Hasbro 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Summary

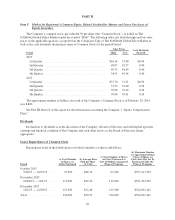

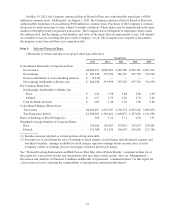

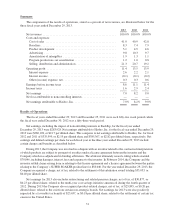

The components of the results of operations, stated as a percent of net revenues, are illustrated below for the

three fiscal years ended December 29, 2013.

2013 2012 2011

Net revenues .................................................. 100.0% 100.0% 100.0%

Costs and expenses:

Cost of sales ................................................ 41.0 40.9 42.8

Royalties ................................................... 8.3 7.4 7.9

Product development ......................................... 5.1 4.9 4.6

Advertising ................................................. 9.8 10.3 9.7

Amortization of intangibles .................................... 1.9 1.3 1.1

Program production cost amortization ............................ 1.2 1.0 0.8

Selling, distribution and administration ........................... 21.3 20.7 19.2

Operating profit ............................................... 11.4 13.5 13.9

Interest expense ............................................. 2.6 2.2 2.1

Interest income .............................................. (0.1) (0.1) (0.2)

Other (income) expense, net .................................... 0.3 0.3 0.6

Earnings before income taxes .................................... 8.6 11.1 11.4

Income taxes .................................................. 1.6 2.9 2.4

Net earnings .................................................. 7.0 8.2 9.0

Net loss attributable to noncontrolling interests .......................———

Net earnings attributable to Hasbro, Inc. ............................ 7.0% 8.2% 9.0%

Results of Operations

The fiscal years ended December 29, 2013 and December 25, 2011 were each fifty-two week periods while

the fiscal year ended December 30, 2012 was a fifty-three week period.

Net earnings, including the impact of noncontrolling interests in Backflip, for the fiscal year ended

December 29, 2013 were $283,928. Net earnings attributable to Hasbro, Inc. for the fiscal year ended December 29,

2013 were $286,198, or $2.17 per diluted share. This compares to net earnings attributable to Hasbro, Inc. for fiscal

2012 and 2011 of $335,999, or $2.55 per diluted share and $385,367, or $2.82 per diluted share, respectively. Net

earnings and diluted earnings per share for each fiscal year in the three years ended December 29, 2013 include

certain charges and benefits as described below.

During 2013, the Company was involved in a dispute with an inventor related to the contractual interpretation

of which products are subject to payment of royalties under a license agreement between the inventor and the

Company which was adjudicated in binding arbitration. The arbitrator ultimately issued a ruling which awarded

$70,046, including damages, interest, fees and expenses to the inventor. In February 2014, the Company and the

inventor settled claims arising from or relating to this license agreement and a license agreement between the parties

relating to the Company’s SUPER SOAKER product line for $58,040. For the year ended December 29, 2013, the

Company recognized a charge, net of tax, related to the settlement of this arbitration award totaling $53,053, or

$0.40 per diluted share.

Net earnings for 2013 also includes restructuring and related pension charges, net of tax, of $30,877, or

$0.23 per diluted share, related to the multi-year cost savings initiative announced during the fourth quarter of

2012. During 2013 the Company also recognized product-related charges, net of tax, of $25,895, or $0.20 per

diluted share, related to the exit from certain non-strategic brands. Net earnings for 2013 were also positively

impacted by a favorable tax benefit of $23,637, or $0.18 per diluted share, related to the settlement of certain tax

exams in the United States.

31