Hyundai 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I

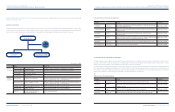

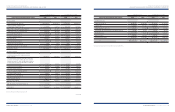

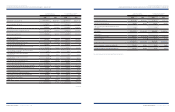

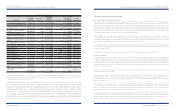

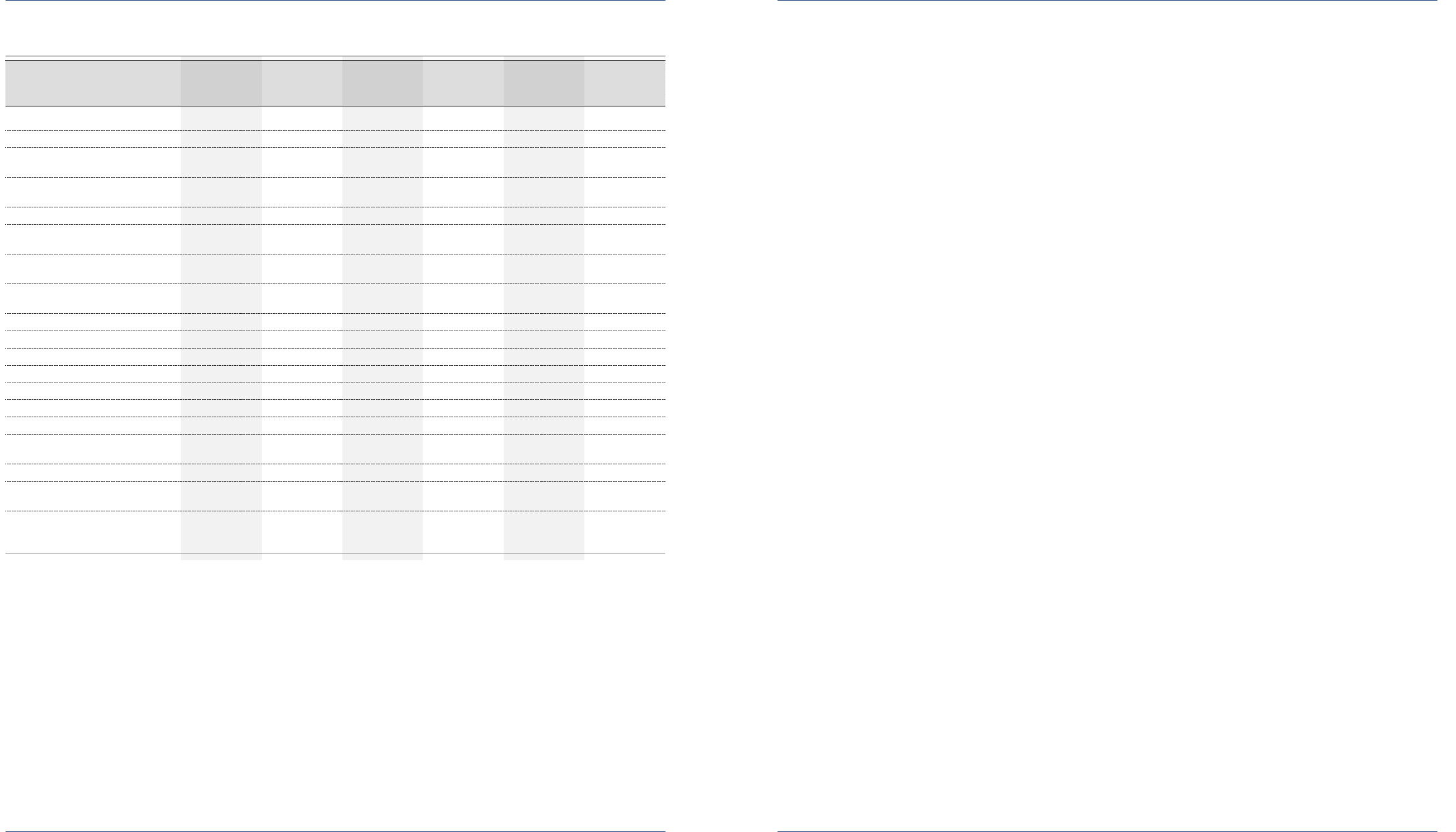

Subsidiaries

Nature of

business

Korean Won (*1)

In millions

U.S. Dollars

(Note 2)

