Hyundai 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

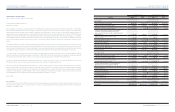

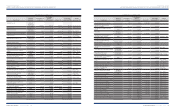

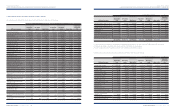

Accrued Severance Benefits

Employees and directors of the Company and its domestic subsidiaries with more than one year of service are entitled to receive a lump-sum payment upon

termination of their service with each company, based on their length of service and rate of pay at the time of termination. The accrued severance benefits that would

be payable assuming all eligible employees were to resign amount to

₩

3,067,643 million (US$2,439,478 thousand) and

₩

2,888,680 million (US$2,297,161 thousand)

as of December 31, 2008 and 2007, respectively.

In accordance with the National Pension Act, certain portions of the accrued severance benefits are deposited with the National Pension Fund and deducted from

accrued severance benefits.

Actual payments of severance benefits by the Company and its domestic subsidiaries amounted to

₩

787,393 million (US$626,157 thousand) and

₩

805,708 million

(US$640,722 thousand) in 2008 and 2007, respectively.

Also, overseas subsidiaries’ accrued severance benefits are in accordance with each subsidiary’ policies and their counties’ regulations.

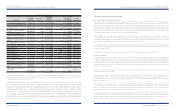

Accrued Warranties and Product Liabilities

The Company and its subsidiaries generally provide a warranty to the ultimate consumer for each product sold and accrues warranty expense at the time of sale

based on actual claims history. Also, the Company accrues potential expenses, which may occur due to product liability suit, voluntary recall campaign and other

obligations as of the balance sheet date.

If the difference between nominal value and present value is material, the provision is valued at present value of the expenditures estimated to settle the obligation.

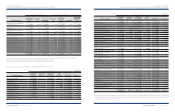

Share-based Payment

Equity-settled share-based payments to employees are measured at fair value of the equity instrument or the goods and services received and the fair value is

expensed on a straight-line basis over the vesting period. For cash-settled share-based payments, a liability equal to the portion of the goods or services received is

recognized at the current fair value determined at each balance sheet date.

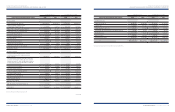

Derivative Instruments

All derivative instruments are accounted for at fair value with the valuation gain or loss recorded as an asset or liability. If the derivative instrument is not part of a

transaction qualifying as a hedge, the adjustment to fair value is reflected in current operations.

The accounting for derivative transactions that are part of a qualified hedge based both on the purpose of the transaction and on meeting the specified criteria for

hedge accounting differs depending on whether the transaction is a fair value hedge or a cash flow hedge. Fair value hedge accounting is applied to a derivative

instrument designated as hedging the exposure to changes in the fair value of an asset or a liability or a firm commitment (hedged item) that is attributable to a

particular risk. The gain or loss both on the hedging derivative instruments and on the hedged item attributable to the hedged risk is reflected in current operations.

Cash flow hedge accounting is applied to a derivative instrument designated as hedging the exposure to variability in expected future cash flows of an asset or a

liability or a forecast transaction that is attributable to a particular risk. The effective portion of gain or loss on a derivative instrument designated as a cash flow hedge

is recorded as accumulated other comprehensive income (loss) and the ineffective portion is recorded in current operations. The effective portion of gain or loss

recorded as accumulated other comprehensive income (loss) is reclassified to current earnings in the same period during which the hedged forecasted transaction

affects earnings. If the hedged transaction results in the acquisition of an asset or the incurrence of a liability, the gain or loss in accumulated other comprehensive

income (loss) is added to or deducted from the asset or the liability.

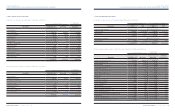

Accounting for Foreign Currency Transactions and Translation

The Company and its domestic subsidiaries maintain their accounts in Korean Won. Transactions in foreign currencies are recorded in Korean won based on

the prevailing rates of exchange on the transaction dates. Monetary accounts with balances denominated in foreign currencies are recorded and reported in the

accompanying financial statements at the exchange rates prevailing at the balance sheet dates. The balances have been translated using the Base Rate announced

by Seoul Money Brokerage Services, Ltd., which was

₩

1,257.50 and

₩

938.20 to US$1.00 at December 31, 2008 and 2007, respectively, and translation gains or losses

are reflected in current operations.

