GameStop 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

of the Series A Preferred Stock shall have the right, voting as a class, to elect two of the Company's Directors.

In the event of any merger, consolidation or other transaction in which the Company's Common Stock is

exchanged, each share of Series A Preferred Stock will be entitled to receive one thousand times the amount

and type of consideration received per share of the Company's Common Stock. At January 29, 2005 there

were no shares of Series A Preferred Stock outstanding.

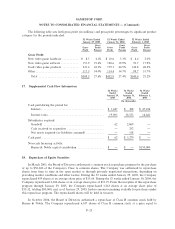

20. Unaudited Quarterly Financial Information

The following table sets forth certain unaudited quarterly consolidated statement of operations informa-

tion for the Ñscal years ended January 29, 2005 and January 31, 2004. The unaudited quarterly information

includes all normal recurring adjustments that management considers necessary for a fair presentation of the

information shown.

Fiscal Year Ended January 29, 2005 Fiscal Year Ended January 31, 2004

1st 2nd 3rd 4th 1st 2nd 3rd 4th

Quarter Quarter Quarter Quarter Quarter Quarter Quarter Quarter

(In thousands)

Sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $371,736 $345,593 $416,737 $708,740 $321,741 $305,674 $326,042 $625,381

Gross proÑt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 104,642 106,286 118,959 179,413 84,640 88,032 97,783 162,490

Operating earnings(1) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,770 12,545 19,852 55,980 10,689 10,849 17,891 64,955

Net earnings(2) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,678 7,672 12,059 34,517 6,611 6,606 10,693 39,557

Net earnings per Class A and Class B

common share Ì basic(3) ÏÏÏÏÏÏÏÏ 0.12 0.14 0.22 0.68 0.12 0.12 0.19 0.71

Net earnings per Class A and Class B

common share Ì diluted(3)ÏÏÏÏÏÏÏ 0.11 0.13 0.21 0.64 0.11 0.11 0.18 0.67

(1) Includes the following pre-tax charges:

‚ $2,750 in the Ñrst quarter of the Ñscal year ended January 29, 2005 attributable to the California labor

litigation settlement,

‚ $2,800 in the third quarter of the Ñscal year ended January 29, 2005 attributable to the professional fees

related to the spin-oÅ by Barnes & Noble of the Company's Class B common shares, and

‚ $5,373 in the fourth quarter of the Ñscal year ended January 29, 2005 attributable to correcting the

Company's method of accounting for rent expense and depreciation expense on leasehold improve-

ments for those leases that do not contain a renewal option.

(2) Includes the following after-tax charges:

‚ $1,708 in the Ñrst quarter of the Ñscal year ended January 29, 2005 attributable to the California labor

litigation settlement,

‚ $1,739 in the third quarter of the Ñscal year ended January 29, 2005 attributable to the professional fees

related to the spin-oÅ by Barnes & Noble of the Company's Class B common shares, and

‚ $3,312 in the fourth quarter of the Ñscal year ended January 29, 2005 attributable to correcting the

Company's method of accounting for rent expense and depreciation expense on leasehold improve-

ments for those leases that do not contain a renewal option.

(3) Includes the following charges per basic and diluted share:

‚ $0.03 per basic and diluted share in the Ñrst quarter of the Ñscal year ended January 29, 2005

attributable to the California labor litigation settlement,

‚ $0.03 per basic and diluted share in the third quarter of the Ñscal year ended January 29, 2005

attributable to the professional fees related to the spin-oÅ by Barnes & Noble of the Company's

Class B common shares, and

F-27