In thousands Shares (*2)

Percentage

ownership (*2)

Indirect

ownership (*2)

Kia Motors Deutschland GmbH (KMD) Sales

₩

29,162 $23,190 -100.00%

KIA : 100%

Kia Motors Polska Sp.z.o.o. (KMP)

″

(2,491) (1,981) 15,637 99.60% KMD : 99.6%

Kia Canada, Inc. (KCI)

″

(103,224) (82,087) 6,298 100.00%

KIA : 82.5%

& KMA : 17.5%

Wia Automotive Engine (Shandong)

Company Manufacturing 194,205 154,437 -70.00%

KIA : 18.00%

& WIA : 30.00%

Wia Automotive Parts (WAP)

″

60,128 47,816 - 100.00% WIA : 100%

Hyundai-Kia Machine Europe GmbH

(HKME)

″

18,790 14,942 - 100.00% WIA : 100%

Hyundai-Kia Machine America Corp.

(HKMA)

″

3,373 2,682 1,000 100.00% WIA : 100%

Beijing Hyundai Hysco Steel Process

Co., Ltd. (BHYSCO)

″

47,863 38,062 - 100.00% HYSCO : 100%

Jiangsu Hysco Steel Process. Co. Ltd

″

18,951 15,070 -90.00% HYSCO : 90%

Hysco Slovakia, s.r.o.

″

19,946 15,862 - 100.00% HYSCO : 100%

Hyundai Hysco USA, Inc.

″

13,535 10,763 250,000 100.00% HYSCO : 100%

Hysco America Co. Inc.

″

9,451 7,516 1,000 100.00% HYSCO : 100%

Hysco Steel India, Ltd. 2,495 1,984 270,271 100.00% HYSCO : 100%

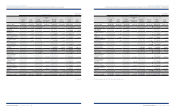

Hyundai-Hitech Electronics

″

20,418 16,237 - 100.00% Autonet : 100%

Rotem USA Corporation

″

9,570 7,610 700,000 100.00% Rotem : 100%

Eurotem DEMIRYOLU ARACLARI

SAN. VE TIC A.S.

″

3,444 2,739 -50.50% Rotem : 50.50%

Dymos Lear Automotive India (DLAI)

″

24,709 19,649 5,674,032 65.00% DYMOS : 65%

Autoever Systems Europe GmbH

(ASE)

Information

technology 3,333 2,650 - 100.00% Autoever : 100%

Hyundai Powertech Manufacturing

America (PTA)

Manufacturing 43,242 34,387 -80.00%

KIA : 10%,

Powertech : 40%

& HMA : 30%

Shareholders’ equity as of December 31, 2008

(*1) Local currency in foreign subsidiaries is translated into Korean Won using the Base Rate announced by Seoul Money Brokerage Services, Ltd. at December 31, 2008.

(*2) Shares and ownership are calculated by combining the shares and ownership, which the Company and its subsidiaries hold as of December 31, 2008. Indirect

ownership represents subsidiaries’ holding ownership.

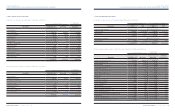

In 2008, the Company added three domestic companies: HMC Investment Securities Co., Ltd., Green Air Co., Ltd. and HMC win win fund and eleven overseas companies:

Dymos Lear Automotive India(DLAI), Autoever Systems Europe GmbH (ASE), Hyundai Motor Commonwealth of Independent States (HMCIS), HMCIS B.V, Hyundai

Auto Czech s.r.o. (HMCZ), Hyundai Motor Manufacturing Rus LLC (HMMR), Hyundai Motor Company Italy (HMCI), Kia Motors Manufacturing Georgia Inc. (KMMG),

Hyundai Powertech Manufacturing America (PTA), Eurotem DEMIRYOLU ARACLARI SAN. VE TIC A.S. and Hyundai Motor India Engineering Private Ltd. (HMIE), to

its consolidated subsidiaries due to acquisition of ownership enabling the Company and its subsidiaries to exercise substantial control or the increase in individual

assets at the end of the preceding year exceeding the required level of

₩

7,000 million (US$5,567 thousand) for consolidation with substantial control. In addition, Seoul

Metro 9th line, Chasan Co., Ltd. (Chasan) and Rotem Equipments (Beijing) Co., Ltd. were excluded from consolidated subsidiaries. The ownership percentage of the

Company to Seoul Metro 9th line decreased as the Company did not participate in the issue of new shares to be purchased. Chasan Co., Ltd. was merged to Haevichi

Resort in 2008 and the total assets of Rotem Equipments (Beijing) Co., Ltd. did not exceed the required level of

₩

7,000 million (US$5,567 thousand) for consolidation

with substantial control at the end of the preceding year.

