Honda 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

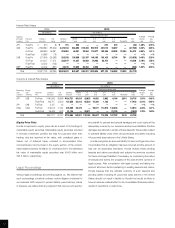

As of and for the year ended March 31, 2010

U.S. dollars (millions)

Financial Power Product

Motorcycle Automobile Services and Other Segment Reconciling

Business Business Business Businesses Total Items Consolidated

Net sales and other operating revenue:

External customers $12,256 $70,452 $ 6,517 $2,985 $ 92,210 $ — $ 92,210

Intersegment — — 134 289 423 (423) —

Total 12,256 70,452 6,651 3,274 92,633 (423) 92,210

Cost of sales, SG&A and R&D expenses 11,624 69,090 4,556 3,453 88,723 (423) 88,300

Segment income (loss) 632 1,362 2,095 (179) 3,910 — 3,910

Equity in income of affiliates 249 742 — 12 1,003 — 1,003

Assets 11,024 54,216 59,563 3,031 127,834 (2,843) 124,991

Investments in affiliates 1,107 3,599 — 181 4,887 — 4,887

Depreciation and amortization 523 3,631 2,477 137 6,768 — 6,768

Capital expenditures 412 3,059 5,872 255 9,598 — 9,598

Impairment loss on long-lived assets

and goodwill — 6 36 (1) 41 — 41

Provision for credit and

lease residual losses on

finance subsidiaries—receivables $ — $ — $ 431 $ — $ 431 $ — $ 431

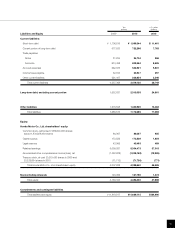

Explanatory notes:

1. Segment income (loss) is measured in a consistent manner with consolidated operating income, which is income before income taxes and

equity in income of affiliates before other income (expenses). Expenses not directly associated with specific segments are allocated based

on the most reasonable measures applicable.

2. Assets of each segment are defined as total assets, including derivative financial instruments, investments in affiliates, and deferred tax

assets. Segment assets are based on those directly associated with each segment and those not directly associated with specific segments

are allocated based on the most reasonable measures applicable except for the corporate assets described below.

3. Intersegment sales and revenues are generally made at values that approximate arm’s-length prices.

4. Unallocated corporate assets, included in reconciling items, amounted to ¥385,442 million as of March 31, 2008, ¥257,291 million as of

March 31, 2009, and ¥338,135 million ($3,634 million) as of March 31, 2010, which consist primarily of cash and cash equivalents and

marketable securities held by the Company. Reconciling items also include elimination of intersegment transactions.

5. Depreciation and amortization of the Financial Services Business include ¥101,032 million for the year ended March 31, 2008, ¥195,776

million for the year ended March 31, 2009 and ¥227,931 million ($2,450 million) for the year ended March 31, 2010 related to depreciation

of property on operating leases.

6. Capital expenditures of the Financial Services Business includes ¥839,261 million for the year ended March 31, 2008, ¥668,128 million for

the year ended March 31, 2009 and ¥544,027 million ($5,847 million) for the year ended March 31, 2010 related to purchases of operating

lease assets.

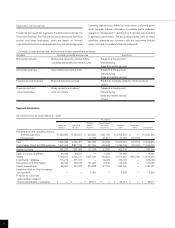

External Sales and Other Operating Revenue by Product or Service Groups

Yen U.S. dollars

(millions) (millions)

Years ended March 31: 2008 2009 2010 2010

Motorcycles and relevant parts ¥ 1,418,028 ¥ 1,323,259 ¥1,079,165 $11,599

All-terrain vehicles (ATVs), personal watercraft and relevant parts 140,668 88,252 61,127 657

Automobiles and relevant parts 9,489,391 7,674,404 6,554,848 70,452

Financial, insurance services 533,553 582,261 606,352 6,517

Power products and relevant parts 288,243 224,648 188,014 2,021

Others 132,951 118,417 89,668 964

Total ¥12,002,834 ¥10,011,241 ¥8,579,174 $92,210

62