Honda 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

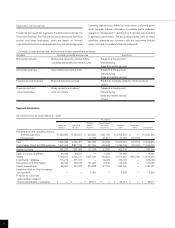

Yen (millions)

2009 2010

Non-financial Non-financial

services Finance Reconciling services Finance Reconciling

Years ended March 31, 2009 and 2010 businesses subsidiaries items Consolidated businesses subsidiaries items Consolidated

Cash flows from operating activities:

Net income ¥ 103,780 ¥ 47,153 ¥ — ¥ 150,933 ¥ 176,370 ¥ 106,241 ¥ — ¥ 282,611

Adjustments to reconcile net

income to net cash provided

by operating activities:

Depreciation 438,320 199,324 — 637,644 399,221 230,453 — 629,674

Deferred income taxes (12,547) 54,320 — 41,773 20,622 35,984 — 56,606

Equity in income of affiliates (99,034) — — (99,034) (93,282) — — (93,282)

Dividends from affiliates 65,140 — — 65,140 140,901 — — 140,901

Impairment loss on investments

in securities 26,001 — — 26,001 603 — — 603

Impairment loss on long-lived

assets and goodwill 21,597 18,528 — 40,125 548 3,312 — 3,860

Loss (gain) on derivative

instruments, net 24,045 (39,551) — (15,506) (6,683) (31,070) — (37,753)

Decrease (increase) in trade

accounts and notes receivable (55,881) 25,995 (139) (30,025) (67,982) 63,763 (2,691) (6,910)

Decrease (increase) in inventories (262,782) — — (262,782) 352,994 — — 352,994

Increase (decrease) in trade

accounts and notes payable (132,909) — (753) (133,662) 153,440 — (2,095) 151,345

Other, net (144,915) 95,425 12,524 (36,966) 22,892 28,393 12,278 63,563

Net cash provided by (used in)

operating activities (29,185) 401,194 11,632 383,641 1,099,644 437,076 7,492 1,544,212

Cash flows from investing activities:

Decrease (increase) in investments

and advances 75,714 — (68,393) 7,321 106,565 (5,878) (121,852) (21,165)

Capital expenditures (632,191) (2,999) — (635,190) (389,747) (2,315) — (392,062)

Proceeds from sales of property,

plant and equipment 18,501 342 — 18,843 24,132 340 — 24,472

Decrease (increase) in finance

subsidiaries—receivables — 45,509 (1,736) 43,773 — 87,571 4,350 91,921

Purchase of operating lease assets — (668,128) — (668,128) — (544,027) — (544,027)

Proceeds from sales of operating

lease assets — 100,017 — 100,017 — 245,110 — 245,110

Net cash used in

investing activities (537,976) (525,259) (70,129) (1,133,364) (259,050) (219,199) (117,502) (595,751)

Cash flows from financing activities:

Increase (decrease) in short-term

debt, net 452,437 (243,690) 62,048 270,795 (458,642) (304,264) 113,265 (649,641)

Proceeds from long-term debt 63,253 1,250,961 (14,230) 1,299,984 115,120 1,023,804 (6,702) 1,132,222

Repayment of long-term debt (23,165) (879,541) 13,223 (889,483) (25,285) (941,995) 3,447 (963,833)

Proceeds from issuance of

common stock — 2,544 (2,544) — — — — —

Dividends paid (139,724) — — (139,724) (61,696) — — (61,696)

Dividends paid to

noncontrolling interests (10,841) — — (10,841) (16,278) — — (16,278)

Sales (purchase) of treasury stock, net 131 — — 131 (18) — — (18)

Net cash provided by (used in)

financing activities 342,091 130,274 58,497 530,862 (446,799) (222,455) 110,010 (559,244)

Effect of exchange rate changes

on cash and cash equivalents (129,282) (12,390) — (141,672) 38,786 1,530 — 40,316

Net change in cash and

cash equivalents (354,352) (6,181) — (360,533) 432,581 (3,048) — 429,533

Cash and cash equivalents at

beginning of period 1,022,466 28,436 — 1,050,902 668,114 22,255 — 690,369

Cash and cash equivalents

at end of period ¥668,114 ¥ 22,255 ¥ — ¥ 690,369 ¥1,100,695 ¥ 19,207 ¥ — ¥1,119,902

Notes:

1. Honda adopted the FASB Accounting Standards Codification (ASC) 810 “Consolidation”, which is a replacement of Statement of Financial Accounting Standards No. 160,

“Noncontrolling Interests in Consolidated Financial Statements – an amendment of ARB No. 51”, effective April 1, 2009. Upon the adoption of ASC 810, presentation of cash flows has

been changed.

2. Non-financial services businesses lend to finance subsidiaries. These cash flows are included in the decrease (increase) in investments and advances, increase (decrease) in short-term

debt, proceeds from long-term debt, and repayment of long-term debt. The amount of the loans to finance subsidiaries is a ¥70,937 million decrease for the fiscal year ended March 31,

2009, and a ¥121,852 million decrease for the fiscal year ended March 31, 2010, respectively.

3. Decrease (increase) in trade accounts and notes receivable for finance subsidiaries is due to the reclassification of finance subsidiaries—receivables which relate to sales of inventory in

the unaudited consolidated statements of cash flows presented above.

67

Consolidated Statements of Cash Flows Divided into

Non-Financial Services Businesses and Finance Subsidiaries