IHOP 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

71

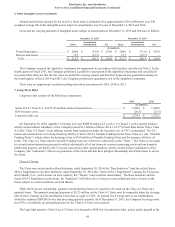

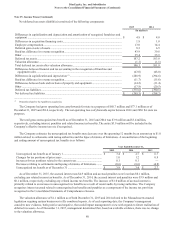

8. Financing Obligations

On May 19, 2008, the Company entered into a Purchase and Sale Agreement relating to the sale and leaseback of 181

parcels of real property (the “Sale-Leaseback Transaction”), each of which is improved with a restaurant operating as an

Applebee's Neighborhood Grill and Bar (the “Properties”). On June 13, 2008, the closing date of the Sale-Leaseback

Transaction, the Company entered into a Master Land and Building Lease (“Master Lease”) for the Properties. The proceeds

received from the transaction were $337.2 million. The Master Lease calls for an initial term of twenty years and four, five-year

options to extend the term.

The Company has an ongoing obligation related to the Properties until such time as the lease related to each of the

Properties is assigned to a qualified franchisee in a transaction meeting certain parameters set forth in the Master Lease. Due to

this continuing involvement, the Sale-Leaseback Transaction was recorded under the financing method in accordance with

U.S. GAAP. Accordingly, the value of the land and leasehold improvements will remain on the Company's books and the

leasehold improvements will continue to be depreciated over their remaining useful lives. The net proceeds received were

recorded as a financing obligation. A portion of the lease payments is recorded as a decrease to the financing obligation and a

portion is recognized as interest expense. In the event the lease obligation of any individual property or group of properties is

assumed by a qualified franchisee, the Company's continuing involvement will cease. At that time, that portion of the

transaction related to that property or group of properties is expected to be recorded as a sale in accordance with U.S. GAAP

and the net book value of those properties will be removed from the Company's books, along with a ratable portion of the

remaining financing obligation.

As of December 31, 2015, the Company's continuing involvement with 152 of the 181 Properties ended by assignment of

the lease obligation to a qualified franchisee or a release from the lessor. In accordance with the accounting described above,

the transactions related to these properties have been recorded as a sale with property and equipment and financing obligations

each cumulatively reduced by approximately $277.2 million.

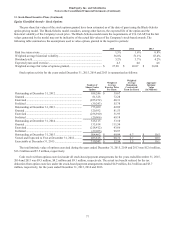

As of December 31, 2015, future minimum lease payments under financing obligations during the initial terms of the leases

related to the sale-leaseback transactions are as follows:

Fiscal Years (In millions)

2016.................................................................................................................................................................. $ 5.0

2017(1) ................................................................................................................................................................................ 4.6

2018.................................................................................................................................................................. 5.2

2019.................................................................................................................................................................. 5.5

2020.................................................................................................................................................................. 5.9

Thereafter......................................................................................................................................................... 69.8

Total minimum lease payments ....................................................................................................................... 96.0

Less: interest .................................................................................................................................................... (53.5)

Total financing obligations .............................................................................................................................. 42.5

Less: current portion(2) .................................................................................................................................................... (0.1)

Long-term financing obligations...................................................................................................................... $ 42.4

____________________________________________________________________________________

(1) Due to the varying closing date of the Company's fiscal year, 11 monthly payments will be made in fiscal 2017.

(2) Included in current maturities of capital lease and financing obligations on the consolidated balance sheet.