GameStop 2004 Annual Report Download - page 37

Download and view the complete annual report

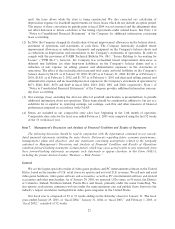

Please find page 37 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On February 12, 2002, we registered and sold an aggregate of 20,763,888 shares of our Class A common

stock at a price of $18.00 per share. The aggregate price of the oÅering amount registered and sold was

approximately $373.7 million. The net proceeds from the initial public oÅering were $347.3 million. A portion

of the proceeds was used to repay $250.0 million of our indebtedness to Barnes & Noble. Upon closing the

initial public oÅering, Barnes & Noble contributed the diÅerence between the aggregate amount of the

intercompany loans and $250.0 million as additional paid-in-capital. The amount of the capital contribution

was $150.0 million. Of the balance of the proceeds (approximately $97.3 million), approximately $33.8 mil-

lion was used for capital expenditures and the remainder was used for working capital and general corporate

purposes.

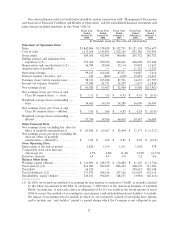

During Ñscal 2004, cash provided by operations was $146.0 million, compared to cash provided by

operations of $71.3 million in Ñscal 2003. In Ñscal 2004, cash provided by operations was primarily due to net

income of $60.9 million, depreciation and amortization of $37.0 million, provisions for inventory reserves of

$17.8 million, a decrease in prepaid taxes of $9.7 million and an increase in accounts payable and accrued

liabilities of $17.9 million, oÅset in part by an increase in merchandise inventory of $10.6 million. The increase

in merchandise inventories was less than increases in Ñscal 2003 and Ñscal 2002 because of video game

hardware shortages, which are expected to be temporary. In Ñscal 2003, cash provided by operations was

primarily due to net income of $63.5 million, depreciation and amortization of $29.5 million, provisions for

inventory reserves of $12.9 million and an increase in accounts payable of $40.0 million, which were oÅset

partially by an increase in merchandise inventories of $72.7 million. The increase in merchandise inventories

in Ñscal 2003 was due to the Company's investment in merchandise inventories to support the overall growth

of the Company and the anticipated store openings in early Ñscal 2004.

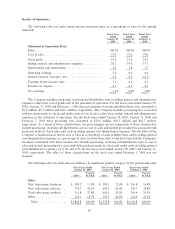

Cash used in investing activities was $99.2 million and $68.0 million during Ñscal 2004 and Ñscal 2003,

respectively. During Ñscal 2004, our capital expenditures included approximately $27.7 million to acquire and

build-out a new corporate headquarters and distribution center facility in Grapevine, Texas. The remaining

$70.6 million in capital expenditures was used to open new stores, remodel existing stores and invest in

information systems. During Ñscal 2003, we had capital expenditures of $64.5 million to open new stores,

remodel existing stores and invest in distribution and information systems.

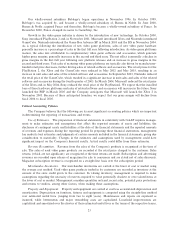

Our future capital requirements will depend on the number of new stores we open and the timing of those

openings within a given Ñscal year. We opened 338 stores in Ñscal 2004 and expect to open between 370 and

400 stores in Ñscal 2005. Projected capital expenditures for Ñscal 2005 are approximately $80 million, to be

used primarily to fund new store openings, equip and improve the Company's new headquarters and

distribution center and invest in distribution and information systems.

The projected capital expenditures for Ñscal 2005 include approximately $6 million to complete the

improvements to and equip the 420,000 square foot headquarters and distribution center facility in Grapevine,

Texas which the Company acquired in March 2004. We expect that the total cost to purchase, improve and

equip this facility will be approximately $34 million. The distribution systems in this facility are expected to be

ready for testing in early Ñscal 2005 and the facility is expected to be fully-operational in the second quarter of

Ñscal 2005, at which time all headquarters and remaining distribution functions will be relocated. Depreciation

on certain leasehold improvements to the Company's existing facility has been adjusted to reÖect the shorter

life of these assets, which will be abandoned after the relocation is complete.

In June 2004, the Company amended and restated its $75.0 million senior secured revolving credit

facility, which now expires in June 2009. The revolving credit facility is governed by an eligible inventory

borrowing base agreement, deÑned as 55% of non-defective inventory, net of certain reserves. Loans incurred

under the credit facility will be maintained from time to time, at the Company's option, as: (1) Prime Rate

loans which bear interest at the prime rate (deÑned in the credit facility as the higher of (a) the administrative

agent's announced prime rate, or (b) 1/2 of 1% in excess of the federal funds eÅective rate, each as in eÅect

from time to time); or (2) LIBO Rate loans bearing interest at the LIBO Rate for the applicable interest

period, in each case plus an applicable interest margin. In addition, the Company is required to pay a

commitment fee, currently 0.375%, for any unused amounts of the revolving credit facility. Any borrowings

under the revolving credit facility are secured by the assets of the Company. If availability under the revolving

30