Honda 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The trusts which were structured in North America in the fiscal year

ended March 31, 2010 did not meet the conditions to be a QSPE.

In addition, we deemed that the total equity investments of these

trusts at risk were not sufficient to finance their activities without

additional subordinated financial support provided by our finance

subsidiaries. Accordingly, we recognized these trusts as VIEs.

Furthermore, as the finance subsidiaries retain certain subordinated

interests of these trusts and it is expected that we would absorb the

majority of the expected losses of these trusts, we have consolidated

these trusts.

Guarantee

At March 31, 2010, we guaranteed ¥31.7 billion of employee bank

loans for their housing costs. If an employee defaults on his/her loan

payments, we are required to perform under the guarantee. The

undiscounted maximum amount of our obligation to make future

payments in the event of defaults is ¥31.7 billion. As of March 31,

2010, no amount was accrued for any estimated losses under the

obligations, as it was probable that the employees would be able to

make all scheduled payments.

and sell pools of these receivables. In these securitizations, our

finance subsidiaries sell a portfolio of finance receivables to a special-

purpose entity, which is established for the limited purpose of buying

and reselling finance receivables. Our finance subsidiaries remain as

a servicer of the finance receivables and are paid a servicing fee for

our services. The special-purpose entity transfers the receivables to

a trust which is newly structured for each securitization or bank

conduit, which issues asset-backed securities or commercial paper,

respectively, to investors. Our finance subsidiaries retain certain

subordinated interests in the sold receivables in the form of

subordinated certificates, servicing assets and residual interests in

certain cash reserves provided as credit enhancements for investors.

Our finance subsidiaries apply significant assumptions regarding

prepayments, credit losses and average interest rates in estimating

expected cash flows from the trust or bank conduit, which affect the

recoverability of our retained interests in the sold finance receivables.

We periodically evaluate these assumptions and adjust them, if

appropriate, to reflect the performance of the finance receivables.

We have not historically consolidated trusts since these trusts

meet the definitions of a qualifying special-purpose entity (QSPE).

