Hasbro 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

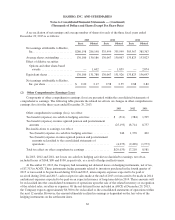

(4) Goodwill and Intangibles

Goodwill and certain intangible assets relating to rights obtained in the Company’s acquisition of Milton

Bradley in 1984 and Tonka in 1991 are not amortized. These rights were determined to have indefinite lives and

total approximately $75,700. The Company’s other intangible assets are amortized over their remaining useful

lives, and accumulated amortization of these other intangibles is reflected in other intangibles, net in the

accompanying consolidated balance sheets.

The Company performs an annual impairment test on goodwill and intangible assets with indefinite

lives. This annual impairment test is performed in the fourth quarter of the Company’s fiscal year. In addition, if

an event occurs or circumstances change that indicate that the carrying value may not be recoverable, the

Company will perform an interim impairment test at that time. For the three fiscal years ended December 29,

2013, no such events occurred. The Company completed its annual impairment tests of goodwill in the fourth

quarters of 2013, 2012 and 2011 concluding that the fair value of each reporting unit substantially exceeded the

carrying value and therefore, no impairment charges were taken in each of the three years.

A portion of the Company’s goodwill and other intangible assets reside in the Corporate segment of the

business. For purposes of the goodwill impairment testing, these assets are allocated to the reporting units within

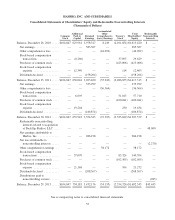

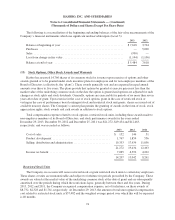

the Company’s operating segments. Changes in the carrying amount of goodwill, by operating segment, for the

years ended December 29, 2013 and December 30, 2012 are as follows:

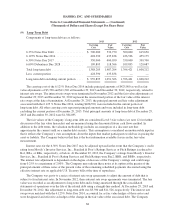

U.S. and

Canada International

Entertainment

and Licensing Total

2013

Balance at December 30, 2012 ............. $296,978 171,451 6,496 474,925

Acquired during the period ................ — — 119,111 119,111

Foreign exchange translation .............. — 285 — 285

Balance at December 29, 2013 ............. $296,978 171,736 125,607 594,321

2012

Balance at December 25, 2011 ............. $296,978 171,318 6,496 474,792

Foreign exchange translation .............. — 133 — 133

Balance at December 30, 2012 ............. $296,978 171,451 6,496 474,925

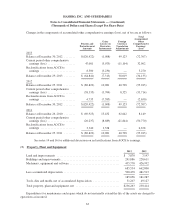

On July 8, 2013, the Company acquired a majority interest in Backflip Studios, LLC (“Backflip”), a mobile

game developer based in Boulder, Colorado. The Company paid $112,000 in cash to acquire a 70% interest in

Backflip, and will be required to purchase the remaining 30% in the future contingent on the achievement by

Backflip of certain predetermined financial performance metrics. The Company is consolidating the financial

statements of Backflip and reporting the 30% redeemable noncontrolling interests as a separate line in the

consolidated balance sheets and statements of operations.

Based on a valuation of approximately $160,000, the Company has allocated approximately $6,000 to net

tangible assets, $35,000 to identifiable intangible assets, $119,000 to goodwill, and $48,000 to redeemable

noncontrolling interests. The valuation was based on the income approach which utilizes discounted future cash

flows expected to be generated from the acquired business. Identifiable intangible assets include property rights

which are being amortized over the projected revenue curve over a period of four years. During 2013,

amortization of intangibles includes $8,100 related to these assets. Goodwill reflects the value to the Company

from leveraging Backflip’s expertise in developing and marketing mobile digital games, including the continued

expansion of its own brands in this arena. The goodwill recorded as part of this acquisition will be reflected in

64