Hyundai 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

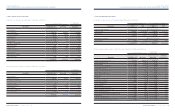

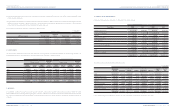

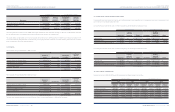

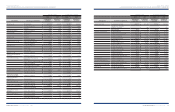

Debentures as of December 31, 2008 and 2007 consist of the following:

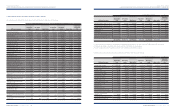

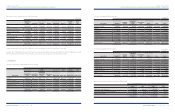

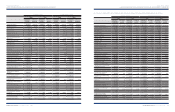

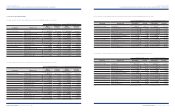

The maturity of long-term debt and debentures as of December 31, 2008 is as follows:

(*1) 11th subordinated bonds issued by Hyundai Card Co., Ltd., Face value:

₩

300,000 million($238,569 thousand),

Conversion period: Oct. 31, 2003~Dec. 31, 2008, Conversion price:

₩

8,831($7.02) per share,

Face value of

₩

1,785 million($1,419 thousand) and

₩

40,892 million($32,518 thousand) converted into 202,044 shares and 4,629,829 shares in 2008 and

2007, respectively.

(*2) Unsecured detachable bonds issued by Hyundai Card Co., Ltd., Face value:

₩

200,000 million($159,046 thousand),

Exercise period: Nov. 14, 2005~Apr. 30, 2009, 1,561,883 shares are issued as a result of exercise of warrants and unexercised warrants are equivalent to 19,077,381

shares as of December 31, 2008.

Description Debentures

Local currency

loans

Foreign currency

loans Total Total

2010

₩

6,943,122

₩

687,591

₩

2,182,638

₩

9,813,351 $7,803,858

2011 5,627,976 745,954 1,355,619 7,729,549 6,146,759

2012 700,000 152,415 784,595 1,637,010 1,301,797

Thereafter 30,000 467,067 2,588,040 3,085,107 2,453,365

13,301,098 2,053,027 6,910,892 22,265,017 17,705,779

Less discount on debentures 27,106 - - 27,106 21,556

₩

13,273,992

₩

2,053,027

₩

6,910,892

₩

22,237,911 $17,684,223

Description Maturity 2008 2008 2007 2008 2007

Domestic debentures:

Guaranteed debentures Jan. 26, 2009 ~

Nov. 21, 2011 5.41 ~ 9.90

₩

330,000

₩

373,000 $262,425 $296,620

Non-guaranteed debentures Jan. 10, 2009 ~

Mar. 18, 2018 3.73 ~ 8.98 18,271,684 14,446,512 14,530,166 11,488,280

Convertible bonds (*1) Jan. 31, 2009 4.00 92,369 94,153 73,455 74,873

Bonds with warrants (*2) Oct. 31, 2010 7.99 200,000 200,000 159,046 159,046

Overseas debentures Oct. 10, 2009 5.50 31,438 499,100 25,000 396,899

18,925,491 15,612,765 15,050,092 12,415,718

Less: discount on debentures 3,043 6,771 2,420 5,385

₩

18,928,534

₩

15,605,994 $15,052,512 $12,410,333

Korean Won In millions

Korean Won In millions

Annual

interest rate (%)

U.S. Dollars (Note 2)

In thousands

U.S. Dollars (Note 2) In thousands

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY

>>

HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I HYUNDAI MOTOR COMPANY I 2008 AnnuAl RepoRt I

16. PLEDGED ASSETS, CHECKS AND NOTES:

As of December 31, 2008, the following assets, checks and notes are pledged as collateral:

(1) The Company’s and its domestic subsidiaries’ property, plant and equipment are pledged as collateral for various loans to a maximum of

₩

6,788,058 million

(US$5,398,058 thousand).

(2) The Company’s and its domestic subsidiaries’ certain bank deposits and investment securities, including 29,713,466 shares of Kia Motors Corporation, and some

government bonds are pledged as collateral to financial institutions and others.

(3) Certain overseas subsidiaries’ receivables and other financial business assets are pledged as collateral for their borrowings.

(4) 42 blank checks, 1 check amounting to

₩

2,624 million (US$ 2,087 thousand), 216 blank promissory notes and 3 promissory notes amounting to

₩

12,917 million

(US$ 10,272 thousand) are pledged as collateral for short-term borrowings, long-term debt and other payables.

