing of goodwill. In the fourth quarter of fiscal 2014, the Company performed a

quantitative test of the goodwill of the Applebee's franchise reporting unit and a qualitative test of the goodwill of the IHOP

franchise unit. In the fourth quarter of fiscal 2013, the Company performed a quantitative test of the goodwill of the Applebee's

franchise unit and the IHOP franchise unit.

There were no impairments of goodwill recorded resulting from these assessments in 2015, 2014 or 2013.

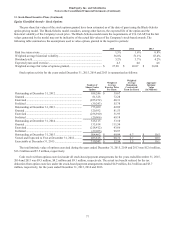

6. Other Intangible Assets

The significant majority of the Company's other intangible assets arose from the November 29, 2007 acquisition of

Applebee's. As of December 31, 2015 and 2014, intangible assets were as follows:

Not Subject to Amortization Subject to Amortization

Tradename Other Franchising

Rights Recipes and

Menus Total

(In millions)

Balance at December 31, 2012...................................... $ 652.4 $ 0.4 $ 149.0 $ 4.3 $ 806.1

Amortization expense.................................................... — — (10.0) (2.3) (12.3)

Other.............................................................................. — 0.3 — — 0.3

Balance at December 31, 2013...................................... 652.4 0.7 139.0 2.0 794.1

Amortization expense.................................................... — — (10.0) (2.0) (12.0)

Other.............................................................................. — 0.2 — — 0.2

Balance at December 31, 2014...................................... 652.4 0.9 129.0 — 782.3

Amortization expense.................................................... — — (10.0) — (10.0)

Other.............................................................................. — 0.6 — — 0.6

Balance at December 31, 2015...................................... $ 652.4 $ 1.5 $ 119.0 $ — $ 772.9