Hasbro 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

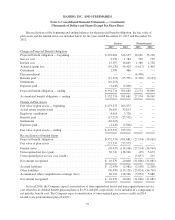

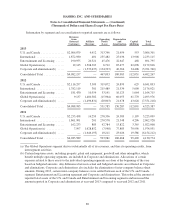

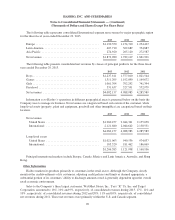

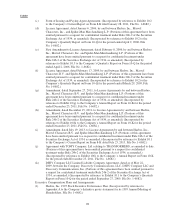

Information by segment and a reconciliation to reported amounts are as follows:

Revenues

from

External

Customers

Affiliate

Revenue

Operating

Profit

(Loss)

Depreciation

and

Amortization

Capital

Additions

Total

Assets

2013

U.S. and Canada ................ $2,006,079 4,412 313,746 21,459 553 3,066,301

International ................... 1,872,980 401 235,482 25,036 13,908 2,233,115

Entertainment and Licensing ...... 190,955 20,521 45,476 22,647 468 691,795

Global Operations(a) ............ 12,143 1,508,303 6,712 65,477 62,696 2,172,816

Corporate and eliminations(b) ..... — (1,533,637) (134,323) 46,366 34,406 (3,761,760)

Consolidated Total .............. $4,082,157 — 467,093 180,985 112,031 4,402,267

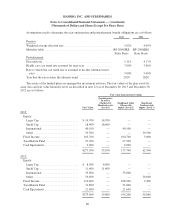

2012

U.S. and Canada ................ $2,116,297 5,309 319,072 24,899 629 6,041,893

International ................... 1,782,119 381 215,489 21,534 5,000 2,176,021

Entertainment and Licensing ...... 181,430 10,559 53,191 16,123 1,064 1,164,715

Global Operations(a) ............ 9,137 1,480,582 (15,964) 66,053 61,770 2,493,976

Corporate and eliminations(b) ..... — (1,496,831) (20,003) 21,678 43,628 (7,551,218)

Consolidated Total .............. $4,088,983 — 551,785 150,287 112,091 4,325,387

2011

U.S. and Canada ................ $2,253,458 16,259 278,356 24,389 1,199 5,225,099

International ................... 1,861,901 201 270,578 21,348 4,296 2,062,928

Entertainment and Licensing ...... 162,233 883 42,784 13,822 3,365 1,022,008

Global Operations(a) ............ 7,997 1,628,852 (7,948) 77,883 70,956 1,974,951

Corporate and eliminations(b) ..... — (1,646,195) 10,211 23,026 19,586 (6,154,212)

Consolidated Total .............. $4,285,589 — 593,981 160,468 99,402 4,130,774

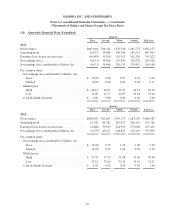

(a) The Global Operations segment derives substantially all of its revenues, and thus its operating results, from

intersegment activities.

(b) Certain long-term assets, including property, plant and equipment, goodwill and other intangibles, which

benefit multiple operating segments, are included in Corporate and eliminations. Allocations of certain

expenses related to these assets to the individual operating segments are done at the beginning of the year

based on budgeted amounts. Any differences between actual and budgeted amounts are reflected in Corporate

and eliminations. Corporate and eliminations also includes the elimination of inter-company balance sheet

amounts. During 2013, certain inter-company balances were settled between each of the U.S. and Canada

segment, Entertainment and Licensing segement and Corporate and eliminations. This reduced the amount of

reported total assets of the U.S. and Canada and Entertainment and Licensing segments and increased the

amount reported in Corporate and eliminations at year-end 2013 compared to year-end 2012 and 2011.

89