Hasbro 2013 Annual Report Download - page 42

Download and view the complete annual report

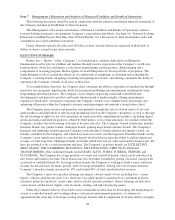

Please find page 42 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company also seeks to express its brands through its lifestyle licensing business. Under its lifestyle

licensing programs, the Company enters into relationships with a broad spectrum of apparel, food, bedding and

other lifestyle products companies for the global marketing and distribution of licensed products based on the

Company’s brands. These relationships further broaden and amplify the consumer’s ability to experience the

Company’s brands.

As the Company seeks to grow its business in entertainment, licensing and digital gaming, the Company

will continue to evaluate strategic alliances and acquisitions, like Backflip, which may complement its current

product offerings, allow it entry into an area which is adjacent to or complementary to the toy and game business,

or allow it to further develop awareness of its brands and expand the ability of consumers to experience its

brands in different forms and formats.

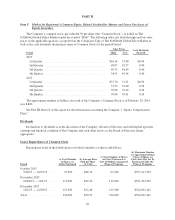

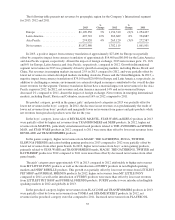

During the fourth quarter of 2012 the Company announced a multi-year cost savings initiative in which it

targets annual cost reductions of $100,000 by the end of 2015. This plan included an approximate 10% workforce

reduction, facility consolidations and process improvements which reduce redundancy and increase efficiencies.

During 2013, the Company incurred restructuring and related pension charges of $43,702 and product-related

charges of $19,736 related to this plan in addition to charges of $36,046 recognized during the fourth quarter of

2012. For the full year 2013, the Company recognized gross cost savings, before restructuring costs, from these

actions of approximately $50,000. These savings are prior to other costs which have or are anticipated to increase in

2013 and in future years, such as compensation costs and other investments in certain components of the business.

The Company’s business is highly seasonal with a significant amount of revenues occurring in the second

half of the year. In 2013, 2012 and 2011, the second half of the year accounted for 65%, 64% and 63% of the

Company’s net revenues, respectively.

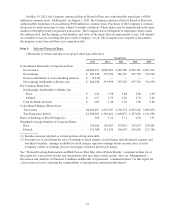

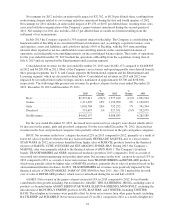

The Company sells its products both within the United States and in a number of international markets. In

recent years, the Company’s international net revenues have experienced growth as the Company has sought to

increase its international presence. Net revenues of the Company’s International segment represented 46%, 44%

and 43% of total net revenues in 2013, 2012 and 2011, respectively. The Company has driven international

growth by opportunistically opening offices in certain markets, primarily emerging markets, to develop a greater

presence. Emerging markets offer greater opportunity for revenue growth than in developed economies which

have faced challenging economic environments in recent years. In 2013 and 2012, net revenues from emerging

markets increased by 25% and 16%, respectively, and represented more than 10% of consolidated net revenues in

each of these years.

The Company’s business is separated into three principal business segments, U.S. and Canada, International

and Entertainment and Licensing. The U.S. and Canada segment develops, markets and sells both toy and game

products in the United States and Canada. The International segment consists of the Company’s European, Asia

Pacific and Latin and South American toy and game marketing and sales operations. The Company’s

Entertainment and Licensing segment includes the Company’s lifestyle licensing, digital licensing and gaming,

movie and television entertainment operations. In addition to these three primary segments, the Company’s

world-wide manufacturing and product sourcing operations are managed through its Global Operations segment.

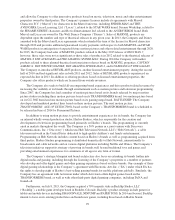

The Company is committed to returning excess cash to its shareholders through share repurchases and

dividends. As part of this initiative, from 2005 through 2013, the Company’s Board of Directors (the “Board”)

adopted seven successive share repurchase authorizations with a cumulative authorized repurchase amount of

$3,325,000. The seventh authorization was approved in August 2013 for $500,000. At December 29, 2013, the

Company had $524,822 remaining available under theses authorizations. During the three years ended 2013, the

Company spent a total of $625,554, to repurchase 15,424 shares in the open market. The Company intends to, at

its discretion, opportunistically repurchase shares in the future subject to market conditions, the Company’s other

potential uses of cash and the Company’s levels of cash generation. In addition to the share repurchase program,

the Company also seeks to return excess cash through the payment of quarterly dividends. In February 2014 the

Company’s Board increased the Company’s quarterly dividend rate to $0.43 per share, an 8% increase from the

prior year quarterly dividend of $0.40 per share. This was the tenth dividend increase in the previous 11 years.

During that period, the Company has increased its quarterly cash dividend from $0.03 to $0.43 per share.

30