Hyundai 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

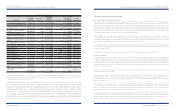

Income Tax Expense

Income tax expense is determined by adding or deducting the total income tax and surtaxes to be paid for the current period and the changes in deferred income tax

assets or liabilities. In addition, current tax and deferred tax is charged or credited directly to equity if the tax relates to items that are credited or charged directly to

equity in the same or different period.

Deferred tax is recognized on differences between the carrying amounts of assets and liabilities in the financial statements and the corresponding tax bases used in

the computation of taxable profits. Deferred tax liabilities are generally recognized for all taxable temporary differences with some exceptions and deferred tax assets

are recognized to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilized. The carrying

amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it is no longer probable that sufficient taxable profits will be

available to allow all or part of the assets to be recovered.

Deferred tax assets and liabilities are classified as current or non-current based on the classification of the related assets or liabilities for financial reporting and

according to the expected reversal date of the specific temporary difference if they are not related to an asset or liability for financial reporting, including deferred tax

assets related to carry for wards. Deferred tax assets and liabilities in the same current or non-current classification are offset if these relate to income tax levied by

the same tax jurisdictions.

Reclassification of the Subsidiaries’ Financial Statements

The Company reclassified some accounts in the subsidiaries’ financial statements according to the Company’s financial statements. This reclassification does not

affect the amount of net income or net assets in the subsidiaries’ financial statements. The assets and liabilities of the subsidiaries in financial industry are classified

into specific current or non-current assets and liabilities; however, if it is not possible, it is classified into other financial assets and liabilities.

Reclassification of Accounts in Prior Financial Statements

The Company reclassified some accounts in the prior financial statements according to the Company’s current financial statements for comparability purposes. This

reclassification does not affect the reported net income or net assets in the prior financial statements.

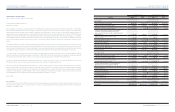

Earnings per Common Share

Basic earnings per common share are computed by dividing net income available to common shareholders by the weighted average number of common shares

outstanding during the period. Diluted earnings per common share are computed by dividing diluted net income, which is adjusted by adding back the after-tax

amount of expenses related to diluted securities, by weighted average number of common shares and diluted securities outstanding during the period.

