GameStop 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Seasonality

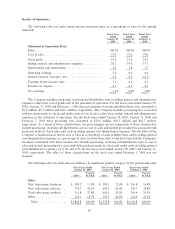

Our business, like that of many retailers, is seasonal, with the major portion of sales and operating proÑt

realized during the fourth quarter which includes the holiday selling season. Results for any quarter are not

necessarily indicative of the results that may be achieved for a full Ñscal year. Quarterly results may Öuctuate

materially depending upon, among other factors, the timing of new product introductions and new store

openings, sales contributed by new stores, increases or decreases in comparable store sales, adverse weather

conditions, shifts in the timing of certain holidays or promotions and changes in our merchandise mix.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Exposure

We do not use derivative Ñnancial instruments to hedge interest rate exposure. We limit our interest rate

risks by investing our excess cash balances in short-term, highly-liquid instruments with an original maturity

of three months or less. We do not expect any material losses from our invested cash balances, and we believe

that our interest rate exposure is modest.

Foreign Exchange Exposure

We do not believe we have material foreign currency exposure, because only a very immaterial portion of

our business is transacted in other than United States currency. The Company historically has not entered into

hedging transactions with respect to its foreign currency, but may do so in the future.

Item 8. Financial Statements and Supplementary Data

See Item 15(a)(1) and (2) of this Form 10-K/A.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this report, the Company's management conducted an evaluation,

under the supervision and with the participation of the principal executive oÇcer and principal Ñnancial

oÇcer, of the Company's disclosure controls and procedures (as deÑned in Rules 13a-15(e) and 15d-15(e)

under the Exchange Act). Based on this evaluation, the principal executive oÇcer and principal Ñnancial

oÇcer concluded that, as of the end of the period covered by this report, the Company's disclosure controls

and procedures are eÅective. Notwithstanding the foregoing, a control system, no matter how well designed

and operated, can provide only reasonable, not absolute, assurance that it will detect or uncover failures within

the Company to disclose material information otherwise required to be set forth in the Company's periodic

reports.

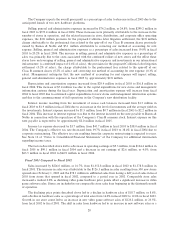

(b) Management's Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over Ñnancial

reporting, as such term is deÑned in Exchange Act Rules 13a-15(f). Under the supervision and with the

participation of our management, including our principal executive oÇcer and principal Ñnancial oÇcer, we

conducted an evaluation of the eÅectiveness of our internal control over Ñnancial reporting based on the

framework in Internal Control Ì Integrated Framework issued by the Committee of Sponsoring Organiza-

tions of the Treadway Commission. Based on our evaluation under the framework in Internal Control Ì

Integrated Framework, our management concluded that our internal control over Ñnancial reporting was

eÅective as of January 29, 2005. Our management's assessment of the eÅectiveness of our internal control over

Ñnancial reporting as of January 29, 2005 has been audited by BDO Seidman, LLP, an independent registered

public accounting Ñrm, as stated in their report which is included herein.

33