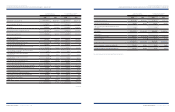

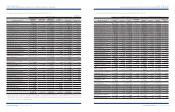

The Company charges all financing cost to current operations in accordance with SKAS No. 7 – “Capitalization of Financing Costs.” In addition, the Company assesses

any possible recognition of impairment loss when there is an indication that expected future economic benefits of a tangible asset is considerably less than its carrying

amount, as a result of technological obsolescence, rapid declines in market value or other causes of impairment. When it is determined that an asset may have

been impaired and that its estimated total future cash flows from continued use or disposal is less than its carrying amount, the carrying amount of a tangible asset

is reduced to its recoverable amount and the difference is recognized as an impairment loss. If the recoverable amount of the impaired asset exceeds its carrying

amount in subsequent reporting period, the amount equal to the excess is treated as the reversal of the impairment loss; however, it cannot exceed the carrying

amount that would have been determined had no impairment loss been recognized.

Intangibles

Intangible assets are stated at cost, net of accumulated amortization. Subsequent expenditures on intangible assets after their purchases or completions, which will

probably enable the assets to generate future economic benefits and can be measured and attributed to the assets reliably, are treated as additions to intangible assets.

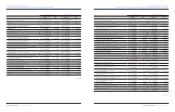

Amortization is computed using the straight-line method based on the estimated useful lives of the assets as follows:

If the recoverable amount of an intangible asset becomes less than its carrying amount as a result of obsolescence, sharp decline in market value or other causes

of impairment, the carrying amount of an intangible asset is adjusted to its recoverable amount and the reduced amount is recognized as impairment loss. If the

recoverable amount of a previously impaired intangible asset exceeds its carrying amount in subsequent periods, an amount equal to the excess is recorded as reversal

of impairment loss; however, it cannot exceed the carrying amount that would have been determined had no impairment loss been recognized in prior years.

Valuation of Receivables and Payables at Present Value

Receivables and payables arising from long-term installment transactions are stated at present value, if the difference between nominal value and present value is

material. The present value discount is amortized using the effective interest rate method, and the amortization is included in interest expense or interest income.

Interest rates of 8.75 and 8.25 percent are used in valuing the receivables and payables at present value as of December 31, 2008 and 2007, respectively.

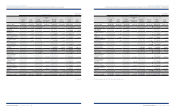

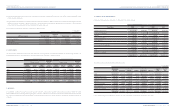

Accounting for Lease Contracts

Whether a lease is a finance lease or an operating lease depends on the substance of the transaction rather than the form of the contract. The situations that

individually or in combination normally lead to a lease being classified as a finance lease are: (1) the lease transfers ownership of the asset to the lessee by the end of

the lease term; (2) the lessee has the option to purchase the asset at a price that is expected to be sufficiently lower than the fair value at the date the option becomes

exercisable for it to be reasonably certain, at the inception of the lease, that the option will be exercised; (3) the lease term is for the major part of the economic life

of the asset even if title is not transferred; (4) at the inception of the lease, the present value of the minimum lease payments amounts to at least substantially all of

the fair value of the leased asset; and (5) the leased assets are of such a specialized nature that only the lessee can use them without major modifications; otherwise,

it is classified as an operating lease.

At the commencement of the lease term, finance leases are recognized as assets and liabilities in their balance sheets at amounts equal to the fair value of the leased

property or, if lower, the present value of the minimum lease payments, each determined at the inception of the lease. The discount rate to be used in calculating the

present value of the minimum lease payments is the interest rate implicit in the lease, if this is practicable to determine; if not, the lessee’s incremental borrowing

rate is used. Minimum lease payments are apportioned between the finance charge and the reduction of the outstanding liability. The finance charge is allocated to

each period during the lease term so as to produce a constant periodic rate of interest on the remaining balance of the liability.

Goodwill (negative goodwill) 5 – 20

Industrial property rights 2 – 40

Development costs 3 – 10

Other 2 – 50

Useful lives (years)

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I 81HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I