IHOP 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

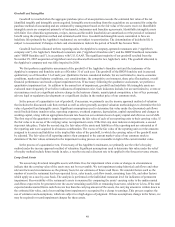

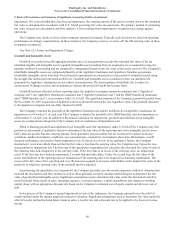

Stock-Based Compensation

We account for stock-based compensation in accordance with U.S. GAAP governing share-based payments. Accordingly,

we measure stock-based compensation expense at the grant date, based on the fair value of the award, and recognize the

expense over the employee's requisite service period using the straight-line method. The fair value of each employee stock

option and restricted stock award is estimated on the date of grant using an option pricing model that meets certain

requirements. We currently use the Black-Scholes option pricing model to estimate the fair value of our stock-based

compensation. The Black-Scholes model meets the requirements of U.S. GAAP. The measurement of stock-based

compensation expense is based on several criteria including, but not limited to, the valuation model used and associated input

factors, such as expected term of the award, stock price volatility, risk free interest rate and forfeiture rate. These inputs are

subjective and are determined using management's judgment. If differences arise between the assumptions used in determining

stock-based compensation expense and the actual factors which become known over time, we may change the input factors

used in determining future stock-based compensation expense. Any such changes could materially impact our operations in the

period in which the changes are made and in subsequent periods.

Income Taxes

We provide for income taxes based on our estimate of federal and state income tax liabilities. We make certain estimates

and judgments in the calculation of tax expense and the resulting tax liabilities and in the recoverability of deferred tax assets

that arise from temporary differences between the tax and financial statement recognition of revenue and expense. Tax laws are

complex and subject to different interpretations by taxpayers and the respective governmental authorities. We review our tax

positions quarterly and adjust the balances as new information becomes available.

We recognize deferred tax assets and liabilities using the enacted tax rates for the effect of temporary differences between

the financial reporting basis and the tax basis of recorded assets and liabilities. Deferred tax accounting requires that deferred

tax assets be reduced by a valuation allowance if it is more likely than not that some or all of the net deferred tax assets will not

be realized. This test requires projection of our taxable income into future years to determine if there will be taxable income

sufficient to realize the tax assets. The preparation of the projections requires considerable judgment and is subject to change to

reflect future events, including changes in the tax laws. When we establish or reduce the valuation allowance against our

deferred tax assets, our income tax expense will increase or decrease, respectively, in the period such determination is made.

FASB ASC Topic 740-10, requires that a position taken or expected to be taken in a tax return be recognized in the

financial statement when it is more likely than not (i.e. a likelihood of more than 50 percent) that the position would be

sustained upon examination by taxing authorities including all appeals or litigation processes, based on its technical merits. A

recognized tax position is then measured on the largest benefit that has a greater than fifty percent likelihood of being realized

upon ultimate resolution. For each reporting period, management applies a consistent methodology to measure and adjust all

uncertain tax positions based on the available information.

Recently Adopted Accounting Standards

See Note 2, Basis of Presentation and Summary of Significant Accounting Policies, of the Notes to the Consolidated

Financial Statements included in this report for a description of accounting standards we adopted in fiscal 2015.

New Accounting Pronouncements

See Note 2, Basis of Presentation and Summary of Significant Accounting Policies, of the Notes to the Consolidated

Financial Statements included in this report, for a description of newly issued accounting standards that may impact us in the

future.