Hasbro 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

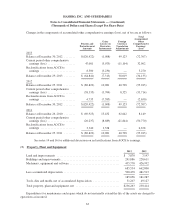

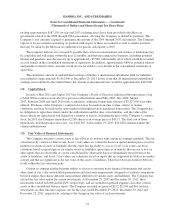

recorded a gain of $3,191 and $15,511 on these instruments in other (income) expense, net for the years ended

December 30, 2012 and December 25, 2011, respectively, relating to the change in fair value of the interest rate

swaps, wholly offsetting gains and losses from the change in fair value of the associated long-term debt.

At December 29, 2013, as detailed above, the Company’s 6.125% Notes mature in 2014 and 6.30% Notes

mature in 2017. All of the Company’s other long-term borrowings have contractual maturities that occur

subsequent to 2017. The aggregate principal amount of long-term debt maturing in the next five years is $775,000.

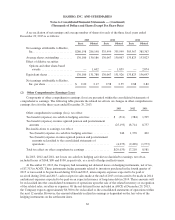

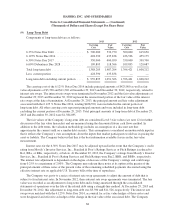

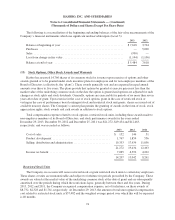

(10) Income Taxes

Income taxes attributable to earnings before income taxes are:

2013 2012 2011

Current

United States ......................................... $12,760 64,076 49,233

State and local ........................................ 1,677 1,587 2,538

International ......................................... 72,640 67,826 52,176

87,077 133,489 103,947

Deferred

United States ......................................... (10,751) (8,832) (1,973)

State and local ........................................ (368) (303) (68)

International ......................................... (8,064) (6,951) (880)

(19,183) (16,086) (2,921)

Total income taxes ...................................... $67,894 117,403 101,026

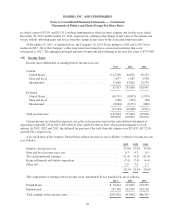

Certain income tax (benefits) expenses, not reflected in income taxes in the consolidated statements of

operations totaled $6,733 in 2013, $(31,682) in 2012 and $(18,266) in 2011 which relate primarily to stock

options. In 2013, 2012 and 2011, the deferred tax portion of the total (benefit) expense was $29,033, $(17,210)

and $(8,581), respectively.

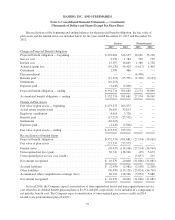

A reconciliation of the statutory United States federal income tax rate to Hasbro’s effective income tax rate

is as follows:

2013 2012 2011

Statutory income tax rate .......................................... 35.0% 35.0% 35.0%

State and local income taxes, net .................................... 0.3 0.3 0.3

Tax on international earnings ...................................... (11.4) (9.4) (11.4)

Exam settlements and statute expirations ............................. (7.4) (7.0) (4.6)

Other, net ...................................................... 2.8 7.0 1.5

19.3% 25.9% 20.8%

The components of earnings before income taxes, determined by tax jurisdiction, are as follows:

2013 2012 2011

United States .......................................... $ 54,424 113,893 132,255

International ........................................... 297,398 339,509 354,138

Total earnings before income taxes ......................... $351,822 453,402 486,393

69