Hasbro 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

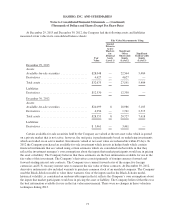

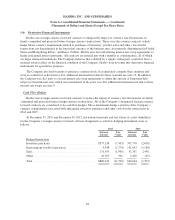

Stock Options

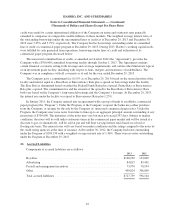

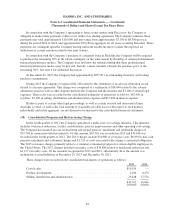

Information with respect to stock options for the three years ended December 29, 2013 is as follows:

2013 2012 2011

Outstanding at beginning of year .............................. 9,283 11,004 11,392

Granted ................................................ 776 1,730 1,080

Exercised ............................................... (4,377) (3,126) (1,267)

Expired or forfeited ....................................... (139) (325) (201)

Outstanding at end of year ................................... 5,543 9,283 11,004

Exercisable at end of year .................................... 3,144 6,094 7,494

Weighted average exercise price:

Granted ................................................ $47.21 36.14 45.66

Exercised ............................................... $26.99 21.23 23.55

Expired or forfeited ....................................... $39.59 35.19 29.35

Outstanding at end of year ................................. $36.63 31.25 27.75

Exercisable at end of year .................................. $33.22 27.84 24.35

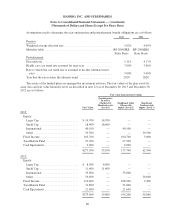

With respect to the 5,543 outstanding options and 3,144 options exercisable at December 29, 2013, the

weighted average remaining contractual life of these options was 3.85 years and 2.87 years, respectively. The

aggregate intrinsic value of the options outstanding and exercisable at December 29, 2013 was $98,498 and

$66,586, respectively. Substantially all unvested outstanding options are expected to vest.

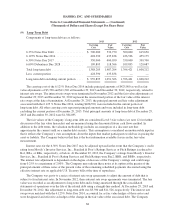

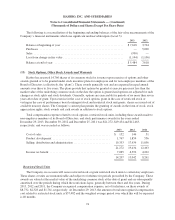

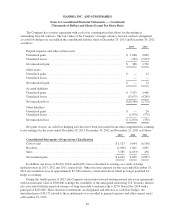

The Company uses the Black-Scholes valuation model in determining the fair value of stock options. The

expected life of the options used in this calculation is the period of time the options are expected to be

outstanding and has been determined based on historical exercise experience. The weighted average fair value of

options granted in fiscal 2013, 2012 and 2011 was $6.94, $6.29 and $9.84, respectively. The fair value of each

option grant is estimated on the date of grant using the Black-Scholes option pricing model with the following

weighted average assumptions used for grants in the fiscal years 2013, 2012 and 2011:

2013 2012 2011

Risk-free interest rate ....................................... 0.62% 0.69% 1.64%

Expected dividend yield ..................................... 3.39% 3.99% 2.63%

Expected volatility ......................................... 26% 31% 30%

Expected option life ........................................ 5years 5 years 5 years

The intrinsic values, which represent the difference between the fair market value on the date of exercise

and the exercise price of the option, of the options exercised in fiscal 2013, 2012 and 2011 were $89,534,

$49,225 and $26,308, respectively.

At December 29, 2013, the amount of total unrecognized compensation cost related to stock options was

$9,514 and the weighted average period over which this will be expensed is 19 months.

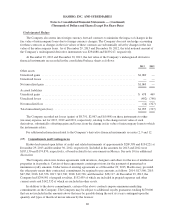

Non-Employee Awards

In 2013, 2012 and 2011, the Company granted 33, 44 and 33 shares of common stock, respectively, to its

non-employee members of its Board of Directors. Of these shares, the receipt of 28 shares from the 2013 grant,

33 shares from the 2012 grant and 27 shares from the 2011 grant has been deferred to the date upon which the

77