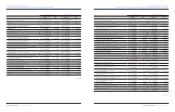

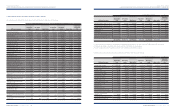

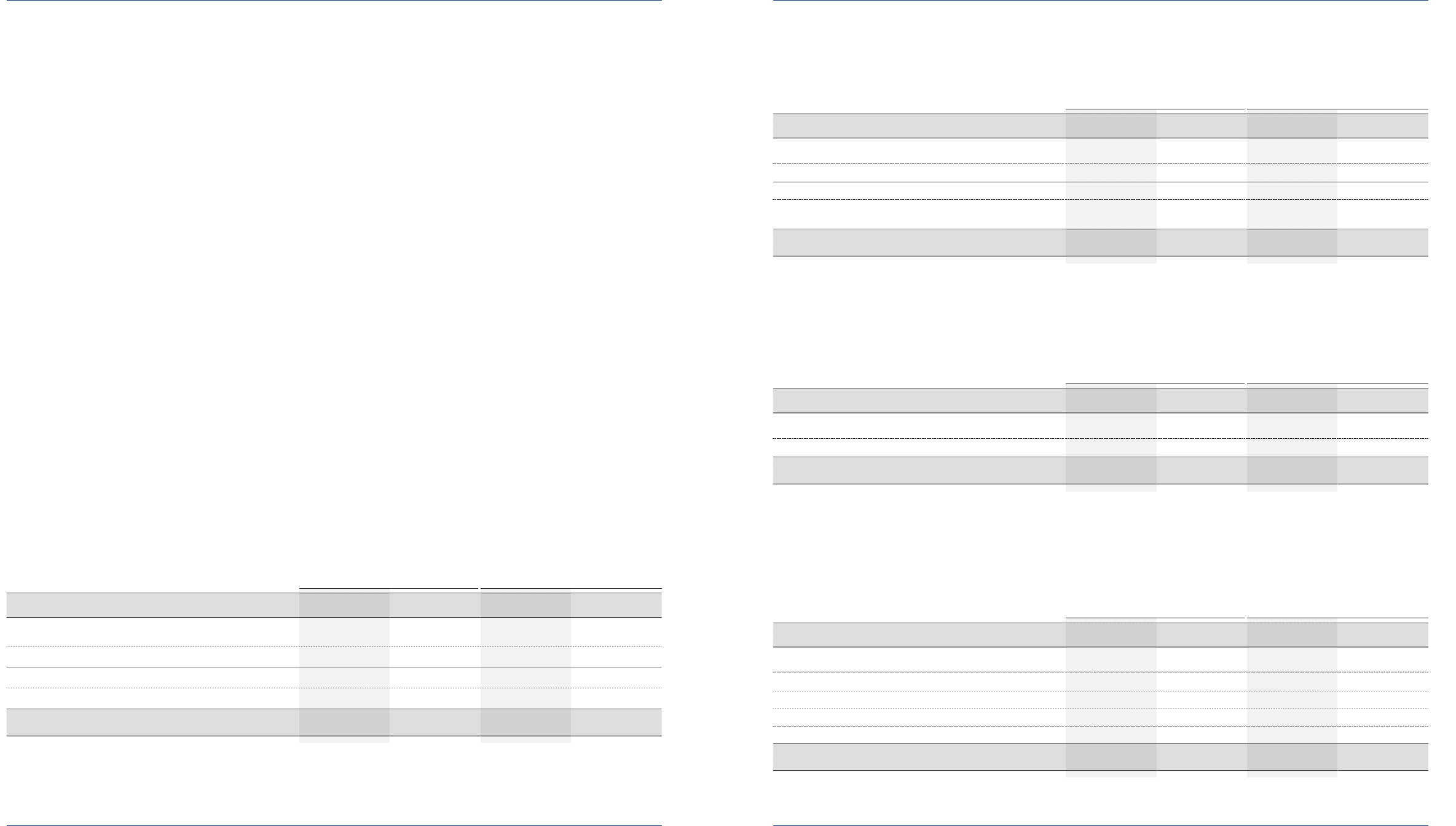

Basic earnings per common share in 2008 and 2007 is computed as follows:

(*) Weighted average number of common shares outstanding includes transactions pertaining to disposal of treasury shares and exercise of stock option.

2008 2007 2008 2007

Net income attributable to equity holders of the parent

₩

857,751

₩

1,600,480 $682,108 $1,272,748

Expected dividends on preferred stock (335,799) (390,199) (267,037) (310,298)

Net income available to common share 521,952 1,210,281 415,071 962,450

Weighted average number of common shares outstanding (*) 208,838,563 208,194,947 208,838,563 208,194,947

Basic earnings per common share

₩

2,499

₩

5,813 $1.99 $4.62

Korean Won

In millions except per share amounts

U.S. Dollars (Note 2)

In thousands except per share amounts

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I 83HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I

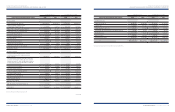

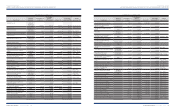

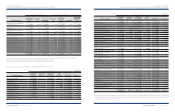

2008 2007 2008 2007

Net income available to common share

₩

521,952

₩

1,210,281 $415,071 $962,450

Expenses related to diluted securities - - - -

Net income available to diluted common share 521,952 1,210,281 415,071 962,450

Weighted average number of common shares and diluted

securities outstanding 209,068,481 208,675,471 209,068,481 208,675,471

Diluted earnings per common share

₩

2,497

₩

5,800 $1.99 $4.61

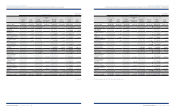

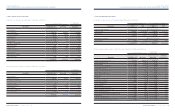

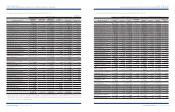

Accounts 2008 2007 2008 2007

Finished goods and merchandise

₩

10,629,934

₩

6,902,708 $8,453,228 $5,489,231

Semi finished goods and work in process 1,531,094 1,243,396 1,217,570 988,784

Raw materials and supplies 2,443,046 1,600,896 1,942,780 1,273,078

Materials in transit 682,798 708,698 542,980 563,578

Other 1,569,126 809,385 1,247,814 643,646

₩

16,855,998

₩

11,265,083 $13,404,372 $8,958,317

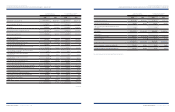

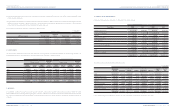

2008 2007 2008 2007

Short-term financial instruments

₩

411,746

₩

190,384 $327,432 $151,399

Long-term financial instruments 5,430 2,152 4,318 1,711

₩

417,176

₩

192,536 $331,750 $153,110

Korean Won

In millions except per share amounts

Korean Won In millions

Korean Won In millions

U.S. Dollars (Note 2)

In thousands except per share amounts

U.S. Dollars (Note 2) In thousands

U.S. Dollars (Note 2) In thousands

Diluted earnings per common share in 2008 and 2007 is computed as follows:

3. RESTRICTED FINANCIAL INSTRUMENTS:

Deposits with withdrawal restrictions as of December 31, 2008 and 2007 consist of the following:

4. INVENTORIES:

Inventories as of December 31, 2008 and 2007 consist of the following: