Hyundai 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

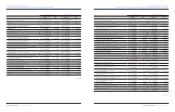

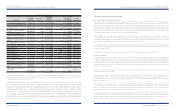

(*1) The acquisition cost of Treasury Stock Fund is

₩

7,213 million (US$5,736 thousand) and the lower of the fair value of treasury stock and investments in those fund

amounting to

₩

1,200 million (US$954 thousand) is recorded as treasury stock in capital adjustments.

(*2) In conformity with Financial Accounting Standards in the Republic of Korea, the equity securities of these affiliates were not accounted for using the equity method

since the Company believes the changes in the investment value due to the changes in the net assets of the investee, whose individual beginning balance of total

assets or paid-in capital at the date of its establishment is less than

₩

7,000 million (US$5,567 thousand), are not material.

(*3) This investment security was excluded from using the equity method despite its ownership percentage exceeding twenty percentages, since there is no significant

influence on the investee.

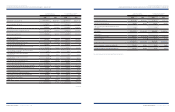

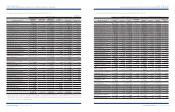

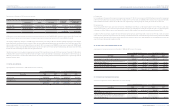

Companies Acquisition cost Book value Book value

Ownership

percentage (*2)

Bond Market Income Fund

₩

2,000

₩

2,003 $1,593 -

NESSCAP Inc. 1,997 1,997 1,588 12.05

Muan Environment System Corporation (*3) 1,848 1,848 1,470 29.90

Korea Securities Finance Corporation 1,096 1,679 1,335 0.32

Machinery Financial Cooperative (*3) 11,201 11,201 8,907 22.20

Hyundai Research Institute 1,359 1,271 1,011 14.90

Korea Defense Industry Association 1,250 1,250 994 2.66

The Sign Corporation 1,200 1,200 954 11.28

Heesung PM Tech Corporation 1,194 1,194 950 19.90

Dongbu NTS Co., Ltd. (Formerly, Backsan ITS Co., Ltd.) 1,134 1,134 902 19.90

Korea Credit Bureau Co., Ltd. 1,000 1,000 795 2.00

Veloxsoft Inc. 1,000 1,000 795 7.14

NGVTEK.com (*2) 821 821 653 78.05

Micro Infinity 607 607 483 9.02

Wia Trade Corporation (*2) 590 590 469 100

Hyundai RB Co., Ltd. 550 550 437 18.64

Clean Air Technology Inc. 500 500 398 16.13

International Convention Center Jeju Co., Ltd. 500 500 398 0.30

Korea Credit Card Electronic Settlement Service Co., Ltd. 484 484 385 7.50

Hankyoreh Plus Inc. 4,800 284 226 5.43

SG Asset Co., Ltd. (Formerly, Koryo Co., Ltd.). 6,625 261 208 1.02

Carnes Co., Ltd. (*2) 250 250 199 49.99

SeAh Besteel Corporation 102 146 116 0.02

KOENTEC 50 108 86 0.20

ENOVA System 4,074 134 107 1.29

Korea Smart Card Co., Ltd. 1,628 22 17 3.77

ROTIS Inc. 1,000 8 6 0.19

Hyundai Unicorns Co., Ltd. 5,795 - - 14.90

GM Daewoo Auto and Technology Co., Ltd. 2,187 - - 0.02

Equity investments 6,571 6,571 5,225 -

Other 11,612 11,087 8,816 -

₩

888,846 $706,836

Korean Won In millions

U.S. Dollars (Note 2)

In thousands (%)

