Hyundai 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I

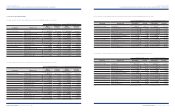

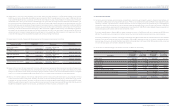

(2) As of December 31, 2008, the outstanding balance of accounts receivable discounted with recourse amounts to

₩

503,329 million (US$400,262 thousand), including

discounted overseas accounts receivable translated using the foreign exchange rate at December 31, 2008.

(3) The Company and its subsidiaries offered financial institutions 43 checks including one check amounting to

₩

2,624 million (US$2,087 thousand) and 219

promissory notes including 3 checks amounting to

₩

12,917 million (US$10,272 thousand) that were issued by the Company as collateral to guarantee the payment

of borrowings.

(4) The Company uses a customer financing system related to a long-term instalment sales system and has provided guarantees of

₩

58,814 million (US$46,771

thousand) to the banks concerned as of December 31, 2008. These guarantees are all covered by insurance contracts, which regulate a customer and the Company

as a contractor and a beneficiary, respectively.

(5) The Company signed lease financial agreements with Hyundai Commercial and Hyundai Capital to promote sales of buses. According to the agreements, the

Company has a joint responsibility to the guarantee limit of the lease user’s liability stipulated in the agreement. As of December 31, 2008, the amount of guarantee

is

₩

65,845 million (US$ 52,362 thousand). In addition, the Company is obliged to pay the lease fee and dispose of leased assets within certain period in case the

lease users are bankrupt or long overdue.

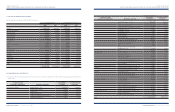

(6) Ongoing lawsuits

1) The Company accrues estimated product liabilities expenses and carries the products and completed operations liability insurance (see Note 9) in order to cover

the potential loss, which may occur due to the lawsuits related to its operation such as product liabilities. The Company expects that the resolution of pending

cases against the Company as of December 31, 2008 will not have any material effect on its financial position.

2) Twenty significant lawsuits that Kia Motors Corporation, one of domestic subsidiaries, is facing are in progress and the potential payment for damages according

to the result of the lawsuits is up to

₩

15,368 million (US$12,221 thousand). Although the outcomes of these lawsuits are not currently predictable, management

believes that the resolution of these matters will not have material adverse effect on the operation or financial position of the company.

3) There exist other ongoing lawsuits related to subsidiaries that were not presented above; however, the Company expects there would not be significant effects

on its consolidated financial statements.

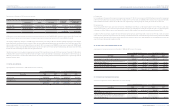

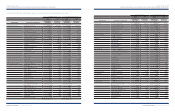

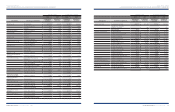

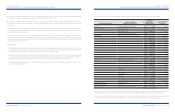

(7) As of December 31, 2008, the Company’s consolidated subsidiaries have been provided for payment guarantee by other companies as follows:

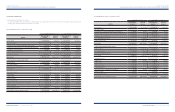

(8) The Company and Kia Motors Corporation made an agreement with its European sales subsidiaries and agents for them to be responsible for projected costs for

dismantling and recycling vehicles sold in corresponding countries to comply with European Parliament directive regarding End-of-Life vehicles (ELV).

(9) In 2006, the Company sold 10,658,367 shares of Hyundai Rotem to MSPE Metro Investment AB and entered into a shareholders’ agreement. MSPE Metro

Investment AB is entitled to put option to sell those shares back to the Company in certain events (as defined) in accordance with the agreement.

Consolidated Subsidiaries

Company providing

guarantee of indebtedness

Amounts of

guarantee

KRW in millions

U.S. Dollars (Note 2)

In thousands