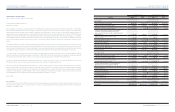

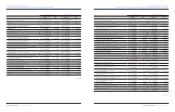

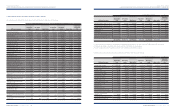

The Company maintains its official accounting records in Korean Won and prepares statutory consolidated financial statements in the Korean language (Hangul)

in conformity with the accounting principles generally accepted in the Republic of Korea. Certain accounting principles applied by the Company that conform with

financial accounting standards and accounting principles in the Republic of Korea may not conform with generally accepted accounting principles in other countries.

Accordingly, these financial statements are intended for use by those who are informed about Korean accounting principles and practices. The accompanying financial

statements have been condensed, restructured and translated into English from the Korean language financial statements. Certain information included in the

Korean language financial statements, but not required for a fair presentation of the Company and its subsidiaries’ financial position, results of operations, changes

in shareholders’ equity or cash flows, is not presented in the accompanying financial statements.

The accompanying financial statements are stated in Korean Won, the currency of the country in which the Company is incorporated and operates. The translation

of Korean Won amounts into U.S. Dollar amounts is included solely for the convenience of readers outside of the Republic of Korea and has been made at the rate

of

₩

1,257.50 to US$1.00 at December 31, 2008, the Base Rate announced by Seoul Money Brokerage Service, Ltd. Such translations should not be construed as

representations that the Korean Won amounts could be converted into U.S. Dollars at that or any other rate.

The Company prepared its consolidated financial statements as of December 31, 2008 in accordance with accounting principles generally accepted in the Republic of

Korea. The significant accounting policies followed by the Company in the preparation of its consolidated financial statements as of December 31, 2008 are identical

to those as of December 31, 2007.

The significant accounting policies followed by the Company in the preparation of its consolidated financial statements are summarized below.

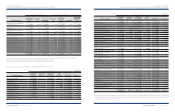

The accompanying financial statements include the accounts of the Company and its subsidiaries. Under financial accounting standards for consolidated financial

statements in the Republic of Korea, a company is regarded as a subsidiary of another company if more than 50% of its issued share capital is held by the other

company, or more than 30% of its issued share capital is held by the other company and that company is the largest shareholder, or substantially controlled by the

other company. Investments of 20% to 50% in affiliated companies or investments in affiliated companies over which the Company exerts a significant influence are

accounted for using the equity method. Under the equity method, the original investment is recorded at cost and adjusted by the Company’s share on the undistributed

earnings or losses of these companies.

The fiscal year of the consolidated subsidiaries is the same as that of the Company. Differences in accounting policy between the Company and consolidated

subsidiaries are adjusted in the consolidation.

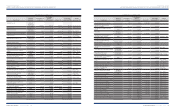

Investments and equity accounts of subsidiaries were eliminated at the dates the Company obtained control of the subsidiaries. The difference between the cost of

acquisition and the book value of the subsidiary is amortized using the straight-line method within twenty years (five years for goodwill recognized before 1998) from

the year the acquisition occurred or reversed over the remaining weighted average useful life of the identifiable acquired depreciable assets for negative goodwill

using the straight-line method.

When the Company acquires additional interests in a subsidiary after obtaining control over the subsidiary, the difference between incremental price paid by the

Company and the amount of incremental interest in the shareholders’ equity of the subsidiary is reflected in the consolidated capital surplus. In case a subsidiary still

belongs to a consolidated economic entity after the Company disposes a portion of the stocks of subsidiaries to non-subsidiary parties, gain or loss on disposal of the

subsidiary’s stock is accounted for as consolidated capital surplus or capital adjustments.

Intragroup balances and transactions, including income, expenses and dividends are eliminated in full. Profits or losses resulting from intragroup transactions that

are recognised in assets are eliminated in full. Unrealized gains and losses arising from sales by a controlling company to its subsidiary (downstream sales) are

eliminated entirely and charged (credited) to controlling interest, and unrealized gains and losses arising from sales by a subsidiary to its controlling company or from

transactions among subsidiaries (upstream sales) are eliminated entirely and allocated to controlling interest and minority interest.