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I 86

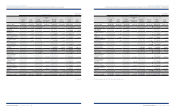

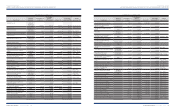

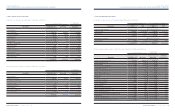

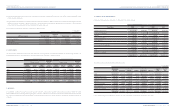

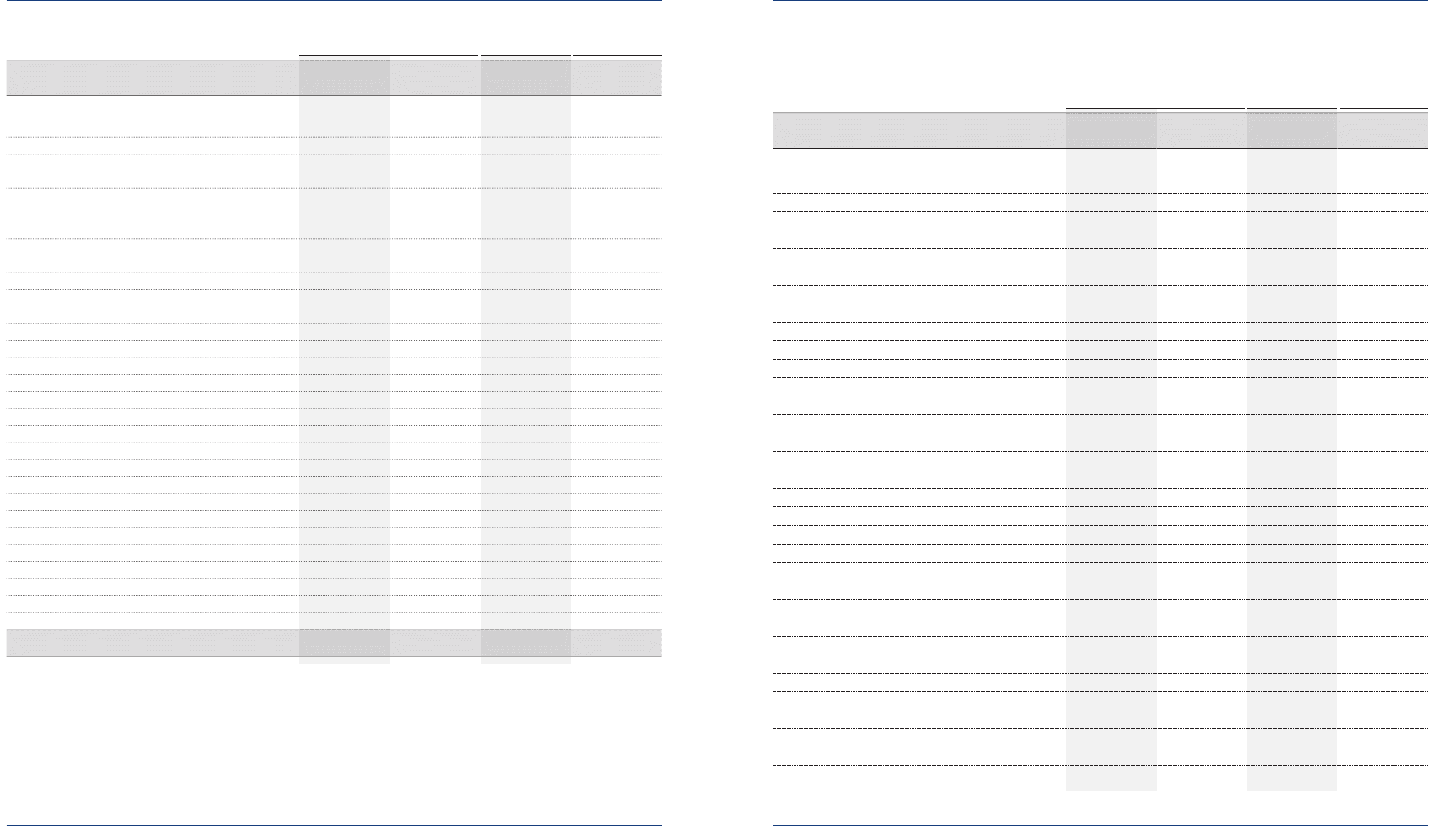

Equity securities included in long-term investment securities as of December31, 2007 consist of the following:

Companies Acquisition cost Book value Book value

Ownership

percentage (*2)

Hyundai Heavy Industries Co., Ltd.

₩

56,924

₩

969,075 $770,636 2.88

Hyundai Oil Refinery Co., Ltd. 53,314 123,907 98,534 4.35

Daewoo International Corporation 9,822 93,852 74,634 2.50

Hyundai Merchant Marine Co., Ltd. 9,731 32,449 25,804 0.49

Doosan Capital Co., Ltd. 10,500 27,453 21,831 10.49

Hyundai Development Company 9,025 41,175 32,744 0.60

Hyundai H&S 15,005 21,462 17,067 4.08

KT Freetel 10,800 10,131 8,056 0.17

Hyundai Finance Corporation 9,888 11,454 9,109 9.29

Hyundai Asan Corporation 22,500 7,053 5,609 4.61

Treasury Stock Fund (*1) 11,840 9,416

Hyundai Technology Investment Co., Ltd. 4,490 4,490 3,571 14.97

Industry Otomotif Komersial 4,439 4,439 3,530 15.00

Korea Investment Mutual Savings & Finance Co., Ltd. 3,000 3,000 2,386 0.41

Kihyup Finance 3,700 3,700 2,942 12.75

Korea Information Service, Inc. 5,252 3,741 2,975 4.41

Kyungnam Credit Information Service Co., Ltd. 2,500 2,500 1,988 13.66

NESSCAP Inc. 1,997 1,997 1,588 12.05

Muan Environment System Corporation (*3) 1,746 1,746 1,388 29.90

Machinery Financial Cooperative (*3) 11,201 11,201 8,907 22.20

Hyundai Research Institute 1,359 1,271 1,011 14.90

The Sign Corporation 1,800 1,800 1,431 17.39

Heesung PM Tech Corporation 1,194 1,194 950 19.90

Dongbu NTS Co., Ltd. (Formerly, Backsan ITS Co., Ltd.) 1,134 1,134 902 19.90

Korea Credit Bureau Co., Ltd. 4,800 4,800 3,817 9.00

Veloxsoft Inc. 1,000 1,000 795 7.69

NGVTEK.com (*2) 821 821 653 78.05

Micro Infinity 607 607 483 9.76

Wia Trade Corporation (*2) 590 590 469 100.00

Hyundai RB Co., Ltd. 550 550 437 18.64

Clean Air Technology Inc. 500 500 398 16.13

International Convention Center Jeju Co., Ltd. 500 500 398 0.30

Korea Credit Card Electronic Settlement Service Co., Ltd. 484 484 385 11.25

Hankyoreh Plus Inc. 4,800 284 226 5.43

Korean Won In millions

U.S. Dollars (Note 2)

In thousands (%)