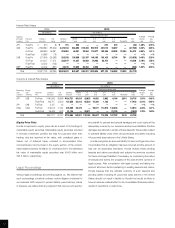

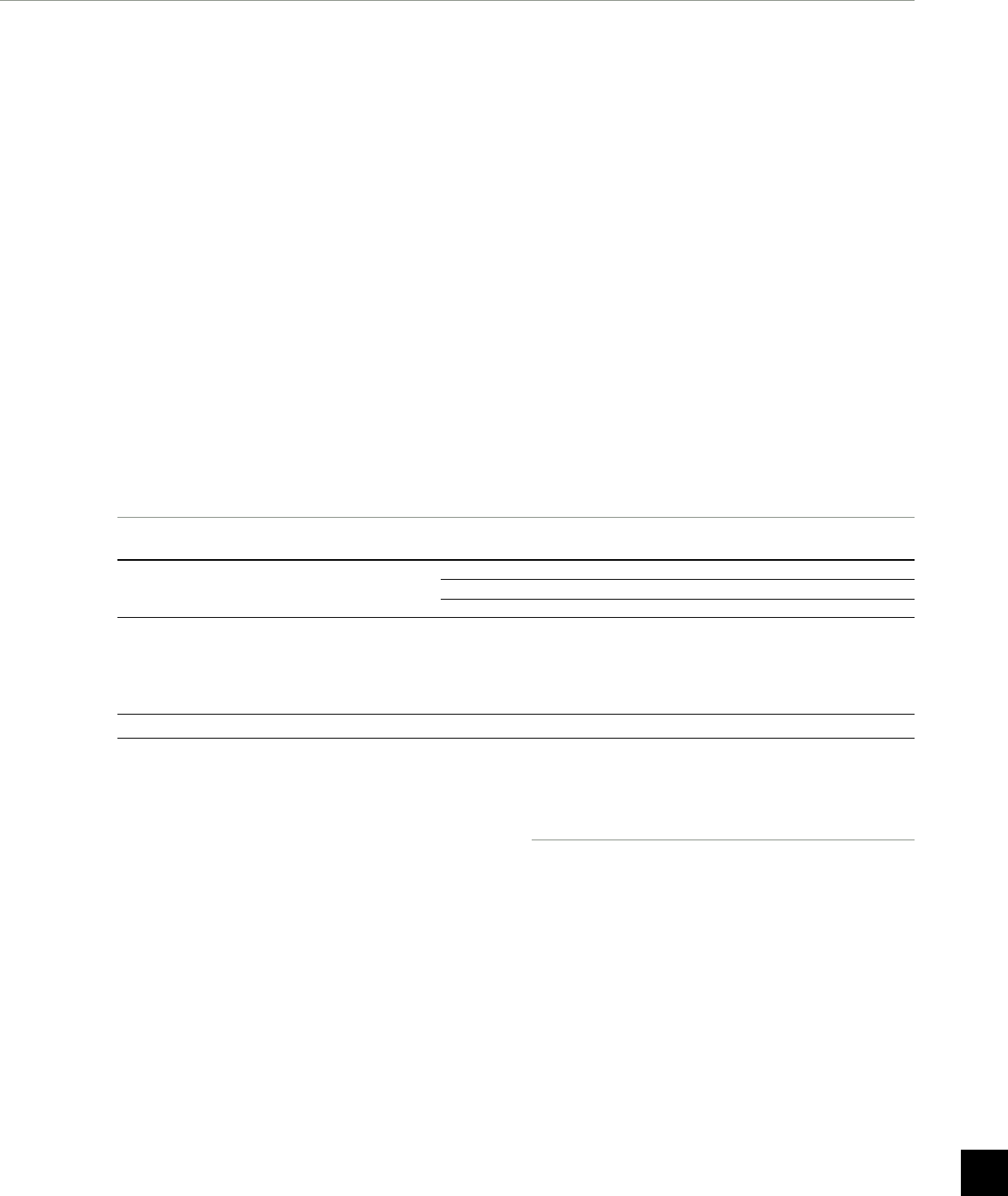

Tabular Disclosure of Contractual Obligations

The following table shows our contractual obligations at March 31, 2010:

Yen (millions)

Payments due by period

At March 31, 2010 Total Less than 1 year 1-3 years 3-5 years After 5 years

Long-term debt ¥3,035,331 ¥ 722,296 ¥1,496,585 ¥730,820 ¥ 85,630

Operating leases 117,027 22,556 28,892 17,362 48,217

Purchase commitments*1 47,436 47,436 — — —

Interest payments*2 337,573 146,794 155,062 33,597 2,120

Contributions to defined benefit pension plans*3 81,544 81,544 — — —

Total ¥3,618,911 ¥1,020,626 ¥1,680,539 ¥781,779 ¥135,967

*1 Honda had commitments for purchases of property, plant and equipment at March 31, 2010.

*2 To estimate the schedule of interest payments, the Company utilized the balances and average interest rates of borrowings and debts and derivative instruments as of March 31, 2010.

*3 Since contributions beyond the next fiscal year are not currently determinable, contributions to defined benefit pension plans reflect only contributions expected for the next fiscal year.

If our estimates of unrecognized tax benefits and potential tax

benefits are not representative of actual outcomes, our consolidated

financial statements could be materially affected in the period of

settlement or when the statutes of limitations expire, as we treat

these events as discrete items in the period of resolution. Since it is

difficult to estimate actual payment in the future related to our

uncertain tax positions, unrecognized tax benefit totaling ¥109,473

million is not represented in the table above.

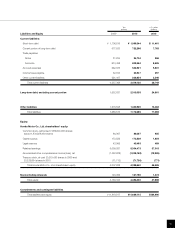

At March 31, 2010, we had no material capital lease obligations

or long-term liabilities reflected on our balance sheet under U.S.

GAAP other than those set forth in the table above.

Application of Critical Accounting Policies

Critical accounting policies are those which require us to apply the

most difficult, subjective or complex judgments, often requiring us to

make estimates about the effect of matters that are inherently

uncertain and which may change in subsequent periods, or for

which the use of different estimates that could have reasonably been

used in the current period would have had a material impact on the

presentation of our financial condition and results of operations. A

sustained loss of consumer confidence which may be caused by

continued economic slowdown, recession, changes in consumer

preferences, rising fuel prices, financial crisis or other factors have

combined to increase the uncertainty inherent in such estimates and

assumptions.

45