Hasbro 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

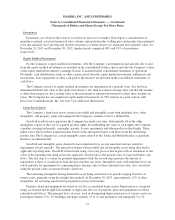

the future deductions or capital losses. Deferred tax liabilities represent expenses recognized on the Company’s

income tax return that have not yet been recognized in the Company’s consolidated financial statements or

income recognized in the consolidated financial statements that has not yet been recognized in the Company’s

income tax return. Deferred income taxes have not been provided on most of the undistributed earnings of

international subsidiaries as most of such earnings are indefinitely reinvested by the Company. In the event the

Company determines that such earnings will not be indefinitely reinvested, it would be required to accrue for any

additional income taxes representing the difference between the tax rates in the United States and the applicable

tax of the international subsidiaries. At December 29, 2013, the difference between the tax rates in the United

States and the applicable tax of the international subsidiaries on cumulative undistributed earnings was

approximately $492,000.

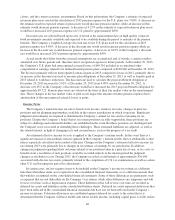

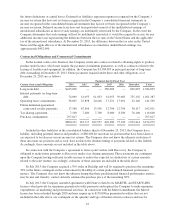

Contractual Obligations and Commercial Commitments

In the normal course of its business, the Company enters into contracts related to obtaining rights to produce

product under license, which may require the payment of minimum guarantees, as well as contracts related to the

leasing of facilities and equipment. In addition, the Company has $1,384,895 in principal amount of long-term

debt outstanding at December 29, 2013. Future payments required under these and other obligations as of

December 29, 2013 are as follows:

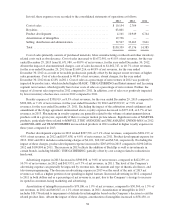

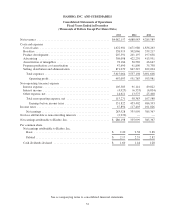

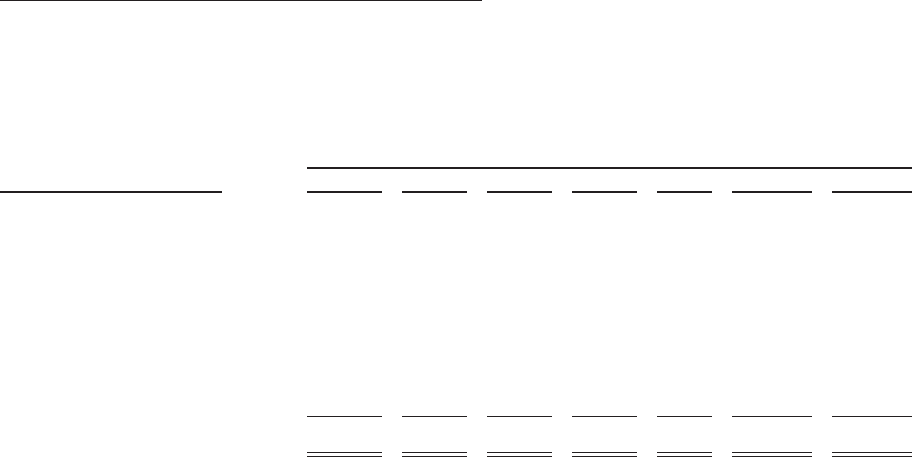

Payments due by Fiscal Year

Certain Contractual Obligations 2014 2015 2016 2017 2018 Thereafter Total

Long-term debt ................ $425,000 — — 350,000 — 609,895 1,384,895

Interest payments on long-term

debt ....................... 74,069 61,053 61,053 61,053 39,003 755,156 1,051,387

Operating lease commitments .... 38,665 25,898 20,248 17,521 17,091 22,146 141,569

Future minimum guaranteed

contractual royalty payments . . . 17,560 67,366 13,556 12,706 12,706 38,117 162,011

Tax sharing agreement .......... 7,100 7,400 7,700 8,000 8,300 78,100 116,600

Purchase commitments .......... 297,817———— —297,817

$860,211 161,717 102,557 449,280 77,100 1,503,414 3,154,279

Included in other liabilities in the consolidated balance sheets at December 29, 2013, the Company has a

liability, including potential interest and penalties, of $80,006 for uncertain tax positions that have been taken or

are expected to be taken in various income tax returns. The Company does not know the ultimate resolution of

these uncertain tax positions and as such, does not know the ultimate timing of payments related to this liability.

Accordingly, these amounts are not included in the table above.

In connection with the Company’s agreement to form a joint venture with Discovery, the Company is

obligated to make future payments to Discovery under a tax sharing agreement. These payments are contingent

upon the Company having sufficient taxable income to realize the expected tax deductions of certain amounts

related to the joint venture. Accordingly, estimates of these amounts are included in the table above.

In July 2013, the Company acquired a 70% stake in Backflip and will be required to purchase the remaining

30% in the future contingent on the achievement by Backflip of certain predetermined financial performance

metrics. The Company does not know the ultimate timing that these predetermined financial performance metrics

may be met and, thereby, cannot currently estimate the purchase price of the remaining 30%.

In July 2013, the Company amended agreements with Disney related to its MARVEL and STAR WARS

licenses which provide for minimum guaranteed royalty payments and requires the Company to make minimum

expenditures on marketing and promotional activities. In connection with the Marvel amendment, the Marvel

license has been extended through 2020 and may require up to $170,000 in guaranteed royalties that are not

included in the table above, are contingent on the quantity and type of theatrical movie releases and may be

47