Hasbro 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013: Focusing our Business

Our increased focus on Hasbro Franchise Brands and the

execution of our brand blueprint is evident in our 2013

results. For the year, Hasbro revenues were $4.08 billion

and, excluding charges, operating profit margin was

14.6%, both essentially flat with 2012 results.1

Hasbro’s Franchise Brands delivered revenue

growth in 2013 of 15% year-over-year and together they

represented 44% of total revenues. Franchise Brands

grew double digits in both the U.S. and Canada segment

and the International segment.

Additionally, in 2013, our investment in Emerging

Markets continued to deliver double-digit revenue

growth for Hasbro in these markets. In 2013, our

Emerging Market revenue grew 25% to $575 million or

14% of Hasbro’s revenues globally. Emerging Market

growth helped deliver higher revenues in all Hasbro’s

major international regions: Europe, Latin America and

Asia Pacific.

Profitability in the Emerging Markets also increased,

growing more than 40% year-over-year to 10.1%

operating profit margin versus 8.9% in 2012. This

improvement is the result of strong top-line growth

driven by the execution of our brand blueprint, as

we begin leveraging our investments in these higher

growth markets. We believe over time these margins will

improve to approach company average operating profit

margin levels.

2013, however, presented dicult comparisons given

the entertainment calendar in 2013 versus 2012 and

continued challenges in developed economies such as

the U.S. and Australia. Despite these challenges, revenues

grew in the Girls, Games and Preschool categories

osetting the decline in the Boys category following a

strong 2012 entertainment year.

We remain focused on growing our profitability

faster than revenues over time. Throughout Hasbro,

we have been actively implementing our cost savings

initiative to deliver $100 million in underlying cost savings

by the end of 2015. From a strategic perspective this

program focuses our eorts on fewer brand initiatives

while we tactically streamline the organization, exit

unprofitable brands, license out select brands and build

Hasbro’s global team orientation. In 2013, we incurred

a number of restructuring and other charges, mostly

associated with the transformation of our business, but

we are better positioned today to deliver long-term

profitable growth in our business and enhanced total

shareholder return.

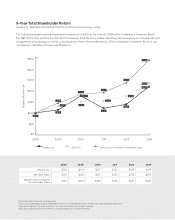

Our balance sheet remained strong and in 2013 we

generated $401 million in operating cash flow. We are

committed to strategically investing in our business and

returning excess cash to our shareholders through our

dividend and buyback programs.

In February 2014, we announced an increase in

our quarterly dividend of $0.03 per share, or 8%, to

$0.43 per share. This is the 10th increase in 11 years and

fifth consecutive year with an increase in our dividend.

In fact, over the last decade our quarterly dividend has

grown from $0.06 per share to its current rate of $0.43

per share.

Additionally, in August 2013, the Board of Directors

authorized the Company to repurchase an additional

$500 million of our common stock. $524.8 million

remained available at year-end in current share

repurchase authorizations.

Over the past five years, we’ve returned $2.1 billion

to you, our shareholders, through our dividend and

buyback programs. This represented 121% of our net

earnings during this period and, after investing in our

business, remains our top priority for use of excess cash.

Our target remains to generate $500 million in

operating cash flow on average per year. In 2013,

operating cash flow would have exceeded $500

million if not for $125 million in long-term royalty

advances we paid during the year as we extended our

strategic merchandising relationship with The Walt

Disney Company.

Revolution Across Geographies

The Revolution in Play we are creating begins with a

Revolution in Geography, where we have significantly

invested in establishing and orienting Hasbro globally.

We are turning the pyramid of global growth on its

head, investing in emerging markets to achieve double-

digit growth, improving our execution in developing

ANNUAL 2013 REPORT