Hyundai 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I

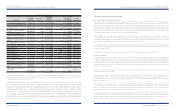

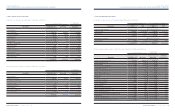

Minority interest is the part of net operation results and net assets of a subsidiary other than controlling interest. When net loss attributable to minority shareholders

exceeds the minority interest, the excess and any further losses attributable to the minority interest is allocated to the minority interest and presented as negative

in equity. Where, under an arrangement, the allocation of interest to the parent and the minority resulting from the losses is not based on their ownership interest,

losses attributable to minority interest are determined according to such arrangement.

When the Company acquires new subsidiaries during the year, the results of operations are reflected in the income statement on an annual basis. However, total net

income (loss) of the consolidated subsidiaries until the acquisition date is deducted from net income after income tax and accounted for as net income (loss) of newly

consolidated subsidiaries before acquisition. In addition, when the Company disposes shares of subsidiaries during the year and the subsidiaries do not belong to the

consolidation entity, the Company applies SKAS No. 11 – “Discontinuing Operation” which requires the Company not to present the income (loss) of the subsidiaries

until the disposal date item-by-item but to present the total net income (loss) of the subsidiaries as a line item in the consolidated income statement.

When translating the financial statements of the affiliates operating overseas, the Company applies the foreign exchange rate as of the investor’s balance sheet date

to the associate’s assets and liabilities, the foreign exchange rate as of the date on which the investor acquired its equity interest in the associate to the investor’s

share of the associate’s equity interest, the foreign exchange rate as of each transaction date to the remaining equity interest in the associate after excluding any

increase in retained earnings after the investor’s acquisition of its equity interest in the associate, and the foreign exchange rate as of the average rate for the pertinent

period to the associate’s income statement items.

Revenue Recognition

Sales of goods is recognized at the time of shipment only if it meets the conditions that significant risks and rewards of ownership of the goods have been transferred

to the customer, and neither continuing managerial involvement nor effective control over the goods sold is retained. Revenue arising from rendering of services

is generally recognized by the percentage-of-completion method at the balance sheet date. In addition, revenue arising from interest, dividends or royalties is

recognized when it is probable that future economic benefits will flow into the Company and those benefits can be measured reliably.

In the case of subsidiaries in financial business, interest revenues earned on financial assets are recognized as time passes using the level yield method, and fees

and commissions in return for services rendered are recognized as services are provided.

Allowance for Doubtful Accounts

The Company provides an allowance for doubtful accounts based on management’s estimate of the collectibility of receivables.

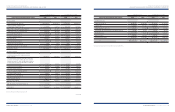

Inventories

Inventories are stated at the lower of cost or net realizable value, cost being determined by the moving average method, except for materials in transit for which cost

is determined using the specific identification method. Valuation loss incurred when the market value of an inventory falls below its carrying amount is added to the

cost of goods sold.

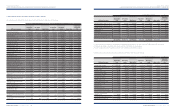

Investments in Securities Other Than Those Accounted for Using the Equity Method

Classification of Securities

At acquisition, the Company classifies securities into one of the three categories; trading, held-to-maturity or available-for-sale. Trading securities are those that were

acquired principally to generate profits from short-term fluctuations in prices. Held-to-maturity securities are those with fixed or determinable payments and fixed

maturity that the Company has the positive intent and ability to hold to maturity. Available-for-sale securities are those not classified as either held-to-maturity or

trading securities. Trading securities are classified as short-term investment securities, whereas available-for-sale and held-to-maturity securities are classified as

long-term investment securities, except for those whose maturity dates or whose likelihood of being disposed of are within one year from balance sheet date, which

are classified as short-term investment securities.

Valuation of Securities

Investments in securities are initially measured at cost, which consists of the market price of the consideration given to acquire them and incidental expenses. If the

market price of the consideration given is not available, the market prices of the securities purchased are used as the basis for measurement. If neither the market

price of the consideration given nor those of the acquired securities are available, the acquisition cost is measured at the best estimates of its fair value. After initial

recognition, held-to-maturity securities are valued at amortized cost. The difference between their acquisition costs and face values is amortized over the remaining

term of the securities by applying the effective interest method and added to or subtracted from the acquisition costs and interest income of the remaining period.

Trading securities are valued at fair value, with unrealized gains or losses included in current operations. Available-for-sales securities are also valued at fair value,

with unrealized holding gains or losses recognized in accumulated other comprehensive income (loss), until the securities are sold or if the securities are determined

to be impaired and the lump-sum accumulated amount of accumulated other comprehensive income (loss) is reflected in current operations. However, available-for-

sales securities that are not traded in an active market and whose fair value cannot be reliably measured are valued at cost.

If the estimated recoverable amount of securities is less than the acquisition cost of equity securities or amortized cost of debt securities and any objective evidence

for such impairment loss exists, impairment loss is recognized in current operations in the period when it arises.

The lower of the fair value of treasury stock included in treasury stock fund and the fair value of investments in treasury stock funds is accounted for as treasury

stock in capital adjustment.

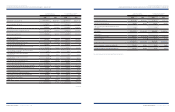

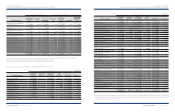

Investment Securities Accounted for Using the Equity Method

Investment securities held for investment in companies in which the Company is able to exercise significant influence over the operating and financial policies of the

investees are accounted for using the equity method. The Company’s share in the net income or net loss of investees is reflected in current operations. The changes

in the retained earnings, capital surplus or other capital accounts of investees are accounted for as an adjustment to retained earnings, to capital surplus or to

accumulated other comprehensive income (loss).

The difference between the cost of the investment and the investor’s share of the net fair value of the investee’s identifiable assets and liabilities at the date of

acquisition is amortized over 20 years for goodwill or reversed over the remaining weighted average useful life of the identifiable acquired depreciable assets for

negative goodwill, which does not exceed the fair value of non-monetary assets acquired, using the straight-line method. Negative goodwill that exceeds the fair value

of non-monetary assets acquired is credited to operations in the year of purchase.

The Company’s portion of profits and losses resulting from inter-company transactions that are recognized in assets, such as inventories and fixed assets, are

eliminated and charged to equity securities accounted for using the equity method.

If an investor’s share of losses of an investee equals or exceeds its interest in the investee, the investor discontinues recognizing its share of further losses. If the

investee subsequently reports profits, the investor resumes recognizing its share of those profits only after its share of the profits equals the share of losses not

recognized. Also, if the recoverable amount of investments in investee becomes less than its carrying amount, the Company recognizes impairment loss.

Property, Plant and Equipment and Related Depreciation

Property, plant and equipment are stated at cost, except for assets revalued upward in accordance with the Asset Revaluation Law of Korea. Routine maintenance

and repairs are expensed as incurred. Expenditures that result in the increase of future economic benefits such as the enhancement of the value or extension of the

useful lives of the facilities involved are treated as additions to property, plant and equipment.

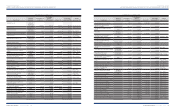

Depreciation is computed using the straight-line method based on the estimated useful lives of the assets as follows:

Buildings and structures 2 – 60

Machinery and equipment 2 – 21

Vehicles 3 – 15

Dies, molds and tools 2 – 14

Other equipment 3 – 15

Useful lives (years)