Hasbro 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

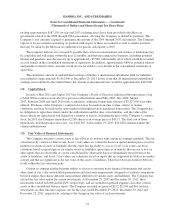

In October 2012, as part of an Amended and Restated Employment Agreement, the Company’s Chief

Executive Officer was awarded 587 shares to be granted in two tranches across 2013 and 2014. As of May 2013,

both tranches met the accounting definition for grant date and, as such, are being expensed from 2013 through

2017. The expense related to 2013 is included in the aforementioned recognized and unrecognized compensation

costs related to restricted stock units. 468 shares of this award are considered granted in 2013 and included in the

table below. The remaining shares were granted in February 2014. These awards provide the recipient with the

ability to earn shares of the Company’s common stock based on the Company’s achievement of four stated stock

price hurdles and continued employment through December 31, 2017. At the completion of the service period,

the recipient will receive one quarter of the award for each stock price hurdle achieved after April 24, 2013. The

four stock price hurdles are $45, $52, $56 and $60 which must be met for a period of at least thirty days using the

average closing price over such period.

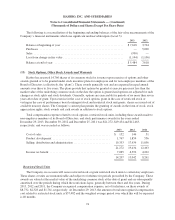

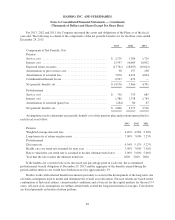

The Company used a Monte Carlo simulation valuation model to determine the fair value of these awards.

The following inputs were used in the simulation that resulted in an average grant date fair value for this award

of $35.56:

Inputs

Grant date stock price ......................................................... $47.28

Stock price volatility ......................................................... 26.12%

Risk-free interest rate ......................................................... 0.65%

Dividend yield .............................................................. 3.38%

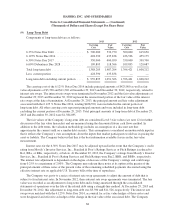

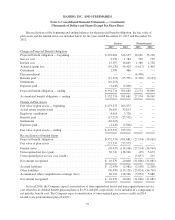

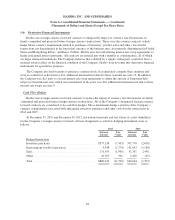

Excluding the aforementioned award for 468 shares, information with respect to the remaining Restricted

Stock Awards and Restricted Stock Units for 2013, 2012 and 2011 is as follows:

2013 2012 2011

Outstanding at beginning of year ................................. 296 232 196

Granted ................................................... 451 92 97

Forfeited .................................................. (44) (27) (3)

Vested .................................................... (1) (1) (58)

Outstanding at end of year ...................................... 702 296 232

Weighted average grant-date fair value:

Granted ................................................... $45.16 36.01 39.81

Forfeited .................................................. $40.40 40.80 40.98

Vested .................................................... $33.62 32.90 34.61

Outstanding at end of year ...................................... $43.10 39.53 41.06

Of the shares vested in 2011, the receipt of 58 shares has been deferred to the date upon which the recipient

is no longer employed by the Company.

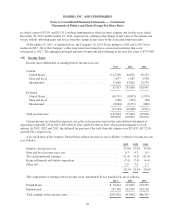

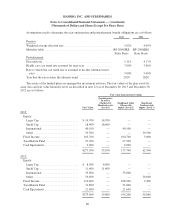

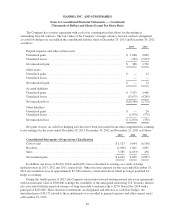

Stock Performance Awards

In 2013, 2012 and 2011, as part of its annual equity grant to executive officers and certain other employees,

the Company issued contingent stock performance awards (the “Stock Performance Awards”). These awards

provide the recipients with the ability to earn shares of the Company’s common stock based on the Company’s

achievement of stated cumulative diluted earnings per share and cumulative net revenue targets over the three

fiscal years ended December 2015, December 2014, and December 2013 for the 2013, 2012 and 2011 awards,

75