Hasbro 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

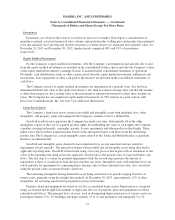

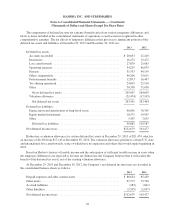

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

Foreign Currency Translation

Foreign currency assets and liabilities are translated into U.S. dollars at period-end exchange rates, and

revenues, costs and expenses are translated at weighted average exchange rates during each reporting period. Net

earnings include gains or losses resulting from foreign currency transactions and, when required, translation

gains and losses resulting from the use of the U.S. dollar as the functional currency in highly inflationary

economies. Other gains and losses resulting from translation of financial statements are a component of

consolidated other comprehensive earnings.

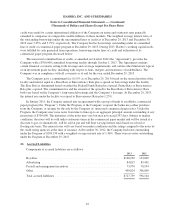

Pension Plans, Postretirement and Postemployment Benefits

Pension expense and related amounts in the consolidated balance sheets are based on actuarial computations

of current and future benefits. The Company’s policy is to fund amounts which are required by applicable

regulations and which are tax deductible. In 2014, the Company expects to contribute approximately $6,400 to its

pension plans. The estimated amounts of future payments to be made under other retirement programs are being

accrued currently over the period of active employment and are also included in pension expense. Hasbro has a

contributory postretirement health and life insurance plan covering substantially all employees who retire under

any of its United States defined benefit pension plans and meet certain age and length of service requirements.

The cost of providing these benefits on behalf of employees who retired prior to 1993 is and will continue to be

substantially borne by the Company. The cost of providing benefits on behalf of substantially all employees who

retire after 1992 is borne by the employee. It also has several plans covering certain groups of employees, which

may provide benefits to such employees following their period of employment but prior to their retirement. The

Company measures the costs of these obligations based on actuarial computations.

Stock-Based Compensation

The Company has a stock-based employee compensation plan for employees and non-employee members of

the Company’s Board of Directors. Under this plan the Company may grant stock options at or above the fair

market value of the Company’s stock, as well as restricted stock, restricted stock units and contingent stock

performance awards. All awards are measured at fair value at the date of the grant and amortized as expense on a

straight-line basis over the requisite service period of the award. For awards contingent upon Company

performance, the measurement of the expense for these awards is based on the Company’s current estimate of its

performance over the performance period. For awards contingent upon the achievement of market conditions, the

probability of satisfying the market condition is considered in the estimation of the grant date fair value. See note

13 for further discussion.

Risk Management Contracts

Hasbro uses foreign currency forward contracts to mitigate the impact of currency rate fluctuations on

firmly committed and projected future foreign currency transactions. These over-the-counter contracts, which

hedge future purchases of inventory and other cross-border currency requirements not denominated in the

functional currency of the business unit, are primarily denominated in United States and Hong Kong dollars as

well as Euros. Further, the Company also uses forward-starting interest rate swap agreements to hedge the

anticipated future interest payments related to the expected refinancing of the Company’s long-term debt due in

2014. All contracts are entered into with a number of counterparties, all of which are major financial institutions.

The Company believes that a default by a counterparty would not have a material adverse effect on the financial

condition of the Company. Hasbro does not enter into derivative financial instruments for speculative purposes.

At the inception of the contracts, Hasbro designates its derivatives as either cash flow or fair value hedges.

The Company formally documents all relationships between hedging instruments and hedged items as well as its

60