Honda 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating and Financial Review

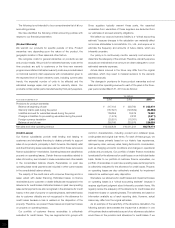

Net Sales and Other Operating Revenue

Honda’s consolidated net sales and other operating revenue

(hereafter, “net sales”) for the fiscal year ended March 31, 2010,

decreased ¥1,432.0 billion, or 14.3%, to ¥8,579.1 billion from the

fiscal year ended March 31, 2009, due mainly to negative foreign

currency translation effects and decreased net sales in automobile

business. Honda estimates that, by applying Japanese yen exchange

rates of the previous fiscal year to the current fiscal year, net sales for

the year would have decreased by approximately ¥746.7 billion, or

7.5%, compared to the decrease as reported of ¥1,432.0 billion,

which includes negative foreign currency translation effects.

Net sales in Japan increased ¥130.7 billion, or 9.0%, to ¥1,577.3

billion from the previous fiscal year and overseas net sales decreased

¥1,562.8 billion, or 18.2%, to ¥7,001.8 billion from the previous

fiscal year.

Operating Costs and Expenses

Operating costs and expenses decreased ¥1,606.1 billion, or

16.4%, to ¥8,215.3 billion from the previous fiscal year. Cost of sales

decreased ¥1,004.8 billion, or 13.5%, to ¥6,414.7 billion from the

previous fiscal year, due mainly to a decrease in costs attributable to

the decreased net sales, positive foreign currency effects and

continuing cost reduction. Selling, general and administrative

expenses decreased ¥501.4 billion, or 27.3%, to ¥1,337.3 billion

from the previous fiscal year, due mainly to positive foreign currency

effects, a decrease in provisions for credit losses and losses on

lease residual values in financial services business and the impact of

expenses in the previous year which related to withdrawal from

some racing activities and cancellations of development of new

models. R&D expenses decreased by ¥99.8 billion, or 17.7%, to

¥463.3 billion from the previous fiscal year, due mainly to improving

development efficiency, while improving safety and environmental

technologies and enhancing of the attractiveness of the products.

Operating Income

Operating income increased ¥174.1 billion, or 91.8%, to ¥363.7

billion from the previous fiscal year, due mainly to decreased selling,

general and administrative expenses and R&D expenses and

continuing cost reduction, which was partially offset by a decrease

in income attributable to the decreased net sales, negative foreign

currency effects and an increase in fixed costs per unit as a result of

reduced production. Excluding negative foreign currency effects of

¥167.5 billion, Honda estimates operating income increased ¥341.7

billion.

With respect to the discussion above of the changes, management

identified the factors and used what it believes to be a reasonable

method to analyze the respective changes in such factors.

Management analyzed changes in these factors at the levels of the

Company and its material consolidated subsidiaries. “Foreign

currency effects” consist of “translation adjustments”, which come

from the translation of the currency of foreign subsidiaries’ financial

statements into Japanese yen, and “foreign currency adjustments”,

which result from foreign-currency-denominated sales. With respect

to “foreign currency adjustments”, management analyzed foreign

currency adjustments primarily related to the following currencies:

U.S. dollar, Canadian dollar, Euro, British pound, Brazilian real and

Japanese yen, at the level of the Company and its material

consolidated subsidiaries.

Income before Income Taxes

and Equity in Income of Affiliates

Income before income taxes and equity in income of affiliates

increased ¥174.4 billion, or 107.9%, to ¥336.1 billion. Main factors

of this increase except factors relating operating income are as

follows:

Unrealized gains and losses related to derivative instruments had

a positive impact of ¥22.2 billion. Other income (expenses) excluding

unrealized gains and losses related to derivative instruments had a

negative impact of ¥21.9 billion, due mainly to a decrease in foreign

currency transaction gains, which was partially offset by a decrease

of impairment losses on investment securities.

Income Tax Expense

Income tax expense increased ¥37.0 billion, or 33.7%, to ¥146.8

billion from the previous fiscal year. The effective tax rate decreased

24.2 percentage points to 43.7% from the previous fiscal year. The

decrease in the effective tax rate was due to (1) a decrease in tax

expenses of ¥21.2 billion related to the dividend and royalty income

from foreign subsidiaries and affiliates, net of foreign tax credit,

because the Company did not utilize indirect foreign tax credit in the

prior fiscal year due to lower taxable income and (2) a decrease in

the valuation allowance of ¥7.0 billion recorded during the fiscal year

ended March 31, 2010.

Equity in Income of Affiliates

Equity in income of affiliates decreased ¥5.7 billion, or 5.8%, to

¥93.2 billion, due mainly to an increase in expenses and tax expense

at affiliates in certain countries in Asia, which was partially offset by

a decrease in expenses at certain affiliates in Japan.

12,000

Yen (billions)

10,000

8,000

6,000

4,000

2,000

2006 2007 2008 2009 2010

0

Net Sales and Other Operating Revenue

Years ended March 31

38

Financial Review