IHOP 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

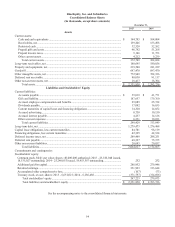

57

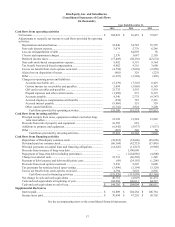

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

Year Ended December 31,

2015 2014 2013

Cash flows from operating activities

Net income.................................................................................................. $ 104,923 $ 36,453 $ 72,037

Adjustments to reconcile net income to cash flows provided by operating

activities:

Depreciation and amortization ............................................................... 32,840 34,745 35,355

Non-cash interest expense...................................................................... 3,074 5,770 6,246

Loss on extinguishment of debt ............................................................. — 64,859 58

Closure and impairment charges............................................................ 2,576 3,687 2,195

Deferred income taxes............................................................................ (17,408) (30,236) (22,674)

Non-cash stock-based compensation expense........................................ 8,892 9,319 9,364

Tax benefit from stock-based compensation.......................................... 4,862 4,316 3,690

Excess tax benefit from stock options exercised.................................... (4,794) (5,028) (2,858)

(Gain) loss on disposition of assets........................................................ (901) 329 (223)

Other....................................................................................................... (6,323) (3,344) (492)

Changes in operating assets and liabilities:

Accounts receivable, net.................................................................... (5,239) (7,326) 8,419

Current income tax receivables and payables ................................... 5,494 (5,868) 6,143

Gift card receivables and payables.................................................... 21,735 3,555 5,519

Prepaid expenses and other current assets......................................... (1,995) 273 8,315

Accounts payable............................................................................... 4,546 2,778 (9,347)

Accrued employee compensation and benefits ................................. (594) 767 2,521

Accrued interest payable ................................................................... (9,869) 551 339

Other current liabilities...................................................................... (6,310) 2,924 3,208

Cash flows provided by operating activities................................. 135,509 118,524 127,815

Cash flows from investing activities

Principal receipts from notes, equipment contracts and other long-

term receivables ................................................................................ 21,328 15,284 13,982

Proceeds from sale of property and equipment...................................... 10,782 681 —

Additions to property and equipment..................................................... (6,642) (5,937) (7,037)

Other....................................................................................................... (267) 540 58

Cash flows provided by investing activities................................. 25,201 10,568 7,003

Cash flows from financing activities

Repurchase of DineEquity common stock............................................. (70,014) (32,006) (29,698)

Dividends paid on common stock.......................................................... (66,164) (42,733) (57,445)

Principal payments on capital lease and financing obligations.............. (14,226) (11,825) (9,968)

Proceeds from issuance of long-term debt............................................. — 1,300,000 —

Repayment of long-term debt (including premiums)............................. — (1,264,086) (4,800)

Change in restricted cash........................................................................ 19,733 (66,298) 1,249

Payment of debt issuance and debt modification costs.......................... (89) (24,192) (1,296)

Proceeds from stock options exercised .................................................. 9,536 8,207 9,080

Tax payments for restricted stock upon vesting..................................... (3,499) (3,194) (3,324)

Excess tax benefit from stock options exercised.................................... 4,794 5,028 2,858

Cash flows used in financing activities ........................................ (119,929) (131,099) (93,344)

Net change in cash and cash equivalents ............................................... 40,781 (2,007) 41,474

Cash and cash equivalents at beginning of year..................................... 104,004 106,011 64,537

Cash and cash equivalents at end of year............................................... $ 144,785 $ 104,004 $ 106,011

Supplemental disclosures

Interest paid............................................................................................ $ 81,809 $ 104,164 $ 106,784

Income taxes paid................................................................................... $ 70,694 $ 47,226 $ 50,702

See the accompanying notes to the consolidated financial statements.