Hasbro 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

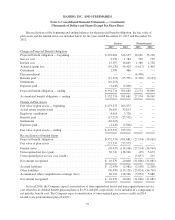

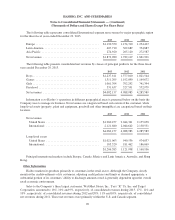

In connection with the Company’s agreement to form a joint venture with Discovery, the Company is

obligated to make future payments to Discovery under a tax sharing agreement. The Company estimates these

payments may total approximately $116,600 and may range from approximately $7,100 to $8,300 per year

during the period 2014 to 2018, and approximately $78,100 in aggregate for all years occurring thereafter. These

payments are contingent upon the Company having sufficient taxable income to realize the expected tax

deductions of certain amounts related to the joint venture.

In connection with the Company’s purchase of a majority stake in Backflip, the Company will be required

to purchase the remaining 30% in the future contingent on the achievement by Backflip of certain predetermined

financial performance metrics. The Company does not know the ultimate timing that these predetermined

financial performance metrics may be met and, thereby, cannot currently estimate the purchase price of the

remaining 30%. See note 4 for additional discussion.

At December 29, 2013, the Company had approximately $297,817 in outstanding inventory and tooling

purchase commitments.

During 2013 the Company recognized $61,140 related to the settlement of an adverse arbitration award

related to a license agreement. This charge was comprised of a settlement of $58,040 related to the adverse

arbitration award as well as other disputes between the Company and the inventor and $3,100 of related legal

expenses. These costs were recorded in the consolidated statements of operations as follows: $42,950 in

royalties, $3,100 in selling, distribution and administration expense and $15,090 in interest expense.

Hasbro is party to certain other legal proceedings, as well as certain asserted and unasserted claims.

Amounts accrued, as well as the total amount of reasonably possible losses with respect to such matters,

individually and in the aggregate, are not deemed to be material to the consolidated financial statements.

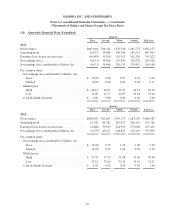

(18) Consolidation Program and Restructuring Charge

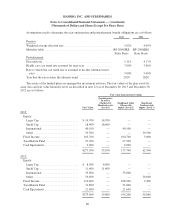

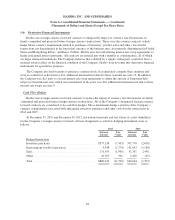

In the fourth quarter of 2012 the Company announced a multi-year cost savings initiative. This initiative

includes workforce reductions, facility consolidations, process improvements and other operating cost savings.

The Company has incurred pre-tax restructuring and related pension curtailment and settlement charges of

$79,748 in connection with this initiative. Of this amount, $43,702 was recorded in 2013 and $36,046 was

recorded in the fourth quarter of 2012. The 2013 charges include $34,980 of severance costs, $6,993 in non-cash

pension curtailment and settlement charges and $1,729 of costs associated with exiting a contractual obligation.

The 2013 severance charges primarily relate to a voluntary retirement program for certain eligible employees in

the United States. The 2012 charges included severance costs of $34,888 related to headcount reductions and

$1,157 of facility costs. Of the amounts recognized in 2013 and 2012, substantially all of the amount was

included in accrued liabilities at December 29, 2013 and December 30, 2012.

These charges were recorded in the consolidated statements of operations as follows:

2013 2012

Cost of sales ...................................................... $10,154 —

Product development ................................................ 4,100 8,470

Selling, distribution and administration ................................. 29,448 27,576

$43,702 36,046

87