Honda 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

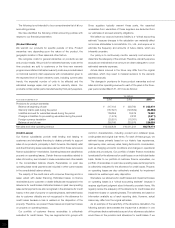

Interest Rate Swaps

2009 2010

Yen (millions) Yen (millions)

Notional Expected maturity date Average Average

principal Receive/ Contract Fair Contract Within 1-2 2-3 3-4 4-5 Fair receive pay

currency Pay amounts value amount 1 year year year year year Thereafter value rate rate

JP¥ Float/Fix ¥ 510 (3) ¥ 770 200 — — 270 300 — (24) 1.26% 2.76%

US$ Float/Fix 2,866,860 (88,322) 2,476,108 383,890 619,493 967,913 431,915 72,897 — (47,762) 0.33% 2.85%

Fix/Float 599,600 36,867 525,362 48,381 32,564 118,977 182,358 63,998 79,084 24,473 4.68% 1.41%

Float/Float 24,558 (76) — — — — — — — — —% —%

CA$ Float/Fix 570,945 (25,298) 525,099 106,896 121,397 146,153 130,108 19,794 751 (10,905) 0.45% 3.39%

Fix/Float 210,427 17,372 233,677 41,237 54,983 54,983 82,474 — — 10,036 5.16% 1.58%

Float/Float 32,222 (143) — — — — — — — — —% —%

GBP Float/Fix 22,002 (691) 45,075 19,803 22,464 2,808 — — — (528) 1.80% 2.63%

Total ¥4,327,124 (60,294) ¥3,806,091 600,407 850,901 1,290,834 827,125 156,989 79,835 (24,710)

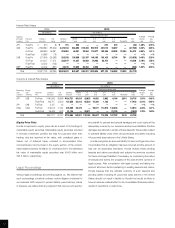

Currency & Interest Rate Swaps

2009 2010

Yen (millions) Yen (millions)

Receiving Paying Expected maturity date Average

Average

side side Receive/ Contract Fair Contract Within 1-2 2-3 3-4 4-5 Fair receive pay

currency currency Pay amounts value amount 1 year year year year year Thereafter value rate

rate

JP¥ US$ Fix/Float ¥190,565 29,896 ¥124,721 63,913 26,653 19,652 5,692 6,196 2,615 29,735 1.30% 0.48%

Float/Float 163,797 12,220 137,850 23,213 65,530 47,384 1,723 — — 17,403 0.81% 0.95%

JP¥ CA$ Fix/Float 2,137 42 — — — — — — — — —% —%

Other Other Fix/Float 275,013 17,461 405,289 55,475 — 98,571 110,910 140,333 — 12,613 4.82% 1.47%

Float/Float 35,499 1,578 51,104 — 29,911 — — 21,193 — (3,953) 1.28% 1.96%

Total ¥667,011 61,197 ¥718,964 142,601 122,094 165,607 118,325 167,722 2,615 55,798

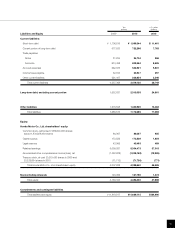

(Equity Price Risk)

Honda is exposed to equity price risk as a result of its holdings of

marketable equity securities. Marketable equity securities included

in Honda’s investment portfolio are held for purposes other than

trading, and are reported at fair value, with unrealized gains or

losses, net of deferred taxes, included in accumulated other

comprehensive income (loss) in the equity section of the consoli-

dated balance sheets. At March 31, 2009 and 2010, the estimated

fair value of marketable equity securities was ¥54.8 billion and

¥94.5 billion, respectively.

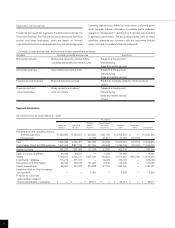

Legal Proceedings

Various legal proceedings are pending against us. We believe that

such proceedings constitute ordinary routine litigation incidental to

our business. With respect to product liability, personal injury claims

or lawsuits, we believe that any judgment that may be recovered by

any plaintiff for general and special damages and court costs will be

adequately covered by our insurance and accrued liabilities. Punitive

damages are claimed in certain of these lawsuits. We are also subject

to potential liability under other various lawsuits and claims including

44 purported class actions in the United States.

Honda recognizes an accrued liability for loss contingencies when

it is probable that an obligation has been incurred and the amount of

loss can be reasonably estimated. Honda reviews these pending

lawsuits and claims periodically and adjusts the amounts recorded

for these contingent liabilities, if necessary, by considering the nature

of lawsuits and claims, the progress of the case and the opinions of

legal counsel. After consultation with legal counsel, and taking into

account all known factors pertaining to existing lawsuits and claims,

Honda believes that the ultimate outcome of such lawsuits and

pending claims including 44 purported class actions in the United

States should not result in liability to Honda that would be likely to

have an adverse material effect on its consolidated financial position,

results of operations or cash flows.

52