Hasbro 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

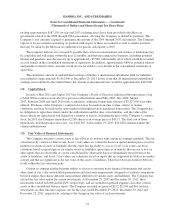

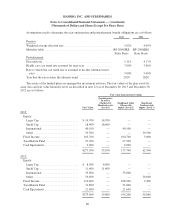

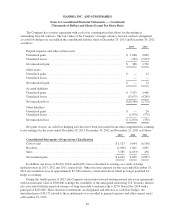

Assumptions used to determine the year-end pension and postretirement benefit obligations are as follows:

2013 2012

Pension

Weighted average discount rate ................................ 5.02% 4.09%

Mortality table ............................................. RP-2000/IRS

Static Basis

RP-2000/IRS

Static Basis

Postretirement

Discount rate ............................................... 5.11% 4.17%

Health care cost trend rate assumed for next year .................. 7.00% 7.00%

Rate to which the cost trend rate is assumed to decline (ultimate trend

rate) .................................................... 5.00% 5.00%

Year that the rate reaches the ultimate trend ...................... 2020 2020

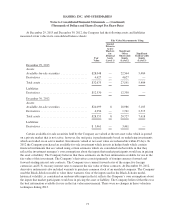

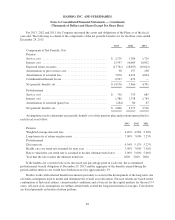

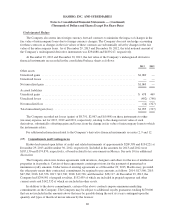

The assets of the funded plans are managed by investment advisors. The fair values of the plan assets by

asset class and fair value hierarchy level (as described in note 12) as of December 29, 2013 and December 30,

2012 are as follows:

Fair value measurements using:

Fair Value

Quoted prices

In active

Markets for

Identical assets

(Level 1)

Significant other

Observable

Inputs (Level 2)

Significant

Unobservable

Inputs (Level 3)

2013:

Equity:

Large Cap .......................... $ 14,700 14,700 — —

Small Cap .......................... 18,400 18,400 — —

International ........................ 40,100 — 40,100 —

Other .............................. 59,500 — — 59,500

Fixed Income .......................... 103,700 — 100,700 3,000

Total Return Fund ...................... 27,900 — 27,900 —

Cash Equivalents ....................... 9,000 — 9,000 —

$273,300 33,100 177,700 62,500

2012:

Equity:

Large Cap .......................... $ 8,000 8,000 — —

Small Cap .......................... 11,400 11,400 — —

International ........................ 33,600 — 33,600 —

Other .............................. 56,600 — — 56,600

Fixed Income .......................... 110,600 — 108,200 2,400

Total Return Fund ...................... 31,800 — 31,800 —

Cash Equivalents ....................... 21,600 — 21,600 —

$273,600 19,400 195,200 59,000

80