IHOP 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

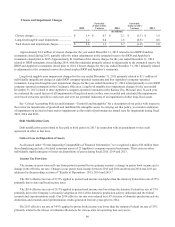

As of each reporting date, we consider new evidence, both positive and negative, that could impact our view with regards

to future realization of deferred tax assets. As of December 31, 2015 and 2014, we determined that, based on available

evidence, no change to the valuation allowance against deferred tax assets was warranted. As of December 31, 2013, because

we implemented a tax planning strategy that was prudent and feasible in the current year, management determined that

sufficient positive evidence existed as of December 31, 2013, to conclude that it was more likely than not that additional

deferred taxes of $3.0 million were realizable, and therefore, reduced the valuation allowance.

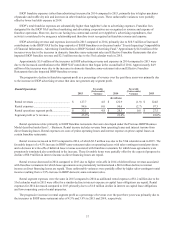

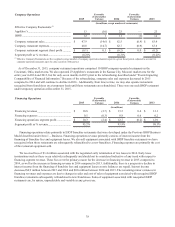

Liquidity and Capital Resources of the Company

Refinancing of Long-Term Debt

Transaction Summary

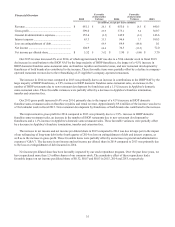

On September 30, 2014, Applebee’s Funding LLC and IHOP Funding LLC (each a “Co-Issuer”), each a special purpose,

wholly-owned indirect subsidiary of the Company, issued $1.3 billion of Series 2014-1 4.277% Fixed Rate Senior Notes, Class

A-2 (the “Class A-2 Notes”) in an offering exempt from registration under the Securities Act. The Co-Issuers also entered into

a revolving financing facility of Series 2014-1 Variable Funding Senior Notes Class A-1 (the “Variable Funding Notes”), which

allows for drawings of up to $100 million of Variable Funding Notes and the issuance of letters of credit. The Class A-2 Notes

and the Variable Funding Notes are referred to collectively as the “Notes.” The Notes were issued in a securitization

transaction pursuant to which substantially all of our domestic revenue-generating assets and our domestic intellectual property,

are held by the Co-Issuers and certain other special-purpose, wholly-owned indirect subsidiaries of the Company (the

“Guarantors”) that act as guarantors of the Notes and that have pledged substantially all of their assets to secure the Notes.

On September 30, 2014, we repaid the entire outstanding principal balance of $463.6 million of our Senior Secured Credit

Facility (the “Credit Facility”); there were no premiums or penalties associated with the repayment. On October 30, 2014, after

a required 30-day notice period, we repaid the entire outstanding $760.8 million principal balance of our 9.5% Senior Notes

(the “Senior Notes”), along with a required make-whole premium for early repayment of $36.1 million. All of our obligations

under the Credit Facility and the Senior Notes terminated upon the respective repayments thereof.

This transaction was accounted for as a debt extinguishment under U.S. GAAP. We recognized a loss on extinguishment of

$64.9 million, comprised of the $36.1 million make-whole premium on the Senior Notes and the write-off of the unamortized

debt discount and the issuance costs associated with the extinguished debt of $16.9 million and $11.9 million, respectively.

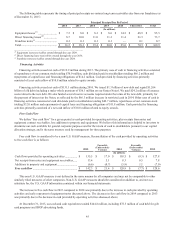

The primary impacts of this transaction on our liquidity during 2014 were cash payments of $36.1 million for the make-

whole premium on the Senior Notes and $24.2 million for issuance costs of the new debt. Additionally, we were required to

fund various reserve accounts required by the indenture under which the new debt was issued totaling approximately $66.7

million. These reserve accounts are considered to be restricted cash. Partially offsetting these cash outflows were proceeds of

approximately $75 million received from issuance of the new debt in excess of the cash required to retire the old debt.

One of the reserve accounts required by the indenture under which the new debt was issued was a short-term interest

reserve account equal to five months of interest on the Class A-2 Notes. After this interest payment was made in March 2015,

the reserve requirement automatically decreased to three months of interest on the Class A-2 Notes. This change reduced our

required restricted cash by $10.1 million.

The primary impacts of this transaction on our liquidity over the term of the Notes are (i) lower annual cash interest

payments on long-term debt than if the Credit Facility and the Senior Notes were still in place, (ii) elimination of interest rate

risk on the variable-rate Credit Facility and (iii) the extension of the maturity of our long-term debt to 2021. The retired Credit

Facility would have expired in October 2017 and the Senior Notes were to be repaid in October 2018.

Class A-2 Notes

The Notes were issued under a Base Indenture, dated September 30, 2014 (the “Base Indenture”) and the related Series

2014-1 Supplement to the Base Indenture, dated September 30, 2014 (the “Series 2014-1 Supplement”), among the Co-Issuers

and Citibank, N.A., as the trustee (in such capacity, the “Trustee”) and securities intermediary. The Base Indenture and the

Series 2014-1 Supplement (collectively, the “Indenture”) will allow the Co-Issuers to issue additional series of notes in the

future subject to certain conditions set forth therein.