Hasbro 2013 Annual Report Download - page 48

Download and view the complete annual report

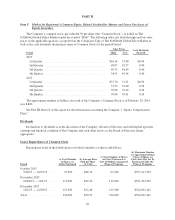

Please find page 48 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEROES products, primarily MARVEL-related, and PLAY-DOH products were wholly offset by decreased net

revenues from PLAYSKOOL and SESAME STREET products.

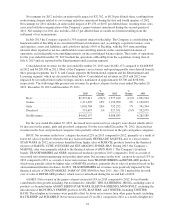

International segment operating profit increased 9% in 2013 compared to 2012 and decreased 20% in 2012

compared to 2011. Operating profit margin increased to 12.6% of net revenues in 2013 from 12.1% of net

revenues in 2012 and decreased in 2012 from 14.5% of net revenues in 2011. Operating profit for the

International segment in 2013 and 2012 was impacted by approximately $4,700 and $(11,900), respectively, due

to the favorable/(unfavorable) impact from translation of foreign currencies to the U.S. dollar. Operating profit

for the year ended December 30, 2012 includes restructuring charges of $1,628. Excluding the impact of

restructuring charges, the operating profit margin in 2012 was 12.2%. In 2013, operating profit and margins

improved primarily due to higher net revenues discussed above. While most operating expenses increased in

dollars, they decreased as a percent of net revenues. In 2012, decreases in operating profit and operating profit

margin were primarily due to lower net revenues discussed above in addition to higher selling, distribution and

administration expenses. Higher cost of sales as a percentage of net revenues was partially offset by lower

royalty expense as a result of the mix of entertainment-based and non-entertainment based product sales. Further,

the decline in operating profit margin in 2012 compared to 2011 reflects the change in geographical mix of net

revenues, with a higher percentage coming from emerging markets, which currently have lower operating profit

margins than the Company has in developed markets.

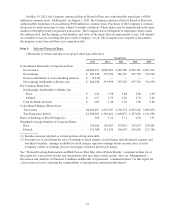

Entertainment and Licensing

Entertainment and Licensing segment net revenues increased 5% in 2013 compared to 2012 and 12% in

2012 compared to 2011. Increased net revenues in 2013 compared to 2012 is predominately the result of

investment to grow the Company’s global licensing organization, particularly lifestyle licensing, and expand into

emerging markets as well as diversification in strategic digital gaming partnerships including the acquisition of a

majority stake in Backflip. These higher net revenues were partially offset by lower net revenues from

distribution of television programming, specifically digital distribution, as 2012 net revenues include the initial

distribution of Hasbro Studios television programming libraries to Netflix. Higher net revenues in 2012

compared to 2011 were primarily due to the sale and distribution of television programming which included

global television distribution, digital distribution and home entertainment, partially offset by decreased net

revenues from lifestyle licensing primarily relating to lower TRANSFORMERS movie-related licensing

revenues.

Entertainment and Licensing segment operating profit decreased 15% in 2013 compared to 2012 and

increased 24% in 2012 compared to 2011. Operating profit for 2013 and 2012 includes restructuring charges of

$1,729 and $555, respectively. Excluding restructuring charges, increased operating profit from lifestyle and

digital gaming licensing was offset by operating losses from entertainment and the addition of Backflip.

Operating profit for 2013 includes an approximate $7,600 operating loss for Backflip, primarily due to

amortization of acquired intangibles. In 2012, higher net revenues from television programming distribution

directly contributed to an increased operating profit.

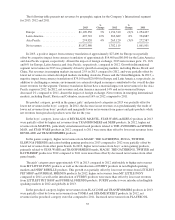

Other Segments and Corporate and Eliminations

In the Global Operations segment, an operating profit of $6,712 in 2013 compared to operating losses of

$15,964 and $7,948 in 2012 and 2011, respectively. The operating loss in 2012 included severance costs of

$4,307 associated with restructuring activities. The improvement in operating results in the Global Operations

segment is primarily due to improvements made in owned manufacturing facilities and expense reductions

associated with restructuring activities.

In Corporate and Eliminations, operating losses of $134,323 and $20,003 in 2013 and 2012, respectively,

compared to operating profit of $10,211 in 2011. Corporate and Eliminations includes restructuring and related

pension charges of $41,973 for the year ended December 29, 2013 and restructuring charges of $38,242 and

$14,385 for the years ended December 30, 2012 and December 25, 2011, respectively. The Corporate and

36