17. ACCRUED WARRANTIES:

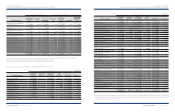

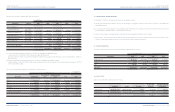

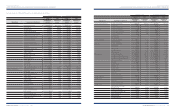

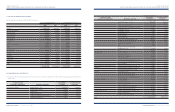

The changes in accrued warranties in current and long-term liabilities in 2008 and 2007 are as follows:

18. CAPITAL STOCK:

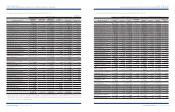

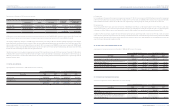

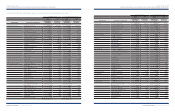

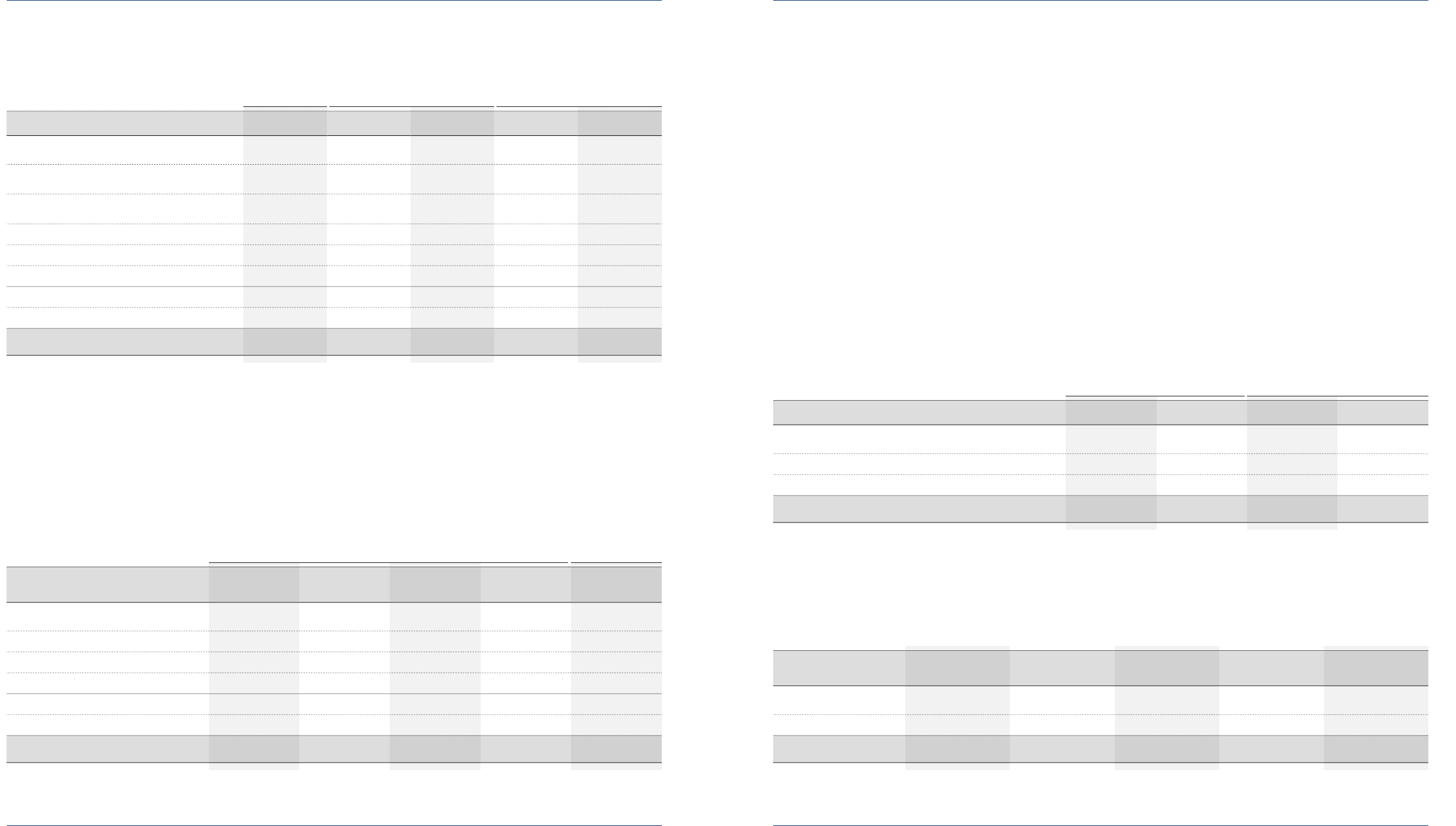

Capital stock as of December 31, 2008 consists of the following:

Description 2008 2007 2008 2007

Beginning of year

₩

4,180,848

₩

4,165,854 $3,324,730 $3,312,806

Accrual 942,335 647,470 749,372 514,887

Use (628,380) (632,476) (499,706) (502,963)

End of year

₩

4,494,803

₩

4,180,848 $3,574,396 $3,324,730

Authorized Issued Par value

Korean Won

In millions

U.S. Dollars (Note 2)

In thousands

Common stock 450,000,000 shares 220,276,479 shares

₩

5,000

₩

1,157,982 $920,861

Preferred stock 150,000,000 shares 65,202,146 shares 5,000 331,011 263,229

₩

1,488,993 $1,184,090

Korean Won In millions U.S. Dollars (Note 2) In thousands