Hasbro 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

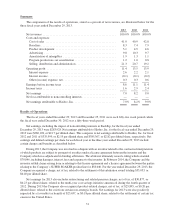

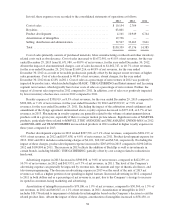

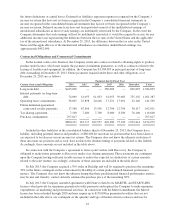

In total, these expenses were recorded to the consolidated statements of operations as follows:

2013 2012 2011

Cost of sales ............................................. $ 10,154 2,764 —

Royalties ................................................ 63,801 — —

Product development ...................................... 4,101 10,949 6,744

Amortization of intangibles ................................. 19,736 — —

Selling, distribution and administration ........................ 32,547 33,463 7,641

Total ................................................... $130,339 47,176 14,385

Cost of sales primarily consists of purchased materials, labor, manufacturing overheads and other inventory-

related costs such as obsolescence. Cost of sales increased to $1,672,901, or 41.0% of net revenues, for the year

ended December 29, 2013 from $1,671,980, or 40.9% of net revenues, for the year ended December 30, 2012.

Absent the impact of aforementioned charges, cost of sales decreased to $1,662,747, or 40.7% of net revenues,

for the year ended December 29, 2013 from $1,669,216, or 40.8% of net revenues, for the year ended

December 30, 2012 as a result of favorable product mix partially offset by the impact on net revenues of higher

sales promotions. Cost of sales decreased to 40.8% of net revenues, absent charges, for the year ended

December 30, 2012 from 42.8% in 2011. Cost of sales as a percentage of net revenues in 2012 was positively

impacted by product mix, which included higher MAGIC: THE GATHERING and Entertainment and Licensing

segment net revenues, which typically have lower costs of sales as a percentage of net revenues. Further, the

impact of closeout sales improved in 2012 compared to 2011. In addition, cost of sales was positively impacted

by lower inventory obsolescence costs in 2012 compared to 2011.

Royalty expense of $338,919, or 8.3% of net revenues, for the year ended December 29, 2013 compared to

$302,066, or 7.4% of net revenues, for the year ended December 30, 2012 and $339,217, or 7.9% of net

revenues, for the year ended December 25, 2011. Excluding the impact of the arbitration award settlement and

amendment of the Zynga agreement summarized above, royalty expense decreased to $275,118, or 6.7% of net

revenues, in 2013. Fluctuations in royalty expense are generally related to the volume of entertainment-driven

products sold in a given year, especially if there is a major motion picture release. Significant sales of MARVEL

products, particularly those related to MARVEL’S THE AVENGERS and THE AMAZING SPIDER-MAN, in 2012

and BEYBLADE and TRANSFORMERS movie-related products in 2011 resulted in higher royalty expenses in

those years compared to 2013.

Product development expense in 2013 totaled $207,591, or 5.1% of net revenues, compared to $201,197, or

4.9% of net revenues, in 2012 and $197,638, or 4.6% of net revenues, in 2011. Product development expense for

2013, 2012 and 2011 includes restructuring charges of $4,101, $10,949 and $6,744, respectively. Excluding the

impact of these charges, product development expense increased to $203,490 in 2013 compared to $190,248 in

2012 and $190,894 in 2011. The increase in 2013 reflects the addition of Backflip as well as investments in

certain brands, including MAGIC: THE GATHERING, partially offset by cost savings related to reduction in

headcount.

Advertising expense in 2013 decreased to $398,098, or 9.8% of net revenues, compared to $422,239, or

10.3% of net revenues, in 2012 and $413,951, or 9.7% of net revenues, in 2011. The level of the Company’s

advertising expense can generally be impacted by revenue mix, the amount and type of theatrical releases, and

television programming. The decrease in advertising expense in 2013 was the result of the mix of 2013 net

revenues as well as a higher portion of our spending in digital formats. Increased advertising in 2012 compared

to 2011 in both dollars and as a percentage of net revenue is, in part, due to the Company’s strategy to increase

its spend in consumer-facing marketing and advertising.

Amortization of intangibles increased to $78,186, or 1.9% of net revenues, compared to $50,569, or 1.3% of

net revenues, in 2012 and $46,647, or 1.1% of net revenues, in 2011. Amortization of intangibles in 2013

includes $19,736 related to impairment of definite-lived intangibles based on the Company’s decision to exit the

related product lines. Absent the impact of these charges, amortization of intangibles increased to $58,450, or

38