IHOP 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

65

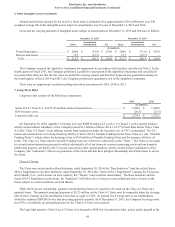

In April 2015, the FASB issued an amendment to existing guidance on the presentation of debt issuance costs. The

amendment requires debt issuance costs be presented in the balance sheet as a direct reduction of the related debt liability rather

than as an asset. Existing recognition and measurement guidance for debt issuance costs was not changed. The amendment is

effective commencing with the Company's first fiscal quarter of 2016. In August 2015, the FASB provided additional guidance

for presentation of debt issuance costs related to line-of-credit arrangements. The Company does not have a material amount of

debt issuance costs related to line-of-credit arrangements. As permitted, the Company elected to adopt early the amendment as

of the beginning of the fourth fiscal quarter of 2015 on a retrospective basis. The following table summarizes the adjustments

made to conform prior period classifications at September 30, 2015 and December 31, 2014 to the new amendment:

September 30, 2015 December 31, 2014

As Filed Reclass As Adjusted As Filed Reclass As Adjusted

(In millions)

Other non-current assets, net.................. $ 39.8 $ (21.3) $ 18.5 $ 42.2 $ (23.5) $ 18.7

Long-term debt....................................... $ 1,300.0 $ (21.3) $ 1,278.7 $ 1,300.0 $ (23.5) $ 1,276.5

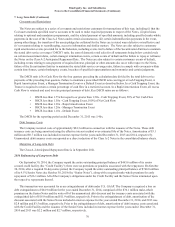

In November 2015, the FASB issued an amendment to existing guidance on the presentation of deferred income taxes that

requires deferred tax assets and liabilities, along with related valuation allowances, be classified as non-current on the balance

sheet. As a result, each tax jurisdiction now only will have one net non-current tax asset or liability. All of the Company's

deferred tax assets are in the same tax jurisdiction as its deferred tax liabilities. The amendment is effective commencing with

the Company's first fiscal quarter of 2017. As permitted, the Company elected to adopt early the amendment as of the

beginning of the fourth fiscal quarter of 2015 on a retrospective basis. The following table summarizes the adjustments made

to conform prior period classifications at September 30, 2015 and December 31, 2014 to the new amendment:

September 30, 2015 December 31, 2014

As Filed Reclass As Adjusted As Filed Reclass As Adjusted

(In millions)

Deferred income tax assets (current)............... $ 35.5 $ (35.5) $ — $ 30.9 $ (30.9) $ —

Deferred income tax liabilities (non-current).. $ 307.6 $ (35.5) $ 272.1 $ 319.1 $ (30.9) $ 288.3

New Accounting Pronouncements

In May 2014, the FASB issued new accounting guidance on revenue recognition, which provides for a single, five-step

model to be applied to all revenue contracts with customers. The new standard also requires additional financial statement

disclosures that will enable users to understand the nature, amount, timing and uncertainty of revenue and cash flows relating to

customer contracts. Companies have an option to use either a retrospective approach or cumulative effect adjustment approach

to implement the standard. In August 2015, the FASB deferred the effective date of the new guidance by one year such that the

Company will be required to adopt the guidance beginning with its first fiscal quarter of 2018.

This new guidance supersedes nearly all of the existing general revenue recognition guidance under U.S. GAAP as well as

most industry-specific revenue recognition guidance, including guidance with respect to revenue recognition by franchisors.

The Company believes the recognition of the majority of its revenues, including franchise royalty revenues, sales of IHOP

pancake and waffle dry mix and retail sales at company-operated restaurants will not be affected by the new guidance.

Additionally, lease rental revenues are not within the scope of the new guidance. The Company is currently evaluating the

impact of the new guidance on its financial statements and related disclosures and which method of adoption will be used.

In January 2016, the FASB issued guidance on the recognition and measurement of financial instruments. The guidance

modifies how entities measure certain equity investments and present changes in the fair value of those investments, as well as

changes how fair value of financial instruments is measured for disclosure purposes. The amendment is effective commencing

with the Company's first fiscal quarter of 2018. The Company is currently evaluating the impact of the new guidance on its

financial statements and disclosures.

The Company reviewed all other newly issued accounting pronouncements and concluded that they either are not

applicable to the Company's operations or that no material effect is expected on the Company's financial statements as a result

of future adoption.